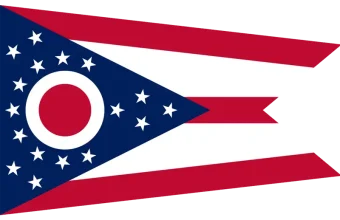

Ohio Remote Work Laws 2026

⚠️Informational only — not legal or tax advice.

Last Updated: December 2025

Applicable Period: 2026 tax year and current employment regulations

Key Characteristic: Employers with remote workers physically located in Ohio

Table of Contents

- Overview

- Key Legal Framework

- Employee Classification Standards

- Minimum Wage Information for Ohio

- Overtime and Break Requirements in Ohio

- Paid Sick Leave

- Workers' Compensation Overview

- Other Leave Entitlements

- Anti-Discrimination Laws

- Tax Implications

- Data Privacy Considerations

- Remote Work Considerations

- Resources

- Frequently Asked Questions

Overview

Ohio is generally considered to have a moderate approach to employment regulation. According to official state sources, Ohio follows federal standards in many areas while establishing some state-specific requirements where state law provides additional protections.

General Characteristics (As of 2025-2026):

- State minimum wage (2025): $10.70/hour for non-tipped employees at employers with gross receipts over $394,000

- State minimum wage (2026): $11.00/hour for non-tipped employees at employers with gross receipts over $405,000 (announced September 2025)

- Paid sick leave: Not mandated by state law for private-sector employers

- State income tax: Progressive state income tax (rates vary by income level)

- Meal/rest breaks: Not mandated by state law for adult employees (18+); required for minors under 18

- Overtime rules: Generally follows federal FLSA standards

- Workers’ compensation: Required for most employers; Ohio operates an exclusive state fund system through the Bureau of Workers’ Compensation (BWC)

Note: These are general starting points only. Specific applicability depends on many factors including employer size, industry, individual circumstances, and local ordinances. Consult official sources and legal counsel for guidance on specific situations.

Sources:

- Ohio Department of Commerce: https://com.ohio.gov

- Ohio Bureau of Workers’ Compensation: https://www.bwc.ohio.gov

Ohio’s approach to employment law reflects a balance between federal compliance requirements and certain state-specific provisions. Employers and workers should verify current law with official agencies before making employment-related decisions.

Key Legal Framework

Official State Agency Information

The Ohio Department of Commerce, Division of Industrial Compliance and Labor administers employment and wage laws in Ohio.

Contact Information:

- Website: https://com.ohio.gov

- Main Phone: (614) 644-2239

- Mailing Address:

Ohio Department of Commerce

Division of Industrial Compliance

6606 Tussing Road

P.O. Box 4009

Columbus, OH 43216-4009 - Available Languages: English, Spanish (limited)

Note: This agency can provide official interpretations of state wage and hour laws. For legal advice on how laws apply to your specific situation, consult a licensed attorney in Ohio.

Ohio Bureau of Workers’ Compensation (BWC)

The Ohio Bureau of Workers’ Compensation administers the state’s workers’ compensation system.

Contact Information:

- Website: https://www.bwc.ohio.gov

- Main Phone: 1-800-644-6292

- Address:

Ohio Bureau of Workers’ Compensation

30 West Spring Street

Columbus, OH 43215 - Hours: Monday-Friday, 7:30 AM – 5:30 PM ET

Major State Employment Statutes

The following statutes are commonly cited in employment matters in Ohio. This is general information only and does not constitute legal interpretation.

1. Ohio Fair Labor Standards Act

Statutory Citation: Ohio Revised Code (ORC) § 4111.01 et seq.

Official Source: https://codes.ohio.gov/ohio-revised-code/chapter-4111

General Provisions (as stated in the statute):

- Ohio’s minimum wage provisions generally apply to employers with annual gross receipts exceeding specified thresholds

- The state minimum wage is adjusted annually based on the Consumer Price Index (CPI-W), as mandated by Constitutional Amendment II-34a (passed by voters in November 2006)

- Overtime provisions generally require payment of 1.5 times the regular rate for hours exceeding 40 in a workweek

- The statute includes provisions regarding wage payment timing, deductions, and recordkeeping

Application to Remote Work: These provisions generally apply based on where work is physically performed. An employee performing work from a location in Ohio would typically be subject to Ohio wage and hour standards. Specific applicability depends on multiple factors. Consult the Ohio Department of Commerce or legal counsel for guidance on particular circumstances.

2. Ohio Workers’ Compensation Law

Statutory Citation: ORC § 4123.01 et seq.

Effective Date: Originally enacted 1912; regularly amended

Official Source: https://codes.ohio.gov/ohio-revised-code/chapter-4123

General Overview:

According to the Ohio Bureau of Workers’ Compensation, Ohio’s workers’ compensation system is an exclusive state fund system. This generally means that employers with one or more employees must obtain coverage through the BWC. Coverage provides benefits for medical treatment and wage replacement for work-related injuries and occupational diseases.

Coverage typically includes (based on official guidance):

- Most employers with one or more employees in Ohio

- Self-employed individuals may elect coverage voluntarily

- Certain family members and corporate officers may elect coverage

Exemptions may include (based on official guidance):

- Sole proprietors who choose not to elect coverage

- Certain family members working for family businesses (subject to specific criteria)

- Employees whose work is performed exclusively outside Ohio

Note: Actual coverage obligations and determinations depend on specific circumstances. Employers should consult the Ohio Bureau of Workers’ Compensation and legal counsel to determine their specific obligations.

Source: Ohio Bureau of Workers’ Compensation – https://www.bwc.ohio.gov

3. Break Requirements for Minors

Statutory Citation: ORC § 4109.07(C)

Official Source: https://codes.ohio.gov/ohio-revised-code/section-4109.07

General Provisions:

According to Ohio law, employers are generally required to provide a 30-minute uninterrupted break to employees under the age of 18 when they work more than five consecutive hours.

Note: Ohio law does not mandate meal or rest breaks for employees aged 18 or older. For adult employees, break provisions are typically governed by federal Fair Labor Standards Act (FLSA) guidelines and employer policies.

4. Civil Rights Protections

Statutory Citation: ORC § 4112.01 et seq. (Ohio Civil Rights Act)

Official Source: https://codes.ohio.gov/ohio-revised-code/chapter-4112

General Provisions:

The Ohio Civil Rights Act generally prohibits employment discrimination based on protected characteristics including race, color, religion, sex, national origin, disability, age (40 and over), ancestry, and military status. The law applies to employers with four or more employees.

Administration: The Ohio Civil Rights Commission administers and enforces Ohio’s civil rights laws.

Contact Information:

- Website: https://crc.ohio.gov

- Phone: (614) 466-2785

For questions about specific circumstances or filing a complaint, individuals should consult the Ohio Civil Rights Commission or a licensed employment attorney.

Employee Classification Standards

Ohio’s Classification Framework

According to various official sources and judicial interpretations, Ohio applies different tests depending on the context and purpose of the classification inquiry. There is no single universal test that applies to all employment law matters in Ohio.

Statutory Authority: Various statutes including ORC § 4141.01 (unemployment compensation), ORC § 4123.01 (workers’ compensation), federal Fair Labor Standards Act

Official Guidance Sources:

- Ohio Department of Job and Family Services (for unemployment insurance)

- Ohio Bureau of Workers’ Compensation (for workers’ compensation coverage)

- Internal Revenue Service (for federal tax purposes)

- U.S. Department of Labor (for FLSA purposes)

General Legal Framework

Ohio courts and agencies typically apply multi-factor tests to determine whether a worker should be classified as an employee or independent contractor. The specific test used may vary depending on the statutory context.

Common Law “Right to Control” Test

For many purposes in Ohio, classification analysis involves examining the degree of control the employer has over the worker. This analysis is sometimes referred to as the “20-factor test” or “Common Law test.”

General Factors That May Be Examined:

The following factors are commonly considered. No single factor is determinative, and the weight given to each factor may vary based on circumstances. This list is not exhaustive.

1. Instructions and Control

General Description: Based on common law principles, the extent to which the hiring party provides instructions about when, where, and how work should be performed may be relevant to classification analysis.

Considerations that may be relevant (examples from various sources):

- Whether the worker receives detailed instructions on methods and procedures

- Whether the worker must comply with specific schedules or reporting requirements

- Whether the worker has autonomy in determining how to accomplish assigned tasks

- Whether the worker can choose their own work hours and location

Illustrative Scenario (for general understanding only):

Scenario 1: A software developer works remotely for a tech company. The company provides detailed specifications for coding projects, requires attendance at daily video meetings, mandates use of specific software tools and coding standards, and monitors work progress through project management software.

General Analysis: This scenario may share characteristics commonly associated with employee relationships because of the level of ongoing instruction, supervision, and control over work methods. However, actual classification depends on all facts and circumstances, including other relevant factors. This is not a determination.

Scenario 2: A graphic designer contracts with multiple clients simultaneously, uses their own equipment and software, sets their own hours, delivers finished products according to contract specifications without ongoing direction, and advertises services to the general public.

General Analysis: This scenario may share characteristics commonly associated with independent contractor relationships because of the autonomy, simultaneous clients, and independent business operation. However, actual classification requires analysis of the complete situation, including the nature of the working relationship and economic realities. This is not a determination.

⚠️ Important: These examples are purely illustrative and do not constitute legal determinations or predictions. Classification depends on the totality of circumstances as evaluated by appropriate authorities and should be determined with professional guidance.

2. Training Provided

General Description: Whether the hiring party provides training to the worker may be relevant. Extensive training in methods and procedures specific to the business may suggest an employment relationship.

Considerations that may be relevant:

- Whether the company provides formal onboarding or training programs

- Whether the worker must attend training sessions or certification courses paid for by the hiring party

- Whether the worker uses skills they independently developed through their own training and experience

3. Integration with Business

General Description: The extent to which the worker’s services are integrated into the regular business operations may be considered.

Considerations that may be relevant:

- Whether the work performed is central to the hiring party’s primary business

- Whether the services are continuous or project-based

- Whether the relationship is exclusive or non-exclusive

4. Personal Services

General Description: Whether the worker must personally perform the services or can delegate to others may be relevant.

Considerations that may be relevant:

- Whether the worker can hire assistants or subcontractors

- Whether the worker must personally provide all services

- Whether the hiring party cares who specifically performs the work

5. Hiring, Supervising, and Paying Assistants

General Description: Who hires, supervises, and pays any assistants may be considered.

Considerations that may be relevant:

- Whether the worker can hire and pay their own helpers

- Whether the hiring party provides and pays for assistants

- Who has authority to fire assistants

6. Continuing Relationship

General Description: The duration and continuity of the relationship may be relevant.

Considerations that may be relevant:

- Whether services are provided on a regular, continuing basis

- Whether the relationship is for a specific project or ongoing

- Historical pattern of work arrangements

7. Set Hours of Work

General Description: Who controls the work schedule may be considered.

Considerations that may be relevant:

- Whether the hiring party establishes fixed hours

- Whether the worker has flexibility to set their own schedule

- Whether the worker must be available during specific hours

8. Full Time Required

General Description: Whether full-time work is required may be relevant.

Considerations that may be relevant:

- Whether the worker can work for other clients simultaneously

- Whether the arrangement restricts the worker from other work

- Whether the relationship is exclusive

9. Doing Work on Employer’s Premises

General Description: The location where work is performed may be considered, though this factor has become less determinative with remote work arrangements.

Considerations that may be relevant:

- Whether work must be performed at the hiring party’s location

- Whether the worker can choose where to work

- Whether the location indicates control over the worker

10. Order or Sequence Set

General Description: Whether the hiring party determines the order or sequence of work may be relevant.

Considerations that may be relevant:

- Whether the worker follows a routine set by the hiring party

- Whether the worker independently decides work priorities

- Level of autonomy in organizing tasks

11. Oral or Written Reports

General Description: Regular reporting requirements may be considered.

Considerations that may be relevant:

- Whether the worker must submit regular progress reports

- Whether the worker must account for time spent

- Nature and frequency of reporting obligations

12. Payment by Hour, Week, Month

General Description: The method of payment may be relevant.

Considerations that may be relevant:

- Whether payment is by hour, week, or month (suggesting employee)

- Whether payment is by project or commission (suggesting contractor)

- Whether payment guarantees a regular wage

13. Payment of Business and/or Traveling Expenses

General Description: Who bears business expenses may be considered.

Considerations that may be relevant:

- Whether the hiring party reimburses business expenses

- Whether the worker bears their own business costs

- Who pays for travel, tools, supplies, and equipment

14. Furnishing of Tools and Materials

General Description: Who provides the tools and materials needed for work may be relevant.

Considerations that may be relevant:

- Whether the hiring party provides necessary equipment

- Whether the worker uses their own tools and materials

- Significance of the investment in equipment

15. Significant Investment

General Description: Whether the worker has a significant investment in facilities and equipment may be considered.

Considerations that may be relevant:

- Whether the worker maintains their own office or workspace

- Whether the worker has invested in specialized equipment

- Scale of the worker’s investment relative to the hiring party

16. Realization of Profit or Loss

General Description: The worker’s opportunity for profit or loss may be relevant.

Considerations that may be relevant:

- Whether the worker can earn more or less based on their efficiency

- Whether the worker risks financial loss

- Whether income depends on managerial skills

17. Working for More Than One Firm at a Time

General Description: Whether the worker provides services to multiple clients simultaneously may be considered.

Considerations that may be relevant:

- Whether the worker has multiple clients

- Whether the arrangement is exclusive or non-exclusive

- Whether the worker markets services to the public

18. Making Service Available to General Public

General Description: Whether the worker makes services available to the general public may be relevant.

Considerations that may be relevant:

- Whether the worker advertises services

- Whether the worker has a business identity separate from any single client

- Whether the worker holds themselves out as an independent business

19. Right to Discharge

General Description: The ability to terminate the relationship may be considered.

Considerations that may be relevant:

- Whether the relationship can be terminated at will

- Whether termination requires breach of contract

- Nature of termination provisions in any agreement

20. Right to Terminate

General Description: The worker’s ability to end the relationship may be relevant.

Considerations that may be relevant:

- Whether the worker can quit without liability

- Whether the worker must complete a project

- Whether leaving the relationship has contractual consequences

Economic Reality Test (Federal FLSA Context)

For purposes of the federal Fair Labor Standards Act (FLSA), which governs minimum wage and overtime, courts in Ohio (under the Sixth Circuit) typically apply an “economic reality” test that examines whether a worker is economically dependent on the business.

Key Factors (as described by the Sixth Circuit in Donovan v. Brandel, 736 F.2d 1114 (6th Cir. 1984)):

- The permanency of the relationship between the parties

- The degree of skill required for rendering the services

- The worker’s investment in equipment or materials for the task

- The worker’s opportunity for profit or loss, depending on their skill

- The degree of the alleged employer’s right to control the manner in which the work is performed

- Whether the service rendered is an integral part of the alleged employer’s business

According to judicial interpretations, the test focuses on economic dependence rather than control alone. However, control remains an important factor.

Remote Work Classification Considerations

For remote workers, classification analysis may involve additional complexities:

- Physical work location vs. business location: Where the work is actually performed may differ from where the business is located

- Nature of work relationship in virtual environment: Remote arrangements may affect how control and independence are evaluated

- Level of supervision in remote setting: Technology enables various degrees of supervision remotely

- Availability and responsiveness expectations: Requirements to be available during specific hours or respond immediately may be relevant

These factors do not change the legal test but may affect how the test is applied in practice. Classification of remote workers should be reviewed with legal counsel familiar with Ohio law and your specific circumstances.

Potential Consequences of Misclassification

According to Ohio statutes, federal law, and various agency guidance, misclassification may result in various consequences. The following is general information only:

For Employers (according to official sources, potential consequences may include, non-exhaustive):

- Potential back payment of unemployment insurance taxes and penalties (Ohio Department of Job and Family Services)

- Possible workers’ compensation premium adjustments and penalties (Ohio Bureau of Workers’ Compensation)

- Potential wage and hour claim exposure for unpaid minimum wage, overtime, and other violations (Ohio Department of Commerce, U.S. Department of Labor)

- Possible penalties and interest for late payments

- Tax implications at state and federal levels (Ohio Department of Taxation, IRS)

- Potential exposure to claims for employee benefits

For Workers (based on general legal principles):

- May affect access to unemployment benefits

- May affect workers’ compensation coverage

- May affect wage and hour protections

- May affect leave benefit eligibility

- May affect access to employee benefit programs

Note: The specific consequences depend on many factors including the nature of the misclassification, duration, number of workers affected, and whether the misclassification was knowing or inadvertent. This is general information only.

How to Seek Guidance

Classification questions should be addressed through appropriate professionals and agencies:

Ohio Department of Job and Family Services (for unemployment insurance questions):

- Website: https://jfs.ohio.gov

- Phone: 1-877-644-6562

Ohio Bureau of Workers’ Compensation (for workers’ compensation coverage questions):

- Website: https://www.bwc.ohio.gov

- Phone: 1-800-644-6292

Ohio Department of Commerce (for wage and hour questions):

- Website: https://com.ohio.gov

- Phone: (614) 644-2239

Employment attorney licensed in Ohio

Tax professional familiar with Ohio and federal tax law

IRS (for federal tax classification):

- Website: https://www.irs.gov

- Form SS-8 can be submitted to request an official IRS determination

Minimum Wage Information for Ohio

Current Rate Information (As Published by Ohio Department of Commerce)

According to the Ohio Department of Commerce Division of Industrial Compliance (source: official annual announcements), Ohio’s state minimum wage is adjusted annually based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This adjustment is mandated by Constitutional Amendment II-34a, which was approved by Ohio voters in November 2006.

2025–2026 Minimum Wage Rates:

| Effective Date | Non-Tipped Rate | Tipped Rate | Gross Receipts Threshold | Source |

|---|---|---|---|---|

| January 1, 2025 | $10.70/hour | $5.35/hour | $394,000 annual gross receipts | Ohio Dept. of Commerce |

| January 1, 2026 | $11.00/hour | $5.50/hour | $405,000 annual gross receipts | Ohio Dept. of Commerce |

The 2026 rates represent a 2.8% increase from 2025 rates, corresponding to the CPI-W change from September 1, 2024 to August 31, 2025.

Source: Ohio Department of Commerce – Division of Industrial Compliance

Official 2025 Poster: https://dam.assets.ohio.gov/image/upload/com.ohio.gov/DICO/WageAndHour/DICO_2025_MW_Poster.pdf

Employer Applicability Thresholds

According to Ohio law (ORC § 4111.02), the state minimum wage generally applies based on the employer’s annual gross receipts:

Employers with gross receipts ABOVE the threshold:

- 2025: Must pay at least $10.70/hour (non-tipped) or $5.35/hour (tipped)

- 2026: Must pay at least $11.00/hour (non-tipped) or $5.50/hour (tipped)

Employers with gross receipts AT OR BELOW the threshold:

- 2025: May pay the federal minimum wage ($7.25/hour)

- 2026: May pay the federal minimum wage ($7.25/hour)

Note: The gross receipts threshold itself adjusts annually. Employers near the threshold should verify their status each year and adjust wages accordingly. Consult with the Ohio Department of Commerce or an accountant to properly calculate gross receipts for this purpose.

Special Categories

Employees Under Age 16:

According to Ohio law (ORC § 4111.02), employees under the age of 16 may be paid the federal minimum wage of $7.25/hour, regardless of the employer’s gross receipts.

Tipped Employees:

According to Ohio regulations, tipped employees are defined as those who customarily and regularly receive more than $30 per month in tips.

For tipped employees:

- Tipped minimum wage (2025): $5.35/hour

- Tipped minimum wage (2026): $5.50/hour

- Calculation: The tipped minimum wage is calculated as exactly 50% of the state’s non-tipped minimum wage

Important provision: According to Ohio law, employers electing to use the tip credit provision must be able to demonstrate that tipped employees receive at least the full minimum wage when direct wages and tips are combined. If tips plus the tipped minimum wage do not equal the full minimum wage, the employer must make up the difference.

Recordkeeping for tip credit: Employers using the tip credit should maintain records demonstrating compliance. Consult legal counsel for recordkeeping requirements.

Application to Remote Workers

According to general legal principles and Ohio Department of Commerce guidance:

- Minimum wage typically applies based on where work is physically performed

- A worker performing work from a location within Ohio would generally be subject to Ohio minimum wage requirements (assuming other applicability criteria are met)

- The employer’s physical location is generally not the primary determining factor for minimum wage applicability

- The worker’s state of residence determines which state’s minimum wage applies

Example for illustration only (not a legal determination):

Scenario 1: A company headquartered in Michigan employs a remote worker who lives and works from their home in Ohio. The Michigan company has annual gross receipts exceeding Ohio’s threshold.

General principle: This worker would likely be subject to Ohio’s minimum wage because they physically perform work in Ohio. However, specific situations may involve additional considerations.

Scenario 2: An Ohio company employs a remote worker who lives and works from their home in Indiana.

General principle: This worker would likely be subject to Indiana’s minimum wage and labor laws, not Ohio’s. Employers should consult legal counsel regarding compliance obligations in states where remote workers are located.

Note: Multi-state employment arrangements can create complex compliance obligations. Employers should consult with legal counsel familiar with interstate employment law when hiring remote workers in multiple states.

Local Minimum Wages

As of December 2025, no cities or counties in Ohio have enacted local minimum wages that differ from the state minimum wage. If you are aware of local ordinances, please verify directly with the relevant local government.

Note: Local laws can change. Employers operating in multiple Ohio jurisdictions should verify whether local minimum wage ordinances have been enacted.

| Jurisdiction | 2025 Rate | 2026 Rate | Notes |

|---|---|---|---|

| Ohio (covered employers) | $10.70 | $11.00 | Employers with $394K+ / $405K+ gross receipts |

| Ohio (small employers) | $7.25 | $7.25 | Below threshold; tied to federal |

| Federal minimum wage | $7.25 | $7.25 | No scheduled increase |

| Michigan | $10.33 | TBD | For comparison |

| Pennsylvania | $7.25 | TBD | For comparison |

| Indiana | $7.25 | TBD | For comparison |

| Kentucky | $7.25 | TBD | For comparison |

| West Virginia | $8.75 | TBD | For comparison |

This comparison is for general reference only. Each state’s laws apply based on where work is performed. Rates listed are as of information available in December 2025 and may have changed.

Resources for Current Information

Ohio Department of Commerce:

- Website: https://com.ohio.gov

- Division of Industrial Compliance: (614) 644-2239

- Email: dic.info@com.ohio.gov

U.S. Department of Labor Wage and Hour Division:

- Website: https://www.dol.gov/agencies/whd

- Ohio offices:

- Cleveland: (216) 357-5400

- Columbus: (614) 469-5678

- Cincinnati: (513) 684-2908

For Legal Advice:

- Consult an employment attorney licensed in Ohio

- Ohio State Bar Association Referral: 1-800-282-6556

Overtime and Break Requirements in Ohio

A. Overtime Standards

Governing Framework

According to Ohio law (ORC § 4111.03) and the federal Fair Labor Standards Act (FLSA), Ohio generally follows federal overtime standards with some state-specific provisions.

Statutory Authority: ORC § 4111.03; 29 U.S.C. § 207 (FLSA)

Official Sources:

- Ohio: https://codes.ohio.gov/ohio-revised-code/section-4111.03

- Federal: https://www.dol.gov/agencies/whd/overtime

General Overtime Threshold (as stated in statute/regulation)

- Trigger: Generally required after 40 hours worked in a workweek

- Rate: Generally 1.5 times the employee’s regular rate of pay

- Workweek definition: A fixed and regularly recurring period of 168 hours (7 consecutive 24-hour periods)

⚠️ Daily Overtime: Ohio does not have a daily overtime requirement. Overtime is calculated on a weekly basis (hours exceeding 40 in a workweek).

Application to Remote Workers:

Overtime regulations typically apply based on the nature of the work and employment relationship, not work location. Remote workers performing non-exempt work would generally be subject to the same overtime requirements as on-site workers, assuming they are properly classified as employees.

However, specific applicability depends on exemption status and other factors. See Exemptions section below.

Calculating Compensable Time for Remote Workers

According to federal Department of Labor guidance and general legal principles, “hours worked” for overtime calculation purposes generally includes time that the employee is “suffered or permitted to work,” meaning time when:

- The employee is actually performing work duties

- The employee is required to be on the premises or at a designated work location

- The employee is waiting to work and cannot use the time effectively for personal purposes

- The employee must attend required meetings or training

⚠️ Complex Issue for Remote Workers:

Determining compensable time for remote workers can involve additional considerations and challenges:

- After-hours communications: Whether responding to emails or messages outside regular hours constitutes compensable time depends on many factors, including whether the employee is required or expected to respond

- On-call time at home: Whether time spent “on call” at home is compensable depends on the degree to which the employee’s freedom is restricted

- Time spent in virtual meetings: Video conferences during or outside regular hours that employees are required to attend are generally compensable

- Incidental activities: Brief, occasional activities (checking emails once in the evening, etc.) may or may not be compensable depending on circumstances

- “Workday” boundaries: When the workday begins and ends may be less clear for remote workers

These determinations are highly fact-specific. Employers should:

- Establish clear policies about work hours and expectations for remote workers

- Implement systems for accurate time tracking

- Prohibit or require pre-approval for after-hours work if appropriate

- Consult wage-hour legal counsel for guidance on tracking and compensating remote workers

Note: Failing to pay for all compensable time can result in FLSA violations even if the employer did not explicitly authorize the work, if the employer “knew or should have known” the employee was working.

Overtime Exemptions

Ohio generally follows federal FLSA exemptions from overtime requirements. Common exemptions include the Executive, Administrative, Professional, Computer Professional, and Outside Sales exemptions.

⚠️ Important: To qualify for an exemption, an employee generally must satisfy three tests:

- Salary Basis Test: Paid a predetermined fixed salary not subject to reduction based on quality or quantity of work

- Salary Level Test: Meets minimum salary threshold

- Duties Test: Performs exempt-level duties as defined by regulations

All three tests must generally be satisfied. Job title alone does not determine exemption status.

Executive, Administrative, and Professional (EAP) Exemptions

Federal Salary Threshold (as of December 2025):

According to federal Department of Labor regulations:

- Minimum weekly salary: $684 per week ($35,568 annually)

- Note: This threshold has been subject to legal challenges and changes. Verify current threshold with the U.S. Department of Labor before making exemption determinations.

Ohio Position:

Ohio law does not establish a separate state salary threshold for overtime exemptions. Employers in Ohio generally follow the federal salary threshold.

Source: 29 C.F.R. § 541.600; U.S. Department of Labor, Wage and Hour Division

Duties Tests (General Summary):

The federal regulations describe exempt duties in detail. This is a simplified overview only:

Executive Exemption (29 C.F.R. § 541.100):

- Primary duty is management of the enterprise or a department/subdivision

- Customarily and regularly directs the work of at least two full-time employees

- Has authority to hire or fire, or recommendations given particular weight

Administrative Exemption (29 C.F.R. § 541.200):

- Primary duty is performance of office or non-manual work directly related to management or general business operations

- Primary duty includes exercise of discretion and independent judgment on significant matters

Professional Exemption (29 C.F.R. § 541.300):

- Learned Professional: Work requiring advanced knowledge (defined as work predominantly intellectual in character) in a field of science or learning, customarily acquired by prolonged specialized intellectual instruction

- Creative Professional: Work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor

⚠️ Important: These are simplified summaries only. The actual regulatory definitions are detailed and complex. Meeting the salary threshold alone is insufficient to establish an exemption. Actual duties must satisfy the regulatory tests. Employers should consult DOL guidance and legal counsel for exemption determinations.

Illustrative Example (NOT a determination):

Scenario: A remote “project manager” earning $75,000 annually coordinates schedules, tracks project timelines, communicates with team members, and prepares status reports. They do not supervise any employees, cannot hire or fire, and follow detailed procedures established by senior management.

General observation: This scenario may not satisfy the executive exemption (no supervisory authority over employees) or administrative exemption (unclear whether duties involve discretion and independent judgment on significant matters vs. production work). However, actual exemption status would require detailed analysis of all duties, including percentage of time spent on various tasks. This is not an exemption determination.

Computer Professional Exemption

Salary/Hourly Threshold (Federal, as of December 2025):

According to federal regulations (29 C.F.R. § 541.400), computer professionals may be paid on a salary or hourly basis:

- Salary basis: $684 per week ($35,568 annually), OR

- Hourly basis: $27.63 per hour

Duties Test (simplified summary):

The employee’s primary duty must consist of:

- The application of systems analysis techniques and procedures, including consulting with users, to determine hardware, software, or system functional specifications; OR

- The design, development, documentation, analysis, creation, testing, or modification of computer systems or programs, including prototypes, based on and related to user or system design specifications; OR

- The design, documentation, testing, creation, or modification of computer programs related to machine operating systems; OR

- A combination of the above duties requiring the same level of skills

Note: The computer employee exemption does not include employees engaged in the manufacture or repair of computer hardware and related equipment. Employees whose work is highly dependent upon the use of computers (e.g., engineers, drafters, many types of skilled professionals) are not necessarily exempt as computer professionals.

Source: 29 C.F.R. § 541.400; DOL Fact Sheet #17E

Other Common Exemptions

Outside Sales Exemption (29 C.F.R. § 541.500):

- Employee’s primary duty is making sales or obtaining orders/contracts

- Customarily and regularly engaged away from the employer’s place of business

- No salary requirement for outside sales exemption

Highly Compensated Employee Exemption (29 C.F.R. § 541.601):

- Total annual compensation of at least $107,432 (as of December 2025; verify current threshold)

- Customarily and regularly performs at least one exempt duty of an executive, administrative, or professional employee

- Note: This exemption has specific requirements; consult DOL guidance

Remote Work Considerations for Exemptions

Classification as exempt or non-exempt is based on actual duties performed and compensation, not work location. Remote workers can be exempt or non-exempt depending on their role.

Considerations for remote workers:

- Remote work does not change exemption criteria

- Employers should evaluate actual duties performed remotely, not just job descriptions

- Technology enables detailed tracking and supervision that may affect “discretion and independent judgment” analysis for administrative exemption

- “Management” of remote teams must still satisfy regulatory requirements for executive exemption

Employers should periodically review remote workers’ actual duties to ensure exemption classifications remain appropriate.

B. Meal and Rest Break Requirements

⚠️ Important: Ohio’s break requirements differ significantly for adults (18+) versus minors (under 18).

Breaks for Adult Employees (Age 18 and Over)

Ohio Statutory Framework:

According to Ohio law, there is no state law requiring employers to provide meal breaks or rest breaks to employees aged 18 or older.

Statutory Citation: Ohio law is silent on break requirements for adult employees (no affirmative mandate in ORC Title 41)

What this means:

- Ohio employers are not required by state law to provide meal breaks to adult employees

- Ohio employers are not required by state law to provide rest breaks to adult employees

- If employers choose to provide breaks, federal FLSA rules regarding payment apply (see below)

Source: Ohio Department of Commerce; Employment Law Handbook – Ohio

Federal Rules for Breaks (If Employer Provides Them)

Although Ohio does not mandate breaks for adults, if an employer chooses to provide breaks, federal law governs whether those breaks must be paid.

Federal FLSA Guidance (29 C.F.R. § 785.18, § 785.19):

Short Breaks (5-20 minutes):

- Generally must be counted as compensable work time

- Must be paid

- Common examples: coffee breaks, restroom breaks, snack breaks

- Typically promote employee efficiency and are customary in industry

Bona Fide Meal Periods (30 minutes or more):

- May be unpaid IF:

- The break is at least 30 minutes in duration, AND

- The employee is completely relieved from duty for the purpose of eating, AND

- The employee is free to leave the workstation

If an employee is required to perform any duties (whether “active” or “inactive”) while eating, the meal period is not bona fide and must be paid.

Examples:

- A receptionist who must answer phones while eating lunch: must be paid

- An employee required to monitor equipment while eating: must be paid

- An employee completely free of all duties for 30+ minutes: may be unpaid (if properly implemented)

Source: U.S. Department of Labor – Fact Sheet #22: https://www.dol.gov/agencies/whd/fact-sheets/22-flsa-hours-worked

Breaks for Minor Employees (Under Age 18)

Ohio Statutory Requirement:

According to Ohio law (ORC § 4109.07(C)), employers must provide a 30-minute uninterrupted meal break to employees under the age of 18 who work more than five consecutive hours.

Key Requirements:

- Duration: At least 30 minutes

- Trigger: After 5 consecutive hours of work

- Must be uninterrupted: The minor must be relieved of all duties

- May be unpaid: If the minor is completely relieved of duties

Statutory Citation: ORC § 4109.07(C)

Source: https://codes.ohio.gov/ohio-revised-code/section-4109.07

Note: Employers should verify compliance with both Ohio’s youth employment laws and federal Fair Labor Standards Act provisions regarding minors.

Application to Remote Workers

Break requirements (or lack thereof) generally apply equally to remote workers and on-site workers in Ohio:

For adult remote workers:

- No state-mandated breaks

- If employer provides breaks voluntarily, federal payment rules apply

- Employers may establish break policies for remote workers

For minor remote workers:

- 30-minute break required after 5 hours of work applies equally to remote work

- Employers should document compliance (e.g., time tracking systems that show breaks)

Challenges for Remote Work:

- Verifying that breaks are actually taken

- Ensuring employees do not work during unpaid meal periods

- Documenting compliance

- Handling interruptions or “quick checks” of email during breaks

Best Practice Considerations (not legal requirements):

Employers may wish to:

- Establish clear written policies about breaks for remote workers

- Use time tracking systems that require employees to log breaks

- Train managers to respect break times and not contact employees during breaks

- Make clear that unpaid meal periods should not involve any work activities

- Consult with legal counsel on break policies and enforcement for remote workers

Paid Sick Leave

No State-Mandated Paid Sick Leave for Private Employers

According to available information, Ohio does not have a state law requiring private-sector employers to provide paid sick leave to employees.

What this means:

- Private employers in Ohio are generally not required by state law to offer paid sick leave

- Employers may choose to provide paid sick leave voluntarily as a benefit

- If employers offer paid sick leave, they must comply with their established policies and employment agreements

- Some local jurisdictions may have their own requirements (see below)

Note: The absence of a state mandate does not mean employers cannot or should not offer paid sick leave. Many employers offer paid sick leave as a competitive benefit to attract and retain employees.

Source: Ohio does not have a statute equivalent to other states’ paid sick leave laws; Employment Law Handbook – Ohio

Public Sector Employees

Public sector employees in Ohio (state, county, municipal, and educational employees) generally have statutory sick leave rights under Ohio Revised Code § 124.38 and related provisions.

General Framework for Public Employees (ORC § 124.38):

- Typically entitled to accrue 4.6 hours of sick leave for every 80 hours worked

- Sick leave generally accumulates without limit

- May be used for personal illness, injury, pregnancy, family illness, and other specified purposes

Note: Public sector sick leave provisions are complex and vary by type of public employer. Public employees should consult their employee handbook, collective bargaining agreement (if applicable), and the relevant statutory provisions.

Source: ORC § 124.38 – https://codes.ohio.gov/ohio-revised-code/section-124.38

This guide focuses primarily on private-sector employment. Public employees should consult their employing agency’s human resources department for specific sick leave policies.

Local Paid Sick Leave Ordinances

As of December 2025, some Ohio municipalities have considered or discussed paid sick leave ordinances. Employers should verify whether local requirements exist in their specific jurisdiction.

Known Considerations:

- The City of Cincinnati has discussed paid sick leave requirements in the past; employers in Cincinnati should verify current local ordinances

- The City of Columbus has considered paid sick leave measures; employers in Columbus should verify current local law

- Other municipalities may enact local requirements

Verification: Employers operating in Ohio cities should:

- Check with the city clerk’s office or city attorney

- Consult with local employment counsel

- Review city code provisions related to employment

Note: This information was current as of December 2025. Local ordinances can change. Always verify current local law.

Federal Protections: Family and Medical Leave Act (FMLA)

Although Ohio does not mandate paid sick leave, eligible employees may be entitled to unpaid leave under the federal Family and Medical Leave Act.

FMLA Overview:

Employer Coverage: Employers with 50 or more employees

Employee Eligibility:

- Worked for employer for at least 12 months

- Worked at least 1,250 hours in the 12 months before leave

- Work at a location where employer has 50+ employees within 75 miles

Leave Entitlement:

- Up to 12 weeks of unpaid, job-protected leave per year for:

- Employee’s own serious health condition

- Care for family member with serious health condition (spouse, child, parent)

- Birth and care of newborn

- Adoption or foster care placement

- Qualifying military family reasons

- Up to 26 weeks for military caregiver leave

Note: FMLA leave is unpaid unless the employer allows or requires use of accrued paid leave. Employers may allow employees to use accrued sick leave, vacation, or PTO during FMLA leave.

Source: U.S. Department of Labor – https://www.dol.gov/agencies/whd/fmla

For questions about FMLA eligibility and rights, consult:

- U.S. Department of Labor, Wage and Hour Division

- Employment attorney licensed in Ohio

- Your employer’s human resources department

Employer Voluntary Paid Sick Leave Policies

If an employer voluntarily offers paid sick leave in Ohio, the employer should:

Establish Clear Written Policy:

- Accrual rates and caps

- Eligible reasons for use

- Notice requirements

- Documentation requirements

- Carryover and payout provisions

Comply with Established Policy:

- Once a policy is established and communicated, it may create contractual obligations

- Employers generally must follow their own stated policies

- Changes to policies should be clearly communicated

Consider Tax and Benefit Implications:

- Consult with accountants and benefits counsel regarding tax treatment

- Understand implications for other leave programs (FMLA, disability, workers’ comp)

Document Administration:

- Track accruals accurately

- Document leave requests and approvals

- Maintain records in compliance with recordkeeping requirements

Resources

For General Information:

- Ohio Department of Commerce: https://com.ohio.gov – (614) 644-2239

For FMLA Questions:

- U.S. Department of Labor, Wage and Hour Division: 1-866-4-USWAGE (1-866-487-9243)

- https://www.dol.gov/agencies/whd/fmla

For Legal Advice:

- Employment attorney licensed in Ohio

- Ohio State Bar Association Lawyer Referral Service: 1-800-282-6556

Workers' Compensation Overview

Legal Framework

Statutory Authority: Ohio Revised Code (ORC) § 4123.01 et seq.

Administering Agencies:

- Ohio Bureau of Workers’ Compensation (BWC) – Administers the state fund, collects premiums, pays benefits

- Industrial Commission of Ohio – Adjudicates disputed claims

Ohio BWC Contact Information:

- Website: https://www.bwc.ohio.gov

- Main Phone: 1-800-644-6292

- Address: 30 West Spring Street, Columbus, OH 43215

- Customer Service Hours: Monday-Friday, 7:30 AM – 5:30 PM ET

Industrial Commission of Ohio:

- Website: https://www.ic.ohio.gov

- Phone: 1-800-521-2691

Ohio’s Exclusive State Fund System

Unique Feature: Ohio operates a monopolistic state fund system, meaning employers must obtain workers’ compensation coverage through the Ohio BWC. Private insurance is not available for workers’ compensation coverage in Ohio.

What this means:

- All covered employers must have a policy with Ohio BWC

- Employers cannot purchase workers’ compensation insurance from private insurance companies

- Ohio is one of only four remaining monopolistic states (along with North Dakota, Washington, and Wyoming)

Source: Ohio BWC; ORC § 4123.29

General Coverage Requirements (As Stated in Law)

According to Ohio statutes (ORC § 4123.01), workers’ compensation coverage is generally required for:

Employer Coverage Requirements:

- Employers with one or more employees must generally obtain workers’ compensation coverage

- Coverage extends to most employees performing services for the employer in Ohio

- Certain corporate officers, sole proprietors, and partners may elect coverage voluntarily

Exemptions from Mandatory Coverage May Include:

- Sole proprietors (unless they elect coverage)

- Business partners (unless they elect coverage)

- Certain family members working for a family business (subject to specific criteria)

- Certain agricultural employers (subject to specific criteria)

- Certain casual employment situations

- Employees working exclusively outside Ohio

Voluntary/Elective Coverage Available For:

- Sole proprietors

- Business partners

- Limited liability company members

- Corporate officers (in some circumstances)

- Ministers and religious workers (in some circumstances)

⚠️ Important: Coverage determinations can be complex and fact-specific. Employers uncertain about their obligations should consult the Ohio Bureau of Workers’ Compensation directly at 1-800-644-6292 or consult with legal counsel.

Source: ORC § 4123.01; Ohio BWC Employer Manual

Coverage for Out-of-State and Remote Workers

General Principle:

According to Ohio BWC guidance and general legal principles:

- Ohio workers’ compensation coverage generally applies to employees whose work is performed in Ohio

- An employer based in Ohio with employees working temporarily in other states may need to coordinate coverage

- An employer based in another state with employees working in Ohio may be subject to Ohio workers’ compensation requirements

Ohio-Based Employers with Out-of-State Employees:

If an Ohio employer has employees who work temporarily in other states, the Ohio policy may provide coverage in some circumstances. However:

- Form U-131 (Notice of Election to Obtain Coverage from Other States) may be required

- Some states may require separate coverage

- Interstate agreements and reciprocity provisions may apply

Out-of-State Employers with Ohio-Based Employees:

Employers based in other states with employees who work physically in Ohio typically must:

- Obtain Ohio BWC coverage for those employees, OR

- Elect coverage under another state’s law (if permitted) using Form C-112

Remote Workers:

For remote workers, coverage typically depends on:

- Where the employee physically performs work (not employer location)

- The terms of any interstate coverage election

- Specific facts about the employment relationship

⚠️ Important: Interstate workers’ compensation issues are complex. Employers with employees in multiple states should consult:

- Ohio Bureau of Workers’ Compensation Interstate Section

- Legal counsel experienced in multi-state workers’ compensation

- Workers’ compensation professionals in relevant states

Resources:

- Ohio BWC Interstate Jurisdiction Information: https://www.bwc.ohio.gov/employer/services/OutofStateJurisdiction.asp

- Forms: C-112, U-131 (available on BWC website)

Remote Worker Coverage Considerations

⚠️ COMPLEX AND FACT-SPECIFIC: Coverage of injuries occurring in home offices involves detailed factual analysis that must be made by the Ohio BWC and Industrial Commission. The following is general background information only about factors that may be considered.

General Legal Standard:

Ohio workers’ compensation law provides coverage for injuries that “arise out of and in the course of employment.” Application of this standard to remote workers depends on specific facts and circumstances.

According to case law and BWC guidance, factors that may be relevant include:

- Whether the employee was engaged in work activity at the time of injury

- Whether the injury occurred in a designated work area

- Whether the injury occurred during work hours

- Whether the activity was authorized, expected, or required by the employer

- Whether the activity served the employer’s interests

- The nature and extent of employer control over the home work environment

⚠️ Important: This list is not exhaustive, and no single factor is determinative. Actual coverage requires complete factual analysis by Ohio BWC.

Illustrative Scenarios (For General Understanding Only)

The following scenarios are provided purely for general educational purposes. They do NOT constitute:

- Coverage determinations or predictions

- Legal advice on claim eligibility

- Recommendations for filing or not filing claims

- Guarantees of any particular outcome

Every workers’ compensation claim is unique and depends on official agency determination based on complete facts.

Scenario Category: Work-Related Activities in Home Office

Example Situation 1:

An employee trips over computer equipment cables in their designated home office while walking to retrieve work documents from a printer during regular work hours.

General Observations:

This type of scenario may share some characteristics with situations that have historically been analyzed as work-related, such as:

- Activity was work-related (retrieving work documents)

- Occurred in a designated work area (home office)

- During work hours

- Involved work equipment or work-related items

However, compensability would depend on complete factual analysis including:

- Whether the home office was designated, approved, or required by employer

- Whether employer knew of or controlled the home office setup

- Whether employer provided or approved the equipment arrangement

- Whether the specific activity was in furtherance of employment

- Other specific circumstances and agency application of legal standards

This is not a coverage determination. Actual determination would be made by Ohio BWC and, if disputed, the Industrial Commission based on all facts.

Example Situation 2:

An employee develops carpal tunnel syndrome allegedly from extended computer use performing work duties over several months while working remotely.

General Observations:

Repetitive stress injuries may potentially be compensable as occupational diseases in some circumstances, but determination depends on factors such as:

- Medical documentation establishing work-relatedness and causation

- Whether the condition arose out of employment activities

- Whether the employment created an increased risk beyond general population exposure

- Medical expert opinions

- Other evidentiary factors

Occupational disease claims are highly complex and require:

- Specific medical evidence

- Detailed work history

- Expert medical testimony in many cases

- Application of specific legal standards for occupational diseases

This is general background only. Consult medical professionals for diagnosis and the Ohio BWC for coverage questions regarding occupational diseases.

Scenario Category: Personal Activities at Home

Example Situation 3:

An employee is injured while preparing a personal meal in their home kitchen during a lunch break, away from their designated work area, during a time when they were relieved of all work duties.

General Observations:

Personal comfort activities unrelated to work duties and outside designated work areas may be less likely to be considered work-related under traditional workers’ compensation principles. However, specific facts always matter, including:

- Whether the employee was completely relieved of all duties

- Whether the activity had any connection to employment

- Specific circumstances of the injury

- BWC and Industrial Commission application of legal standards

This is general background only, not a coverage determination.

Scenario Category: Transitional Activities

Example Situation 4:

An employee slips on ice in their driveway while walking to check their mailbox for a work-related package delivery that the employer had sent to the employee’s home for a work project.

General Observations:

This involves multiple potential considerations:

- Whether receiving the work package was part of employment duties

- Whether the activity was required, expected, or authorized by employer

- Application of “coming and going” rule and exceptions

- Specific facts about employer’s role in the delivery

- Whether the activity was in furtherance of employer’s business

Coverage analysis would require complete factual development and application of relevant legal precedents by BWC and Industrial Commission.

This is not a determination.

⚠️Every workers’ compensation claim is unique and depends on:

- Complete specific facts and circumstances

- Medical evidence and documentation

- Official agency investigation and determination

- Application of current legal standards

- Potential hearing process if disputed

For actual coverage questions:

- File a claim with Ohio BWC if you believe an injury is work-related

- Consult with a workers’ compensation attorney

- Contact Ohio BWC for guidance: 1-800-644-6292

Benefits Generally Available (From Statute)

According to Ohio workers’ compensation statutes (ORC § 4123), benefits may include:

Medical Treatment:

- Coverage for reasonable and necessary medical treatment related to the allowed injury or occupational disease

- Treatment must be provided or approved by BWC Medical Care Organization (MCO)

- Includes physician services, hospital care, physical therapy, medications, medical devices

Wage Replacement (Temporary Total Disability):

- Generally paid at approximately 72% of average weekly wage

- Subject to statutory minimum and maximum amounts

- Available when employee is temporarily unable to work due to allowed injury

Disability Benefits:

- Temporary total, temporary partial, permanent total, and permanent partial disability benefits may be available depending on circumstances

- Specific rates and durations established by statute and BWC rules

Vocational Rehabilitation:

- Services may be available to help injured workers return to work

- Subject to BWC approval and eligibility criteria

Death Benefits:

- Benefits may be available to dependents if death results from allowed work-related injury or disease

Specific benefit amounts, eligibility, and duration depend on:

- The allowed claim and medical findings

- Statutory formulas based on wages and degree of disability

- BWC and Industrial Commission determinations

- Specific facts of each case

Source: ORC § 4123.56 (medical benefits), § 4123.56 (compensation rates), § 4123.57-59 (disability benefits); Ohio BWC Publications

For specific questions: Contact Ohio BWC or consult with a workers’ compensation attorney.

Reporting and Claim Process (General Framework)

According to Ohio BWC regulations and requirements, the general process typically involves:

For Employees (Injured Workers):

- Report injury to employer: Immediately or as soon as practicable

- Seek medical attention: Go to emergency room if serious; otherwise seek treatment from BWC-certified provider or employer’s MCO

- Complete employee claim form: BWC Form C-92 (First Report of an Injury, Occupational Disease or Death)

- Submit claim to BWC: Must generally be filed within two years of injury or manifestation of disease (though earlier filing is strongly advised)

For Employers:

- Report to BWC: Complete and file Form C-92

- Deadline: Within one week of notice of injury or occupational disease

- Report even if questionable: BWC recommends reporting even if compensability is uncertain; BWC will make coverage determination

- Provide information: Cooperate with BWC investigation

After Claim Filed:

- BWC investigates the claim

- BWC makes initial allowance decision (allowed or denied)

- If allowed: Benefits begin; medical treatment authorized

- If denied: Claimant may appeal to Industrial Commission

- Either party may request Industrial Commission hearing on disputed issues

⚠️ Critical: Deadlines are strictly enforced. Late reporting may affect claims and result in penalties. When in doubt, report promptly and seek guidance from BWC or legal counsel.

Resources:

- BWC First Report of Injury Form (C-92): Available on BWC website

- BWC Claims Information: https://www.bwc.ohio.gov/basics

- Injured Worker Hotline: 1-800-644-6292

Best Practices for Remote Work (Recommendations Only)

The following are general recommendations compiled from various sources. They do not constitute legal requirements and may not be suitable for all situations. Consult legal counsel, safety professionals, and insurance advisors for guidance tailored to your specific circumstances.

For Employers:

Consider:

- Providing ergonomic equipment or guidance for home office setup

- Documenting remote work locations and designated work areas

- Developing clear injury reporting procedures for remote workers

- Providing safety training specific to remote/home office work

- Establishing clear policies defining work hours and duties

- Communicating with workers’ compensation counsel about remote work arrangements

- Maintaining documentation of home office approvals and setup

Note: These are suggestions only, not legal requirements.

For Employees:

Consider:

- Setting up a dedicated, safe work area

- Using ergonomic equipment and proper work setup

- Following employer safety guidelines and training

- Reporting injuries promptly to employer and seeking medical attention

- Maintaining clear boundaries between work time and personal time

- Documenting work-related injuries with details about what happened

Note: These are suggestions for general awareness, not guarantees of coverage.

Resources and Contacts

Ohio Bureau of Workers’ Compensation:

- Website: https://www.bwc.ohio.gov

- Phone: 1-800-644-6292

- Injured Worker Services: https://www.bwc.ohio.gov/basics/injuredworkers/index.asp

- Employer Services: https://www.bwc.ohio.gov/employer/index.asp

Industrial Commission of Ohio:

- Website: https://www.ic.ohio.gov

- Phone: 1-800-521-2691

For Legal Advice:

- Workers’ compensation attorney

- Ohio State Bar Association Referral: 1-800-282-6556

- Ohio Academy of Trial Lawyers: https://www.oatl.org

⚠️ FINAL CRITICAL REMINDER: Workers’ compensation is a highly specialized area involving complex medical, legal, and factual determinations. Coverage questions, claim eligibility, and benefit entitlement should be directed to:

- Ohio Bureau of Workers’ Compensation (for official determinations and claims filing)

- Industrial Commission of Ohio (for disputed claim adjudication)

- Licensed workers’ compensation attorney (for legal advice and representation)

- Medical professionals (for injury evaluation and treatment)

This section is for general background information only and should not be relied upon for coverage determinations, claims decisions, or legal advice. Every situation is unique and requires proper evaluation by appropriate authorities.

Other Leave Entitlements

Family and Medical Leave Act (FMLA) – Federal

Statutory Authority: 29 U.S.C. § 2601 et seq.

Official Source: https://www.dol.gov/agencies/whd/fmla

Overview

The federal Family and Medical Leave Act entitles eligible employees of covered employers to take unpaid, job-protected leave for specified family and medical reasons.

Employer Coverage:

- Private employers with 50 or more employees

- Public agencies (all, regardless of size)

- Public and private elementary and secondary schools (all, regardless of size)

Employee Eligibility (must meet all criteria):

- Worked for employer for at least 12 months (need not be consecutive)

- Worked at least 1,250 hours during the 12 months before leave begins

- Work at a location where employer has 50+ employees within 75 miles

Leave Entitlement:

Eligible employees may take up to:

- 12 weeks in a 12-month period for:

- Birth and care of newborn child

- Placement and care of adopted or foster child

- Care for spouse, child, or parent with serious health condition

- Employee’s own serious health condition that makes employee unable to perform job functions

- Qualifying exigency arising from family member’s military service

- 26 weeks in a single 12-month period for:

- Care for covered military servicemember with serious injury or illness (military caregiver leave)

Important Provisions:

- Leave is generally unpaid (unless employer policy or state law provides otherwise)

- Employer may require use of accrued paid leave (vacation, sick leave, PTO) concurrently with FMLA leave

- Health insurance coverage must be maintained during leave

- Employee generally entitled to return to same or equivalent position

- Employer cannot retaliate for taking FMLA leave

Source: U.S. Department of Labor; 29 U.S.C. § 2601 et seq.; 29 C.F.R. Part 825

Ohio Military Family Leave

Statutory Authority: ORC § 5906.021

Official Source: https://codes.ohio.gov/ohio-revised-code/section-5906.021

Overview:

Ohio law generally requires employers with 50 or more employees to provide unpaid leave to employees to spend time with family members who are called to active military duty or who have been injured during service.

Employer Coverage:

- Private employers with 50 or more employees in Ohio

Employee Eligibility:

- Worked for employer for at least 12 consecutive months

- Worked at least 1,250 hours during the previous 12 months

Leave Entitlement:

- Up to 10 days (or 80 hours for salaried employees) when family member is:

- Called to active military duty lasting more than 30 days, OR

- Injured, wounded, or hospitalized while on active military duty

Covered Family Members:

- Spouse

- Parent

- Child

- Person for whom employee is legal guardian

Important Provisions:

- Leave is unpaid (unless employer policy provides otherwise)

- Employee must provide reasonable notice to employer

- Employer may require documentation of military duty or injury

- Employee generally entitled to return to same or similar position

Note: This leave may run concurrently with federal FMLA military family leave in some circumstances. Consult legal counsel or HR professional for coordination of leave entitlements.

Source: ORC § 5906.021

Jury Duty Leave

Statutory Authority: ORC § 2313.18

Official Source: https://codes.ohio.gov/ohio-revised-code/section-2313.18

Overview:

According to Ohio law, employers must generally allow employees time off to serve on a jury. Employers are prohibited from disciplining, threatening, or terminating employees for jury service.

Key Provisions:

- Employers must provide time off for jury duty

- Leave is generally unpaid at state law level (though some employers voluntarily pay)

- Employee should provide reasonable notice and copy of jury summons

- Employee cannot be required to use vacation, sick leave, or PTO for jury duty

- Employer cannot retaliate against employee for jury service

Exemptions:

- According to the statute, certain “exempt” employees under FLSA may have different treatment regarding pay during jury service (consult legal counsel)

Note: While Ohio law does not require employers to pay employees for jury duty, federal FLSA regulations may require that salaried exempt employees be paid their full salary for weeks in which they perform any work, even if they miss time for jury duty. Consult wage-hour counsel for specific situations.

Voting Leave

Statutory Authority: ORC § 3599.06

Official Source: https://codes.ohio.gov/ohio-revised-code/section-3599.06

Overview:

According to Ohio law, employees are generally entitled to “reasonable time” off to vote if they do not have sufficient time outside working hours to vote.

Key Provisions:

- Employers must provide “reasonable time” to vote

- No specific amount of time is defined in statute

- Employer may specify when during the workday employee may take time off to vote

- Time off for voting is generally unpaid (Ohio law does not require paid voting leave)

Note: Many employers voluntarily provide paid time off to vote. Employer policies may provide more generous leave than statutory minimums.

Source: ORC § 3599.06

Pregnancy and Parental Leave

Federal Protections:

Pregnancy Discrimination Act (PDA): Federal law prohibits discrimination based on pregnancy, childbirth, or related medical conditions. Pregnancy must be treated the same as other temporary medical conditions for all employment-related purposes, including leave.

FMLA: Eligible employees may take up to 12 weeks of unpaid leave for:

- Birth and care of newborn

- Employee’s own serious health condition related to pregnancy or childbirth

Ohio Law:

Ohio does not have a separate state-mandated paid parental leave law beyond federal FMLA protections. The Ohio Civil Rights Act prohibits pregnancy discrimination.

Employer Policies:

Many Ohio employers voluntarily provide:

- Paid maternity leave

- Paid paternity leave

- Short-term disability coverage for pregnancy

- Extended unpaid leave beyond FMLA

Employees should consult their employee handbook and HR department for specific employer policies.

Bereavement Leave

Ohio Law:

Ohio does not have a law requiring private employers to provide bereavement leave.

Common Practice:

Many employers voluntarily provide bereavement leave (typically 3-5 days) as a benefit. This is generally governed by employer policy.

Domestic Violence Leave

Ohio Law:

Ohio does not have a specific statute requiring paid or unpaid leave for victims of domestic violence as of December 2025.

Protections:

Victims of domestic violence may be eligible for FMLA leave if they have a serious health condition resulting from domestic violence or to care for a family member with such a condition.

Employers should be aware of their obligations under federal and state anti-discrimination laws and should consider reasonable accommodations for employees affected by domestic violence.

Resources for Leave Information

U.S. Department of Labor (for FMLA):

- Website: https://www.dol.gov/agencies/whd/fmla

- Phone: 1-866-4-USWAGE (1-866-487-9243)

Ohio Department of Commerce (for state wage and hour questions):

- Website: https://com.ohio.gov

- Phone: (614) 644-2239

For Legal Advice:

- Employment attorney licensed in Ohio

- Ohio State Bar Association Referral: 1-800-282-6556

Anti-Discrimination Laws

Ohio Civil Rights Act

Statutory Authority: ORC § 4112.01 et seq.

Official Source: https://codes.ohio.gov/ohio-revised-code/chapter-4112

Administering Agency:

Ohio Civil Rights Commission (OCRC)

- Website: https://crc.ohio.gov

- Phone: (614) 466-2785

- Toll-Free: 1-888-278-7101

General Overview

The Ohio Civil Rights Act generally prohibits discrimination in employment based on protected characteristics.

Employer Coverage:

According to the statute, the Act generally applies to employers with four or more employees.

Protected Characteristics (as listed in ORC § 4112.01 and § 4112.02):

- Race

- Color

- Religion

- Sex (including pregnancy, childbirth, and related medical conditions)

- National origin

- Disability

- Age (40 and older)

- Ancestry

- Military status (past, present, or future)

Prohibited Actions:

According to the statute, employers are generally prohibited from:

- Refusing to hire, discharging, or otherwise discriminating in compensation or terms/conditions of employment based on protected characteristics

- Limiting, segregating, or classifying employees in ways that would deprive them of employment opportunities based on protected characteristics

- Retaliating against employees for opposing discriminatory practices or participating in investigations or proceedings

Harassment:

Sexual harassment and harassment based on other protected characteristics may constitute unlawful discrimination under Ohio law.

Source: ORC § 4112.02; Ohio Civil Rights Commission guidance

Federal Anti-Discrimination Laws

Ohio employers must also comply with federal anti-discrimination laws, including:

Title VII of the Civil Rights Act of 1964

Prohibits discrimination based on:

- Race

- Color

- Religion

- Sex (including pregnancy, sexual orientation, and gender identity per recent case law and EEOC guidance)

- National origin

Employer Coverage: 15 or more employees

Enforcing Agency: Equal Employment Opportunity Commission (EEOC)

- Website: https://www.eeoc.gov

- Phone: 1-800-669-4000

Age Discrimination in Employment Act (ADEA)

Prohibits discrimination based on: Age (40 and older)

Employer Coverage: 20 or more employees

Enforcing Agency: EEOC

Americans with Disabilities Act (ADA)

Prohibits discrimination based on: Disability

Key Provisions:

- Prohibits discrimination against qualified individuals with disabilities

- Requires reasonable accommodations for known disabilities (unless undue hardship)

- Prohibits medical inquiries and examinations except in limited circumstances

Employer Coverage: 15 or more employees

Enforcing Agency: EEOC

Source: 42 U.S.C. § 12101 et seq.

Genetic Information Nondiscrimination Act (GINA)

Prohibits discrimination based on: Genetic information

Employer Coverage: 15 or more employees

Enforcing Agency: EEOC

Pregnancy Discrimination

Federal: Pregnancy Discrimination Act (PDA) – amendment to Title VII – prohibits discrimination based on pregnancy, childbirth, or related medical conditions

Ohio: Ohio Civil Rights Act includes sex discrimination prohibition, which has been interpreted to include pregnancy discrimination

Key Principle: Pregnancy must be treated the same as other temporary medical conditions for all employment-related purposes.

Equal Pay

Federal: Equal Pay Act of 1963 – requires equal pay for equal work regardless of sex

Ohio: ORC § 4111.17 – generally prohibits wage discrimination based on sex for equal work

Reasonable Accommodations

Disability Accommodations (ADA and Ohio Law)

Covered employers must generally provide reasonable accommodations to qualified individuals with disabilities unless doing so would create an undue hardship.

Examples of potential reasonable accommodations (not exhaustive):

- Modified work schedules or part-time schedules

- Reassignment to vacant positions

- Modifications to workplace or equipment

- Provision of auxiliary aids or services

- Modified workplace policies

- Remote work or telework (in some circumstances)

Interactive Process: Employers should engage in an interactive dialogue with employees requesting accommodations to determine appropriate accommodations.