Remote Work Laws by State U.S. Guide 2026

State-by-State Analysis of Remote Work Laws

Navigate U.S. Remote Work Regulations State-by-State

Remote work has created a complex landscape of state-by-state employment regulations that both employers and employees must navigate. Each of the 50 states maintains distinct laws governing minimum wage, overtime, paid leave, tax withholding, and employment protections—all of which apply to remote workers based on where they physically perform work.

Why State Laws Matter:

When an employee works remotely from California, California law governs their employment relationship regardless of where the employer is located. This means California’s $16 minimum wage, mandatory meal breaks, extensive paid leave requirements, and pay transparency laws all apply. An employee working from Texas faces entirely different rules with no state income tax, federal minimum wage, and limited mandated benefits.

Key Compliance Challenges:

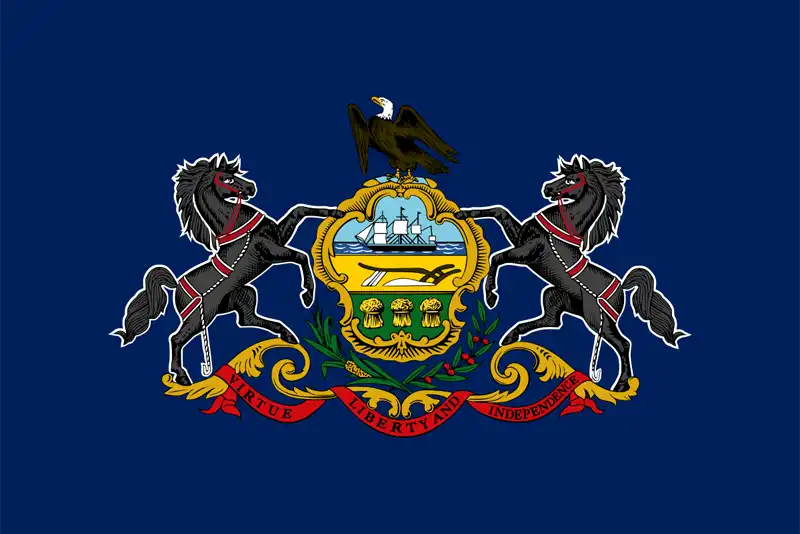

Multi-state employers must navigate competing requirements across jurisdictions. Pay transparency laws in states like California, Colorado, New York, and Washington require salary ranges in job postings. Over a dozen states mandate paid sick leave or comprehensive paid family leave programs. Some states like New York and Pennsylvania impose “convenience rules” potentially taxing residents working remotely for out-of-state employers, while others have reciprocity agreements affecting withholding.

Recent Regulatory Trends:

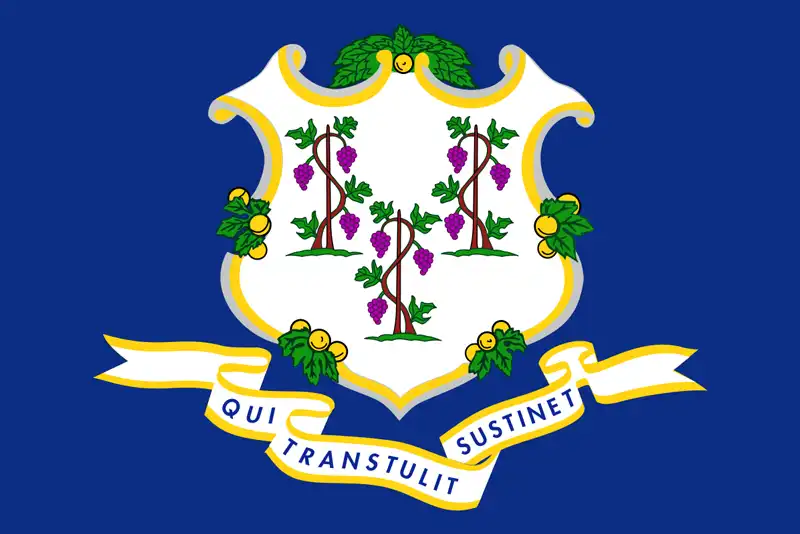

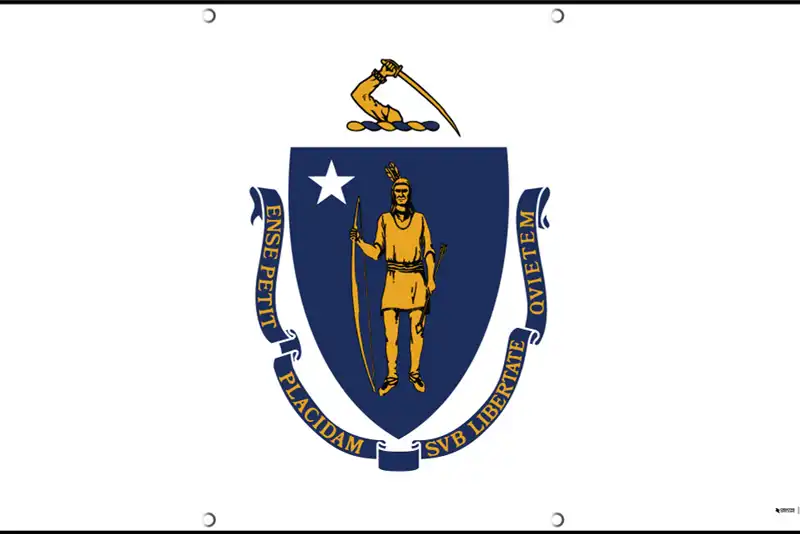

States are rapidly expanding employment protections affecting remote work. Pay transparency requirements continue spreading nationwide. Paid leave mandates now cover millions of workers through state-run programs in Washington, Massachusetts, Connecticut, Oregon, Colorado, and New York. Non-compete agreements face increasing restrictions, with states like California, North Dakota, and Oklahoma banning them entirely while others limit enforceability based on wages or job level. Ban-the-box laws in 35+ states restrict criminal history inquiries during hiring.

Select any state below to access detailed information about employment laws, tax obligations, and compliance requirements for remote workers. Each guide provides current regulations updated for 2026.

Frequently Asked Questions

Which states have no income tax for remote workers?

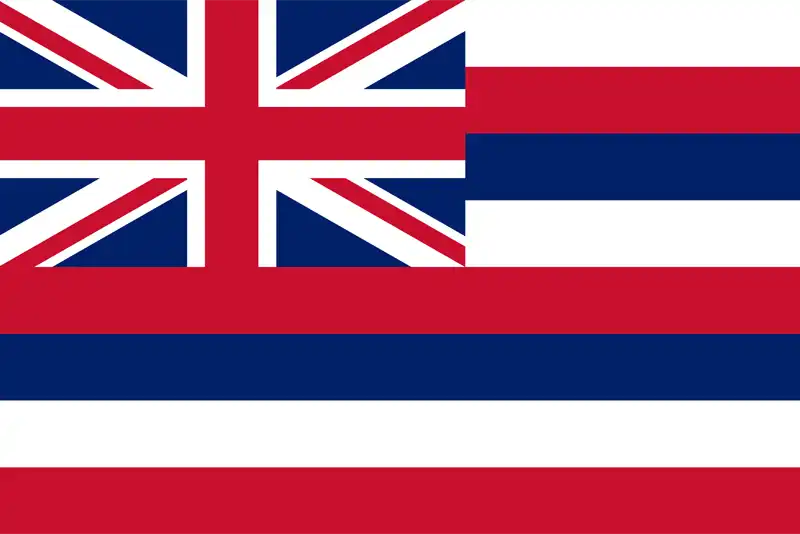

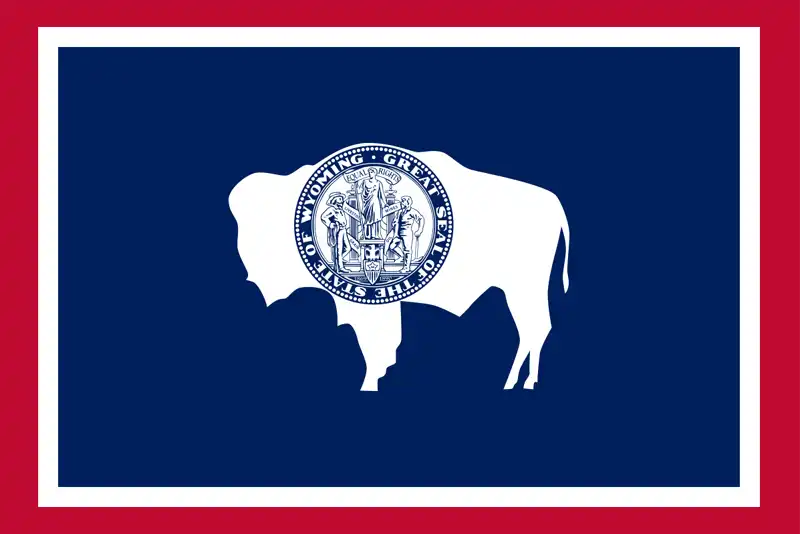

Nine states impose no state income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Remote workers in these states avoid state income tax withholding, resulting in significant savings compared to high-tax states like California (up to 13.3%) or New York (up to 10.9% plus local taxes).

Which states have the highest minimum wages?

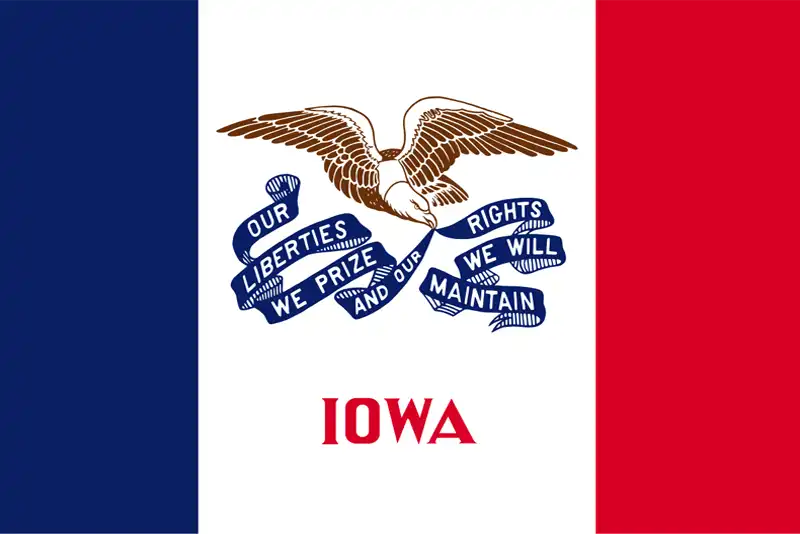

Washington leads at $16.28, followed by California ($16.00), Massachusetts ($15.00), Connecticut ($15.69), and New York ($15.00 statewide). These rates apply to remote workers in these states regardless of employer location. Many cities impose even higher local minimum wages.

Do I pay taxes where I live or where my employer is located?

Generally, you pay state income tax where you physically work (your residence if working from home). Important exceptions include “convenience rules” in states like New York and Pennsylvania that may tax residents working remotely for out-of-state employers. Some states have reciprocity agreements. Consult a tax professional for your situation.

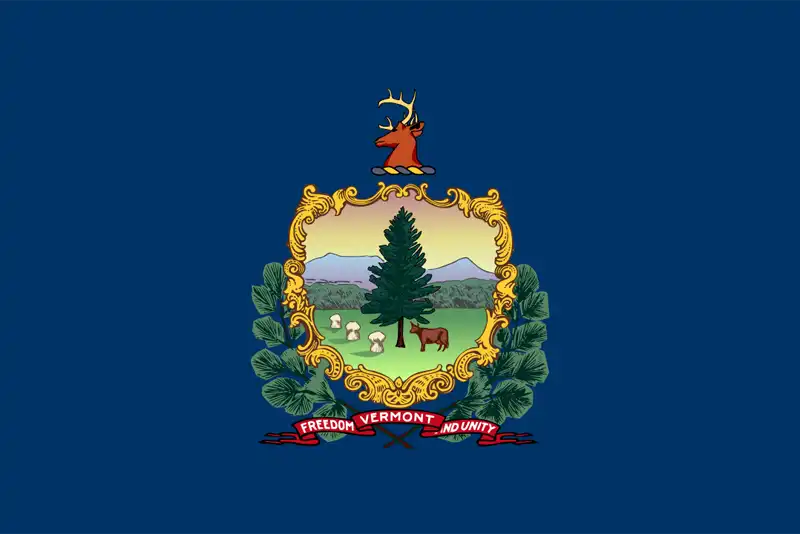

Which states require paid sick leave?

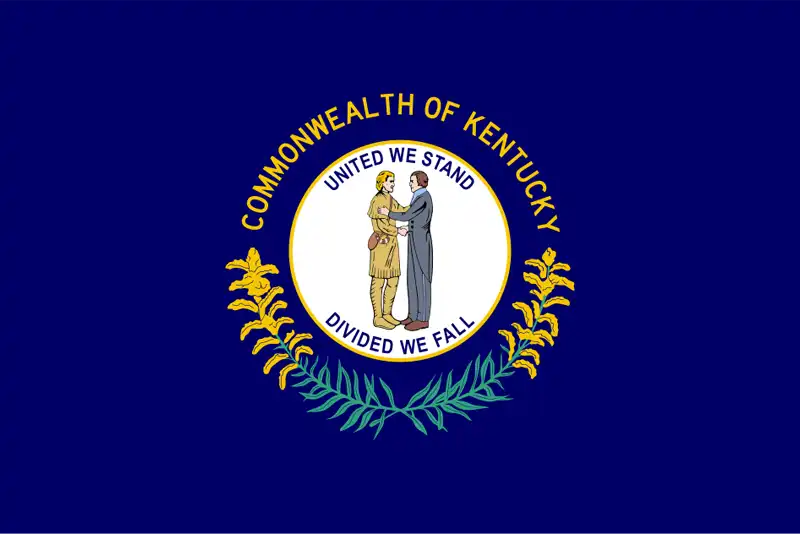

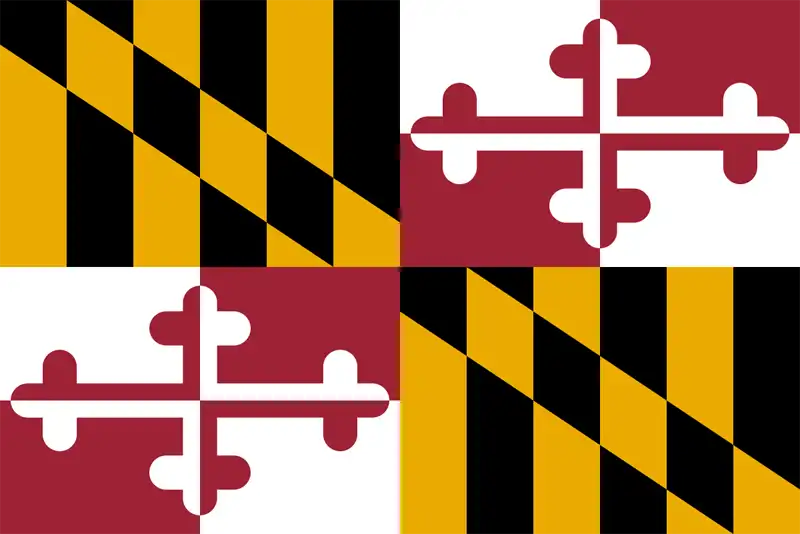

Arizona, California, Colorado, Connecticut, Maine, Maryland, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New Mexico, New York, Oregon, Rhode Island, Vermont, and Washington mandate paid sick leave. Requirements vary from 24-72 hours annually depending on state and employer size.

Which states have paid family leave programs?

Eleven states operate PFML programs: California, Colorado, Connecticut, Delaware, Maryland, Massachusetts, New Jersey, New York, Oregon, Rhode Island, and Washington. These provide 60-90% wage replacement (up to caps) for 8-20 weeks typically, funded through payroll taxes.

Can employers enforce non-compete agreements for remote workers?

Depends on your work state’s law. California, North Dakota, and Oklahoma effectively ban non-competes. Other states impose restrictions: Colorado and Illinois require salary thresholds, Massachusetts caps duration, Minnesota requires employer compensation during restriction. Many states prohibit non-competes for lower-wage workers.

What happens when I move to a different state while working remotely?

You immediately become subject to the new state’s employment laws. Your employer must register for unemployment insurance and workers’ compensation, update tax withholding to the new state, and ensure compliance with new regulations. Notify your employer promptly to avoid withholding errors.

Do state laws apply to independent contractors?

Employment laws like minimum wage and paid leave generally apply only to employees. However, many states use stricter classification tests than federal law, making it harder to classify as contractor. Misclassification can result in back wages, penalties, and tax liability.

Which states require salary ranges in job postings?

California, Colorado, Connecticut, Maryland, Nevada, New York, Rhode Island, and Washington require pay transparency. These laws often apply to remote positions that could be performed in the state, even if the employer is elsewhere.

Are overtime rules different across states?

While federal law requires overtime at 1.5x for hours over 40/week, some states add requirements. California and Nevada mandate daily overtime (over 8 hours). California also requires double-time for hours over 12/day or over 8 on seventh consecutive workday. The most protective law applies.