Wage Garnishment Laws by State 2026 Employee Protection

We are NOT lawyers, debt counselors, or financial advisors. We ARE compilators of publicly available legal information from official government sources.

What is Wage Garnishment?

Wage garnishment, also known as garnishment of wages, is a legal procedure through which a portion of an employee’s earnings is required to be withheld by an employer for the payment of a debt. According to the U.S. Department of Labor, most garnishments are made by court order, though some can be initiated administratively by government agencies.

Source: U.S. Department of Labor – Fact Sheet #30

Types of Wage Garnishment

Wage garnishments can be issued for various types of debts:

Consumer Debts:

- Credit card debt

- Medical bills

- Personal loans

- Auto loan deficiencies

Government Debts:

- Federal income tax debts (IRS levies)

- State income tax debts

- Federal student loans (administrative garnishment)

- Unpaid child support and alimony

Court-Ordered Obligations:

- Criminal restitution payments

- Court fines and fees

- Judgment debts from lawsuits

What Wage Garnishment Is NOT

Wage garnishment does NOT include:

- Voluntary wage assignments – situations where employees voluntarily agree that their employers may turn over some specified amount of their earnings to a creditor

- Payroll deductions for health insurance, retirement contributions, or union dues

- Direct deposits or automatic payments authorized by the employee

Source: 15 U.S.C. § 1673 (Consumer Credit Protection Act)

Federal Wage Garnishment Protections

Consumer Credit Protection Act (CCPA)

The Consumer Credit Protection Act, Title III, sets federal limits on the amount of an employee’s earnings that may be garnished and protects employees from being fired if pay is garnished for only one debt.

Jurisdiction: These federal protections apply in all 50 states, the District of Columbia, and all U.S. territories and possessions.

Administered by: U.S. Department of Labor’s Wage and Hour Division

Federal Wage Garnishment Limits

Understanding wage garnishment limits is critical for both employees and employers. For ordinary garnishments (not for support, bankruptcy, or tax), the federal wage garnishment limits specify that the maximum wage garnishment amount cannot exceed the lesser of:

- 25% of the employee’s disposable earnings, OR

- The amount by which disposable earnings exceed 30 times the federal minimum wage

Current Federal Minimum Wage: $7.25 per hour

Protected Weekly Amount: $217.50 (30 × $7.25)

This means:

- If disposable weekly earnings are $217.50 or less: NO garnishment allowed

- If disposable weekly earnings are more than $217.50 but less than $290: Amount ABOVE $217.50 can be garnished

- If disposable weekly earnings are $290 or more: MAXIMUM 25% can be garnished

Source: U.S. Department of Labor – Federal Wage Garnishment Law

What Are “Disposable Earnings”?

Disposable earnings are the amount of earnings left after legally required deductions are made.

Deductions Required by Law (subtracted to calculate disposable earnings):

- Federal income tax

- State and local income taxes

- Social Security (FICA) taxes

- Medicare taxes

- State unemployment insurance tax

- Employee contributions to state retirement systems required by law

Deductions NOT Required by Law (cannot be subtracted when calculating disposable earnings):

- Voluntary wage assignments

- Union dues

- Health and life insurance premiums

- Charitable contributions

- Savings bond purchases

- Retirement plan contributions (except those required by law)

- Payroll advances or merchandise purchases from employer

Source: 15 U.S.C. § 1673(b); DOL Fact Sheet #30

Federal Garnishment Table

Based on the current federal minimum wage of $7.25 per hour:

| Pay Period | Threshold Amount | Amount Above Threshold That Can Be Garnished | Maximum 25% Applies When Earnings Are: |

|---|---|---|---|

| Weekly | $217.50 or less: NONE |

More than $217.50 but less than $290 | $290 or more |

| Biweekly | $435 or less: NONE |

More than $435 but less than $580 | $580 or more |

| Semimonthly | $471.25 or less: NONE |

More than $471.25 but less than $628.33 | $628.33 or more |

| Monthly | $942.50 or less: NONE |

More than $942.50 but less than $1,256.66 | $1,256.66 or more |

Source: U.S. Department of Labor calculations based on 15 U.S.C. § 1673

Exceptions to Federal Limits

Federal garnishment limits DO NOT apply to:

- Bankruptcy court orders (certain types)

- Federal or state tax debts

- Child support and alimony garnishments (see separate limits below)

Child Support and Alimony Garnishment Limits

For court orders for child support or alimony, federal law allows higher garnishment amounts:

- Up to 50% of disposable earnings if the worker is supporting another spouse or child

- Up to 60% of disposable earnings if the worker is NOT supporting another spouse or child

- An additional 5% may be garnished for support payments more than 12 weeks in arrears

Example:

- Supporting another child: Maximum 50% (55% if 12+ weeks behind)

- Not supporting another child: Maximum 60% (65% if 12+ weeks behind)

Source: 15 U.S.C. § 1673(b)(2)

Federal Tax Debt Garnishment

IRS Tax Levies: The IRS uses a different calculation based on filing status and number of dependents to determine exempt amounts. Unlike regular garnishments, there is no fixed percentage cap.

Process:

- The IRS must have assessed the tax

- The IRS must have sent a written Notice and Demand for Payment

- The taxpayer must have failed to pay

- The IRS must send a Final Notice at least 30 days before the levy

Source: Internal Revenue Code § 6331; IRS.gov

Federal Student Loan Garnishment

Administrative Wage Garnishment (AWG):

- The U.S. Department of Education can garnish up to 15% of disposable earnings for defaulted federal student loans

- No court order required

- As of December 20, 2018, the limit was increased from 10% to 15%

Protections:

- Must keep an amount equal to 30 times the federal minimum wage

- Cannot garnish if employee has been in current job less than 12 months AND was involuntarily separated from previous job

- Must provide 30 days written notice before beginning garnishment

Source: Higher Education Act; 31 U.S.C. § 3720D; Federal Student Aid

Federal Non-Tax Debt Collection

Federal Agency Administrative Garnishment: Federal agencies can garnish up to 15% of disposable earnings to collect other defaulted debts owed to the U.S. government.

Source: Debt Collection Improvement Act; 31 C.F.R. § 285.11

Protection Against Termination

Federal law prohibits employers from firing an employee whose earnings are subject to garnishment for ANY ONE DEBT, regardless of the number of levies made or proceedings brought to collect that debt.

Important: This protection applies only to garnishment for a SINGLE debt. If an employee’s wages are garnished for two or more separate debts, federal law does not protect against termination.

Penalty for violation: Employers who willfully violate this prohibition may be fined up to $1,000 and imprisoned for up to one year.

Source: 15 U.S.C. § 1674

How Wage Garnishment Works

The Garnishment Process Step-by-Step

Step 1: Creditor Obtains Judgment

- For most consumer debts, the creditor must first file a lawsuit

- The creditor must win the lawsuit and obtain a court judgment

- Exceptions: IRS tax levies, federal student loans, child support – these can skip court

Step 2: Creditor Requests Writ of Garnishment

- After obtaining judgment, creditor requests garnishment order from court

- Court issues “Writ of Garnishment” or “Earnings Withholding Order”

Step 3: Notice to Employee

- Employee receives notice of garnishment

- Notice must include information about exemption rights

- Typical timeframe: 20-30 days to respond (varies by state)

Step 4: Notice to Employer (Garnishee)

- Court sends garnishment order to employer

- Employer becomes legally obligated to comply

- Timeframe: Usually must begin withholding within 10-15 days

Step 5: Employer Withholds Wages

- Employer calculates disposable earnings

- Employer withholds allowable amount per pay period

- Employer sends withheld amounts to creditor or court

Step 6: Garnishment Continues

- Garnishment continues until debt is paid in full

- Or until employee’s employment terminates

- Or until garnishment is legally stopped

Source: State garnishment statutes; DOL guidance

Priority of Multiple Garnishments

When an employee has multiple garnishments, federal and state laws determine priority:

Typical Priority Order:

- Child support and alimony (highest priority)

- Federal tax levies

- State tax levies

- Federal student loans

- Other court judgments

Important: The TOTAL amount garnished cannot exceed federal/state limits, even with multiple garnishments. If child support already takes 50% of disposable earnings, no additional amount can be garnished for consumer debts.

Source: State priority statutes; CCPA limitations

Continuing vs. One-Time Garnishments

Continuing Garnishment:

- Remains in effect for future paychecks

- Employer must continue withholding until debt paid or employment ends

- Common for: child support, consumer debts

One-Time (Non-Continuing) Garnishment:

- Applies only to specific paycheck or time period

- Requires new order for future withholding

- Less common; varies by state law

State-by-State Wage Garnishment Laws

Important Note: If state law provides greater protection (results in less garnishment) than federal law, the state law must be followed. If state law is less protective, federal law prevails.

Source: 15 U.S.C. § 1673(a)(1)

Alabama

State Statute: Alabama Code § 6-10-7

Standard Garnishment Limits: Alabama generally follows federal limits:

- 25% of disposable earnings, OR

- Amount by which disposable earnings exceed 30 times the federal minimum wage

- Whichever is LESS

Head of Household Protection:

- 75% of wages exempt for laborers and employees who are residents of Alabama

- Remaining 25% can be garnished

- Garnishee must pay funds into court after 30 days

Special Provisions:

- Garnishment limited to debts contracted or judgments entered in tort

- Head of household protections apply specifically to Alabama residents

- Court must show amount of plaintiff’s claim and court costs on the writ

For Debts Created BEFORE April 12, 1988: Different limits applied:

- 20% of disposable earnings, OR

- Amount exceeding 50 times federal minimum wage

- Whichever is less

Employer Termination Protection: Employers cannot fire or refuse to hire someone because of:

- Child support withholding orders

- Withholding orders for criminal restitution payments

Sources:

Alaska

State Statute: Alaska Stat. § 09.38.030

Standard Garnishment Limits: Alaska follows federal limits:

- 25% of weekly disposable earnings, OR

- Amount exceeding 30 times the federal minimum wage per week

- Whichever is LESS

Weekly Protected Amount: $217.50 (30 × $7.25)

Exemptions:

- First $402.50 of weekly net wages are exempt from garnishment (this is an additional state protection)

- Creditors can take no more than 25% of remaining wages after the $402.50 exemption

Special Protections: Alaska provides more protection than federal law through its higher exemption threshold.

Sources:

- Alaska Statutes § 09.38.030

- Alaska Department of Labor and Workforce Development – (907) 465-2700

Arizona

State Statute: Arizona Revised Statutes § 12-1598

Enhanced Garnishment Limits: Arizona provides GREATER protection than federal law:

- 25% of disposable earnings, OR

- Amount exceeding 30 times the federal minimum wage, OR

- Amount exceeding 60 times the Arizona state minimum wage

- Whichever protects MORE of the earnings

Arizona Minimum Wage (2025): $14.35/hour Protected Weekly Amount (state): $861 (60 × $14.35)

This means Arizona workers keep significantly more of their earnings than under federal law alone.

Poverty Level Exemption: Individuals earning less than 150% of the federal poverty level may qualify for additional exemptions.

Multiple Garnishments: Total garnishments still limited to maximum amounts even with multiple creditors.

Sources:

- Arizona Revised Statutes § 12-1598 and § 33-1131

- Arizona Industrial Commission – (602) 542-4515 (Phoenix) or (520) 628-5459 (Tucson)

- Arizona Minimum Wage Information

Arkansas

State Statute: Arkansas Code Annotated § 16-110-419

Standard Garnishment Limits: Arkansas follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times the federal minimum wage

- Whichever is LESS

Special Provisions:

- Garnishment process governed by Arkansas Rules of Civil Procedure

- Notice requirements to debtor before garnishment

- Exemption claim procedures available

Sources:

- Arkansas Code Annotated § 16-110-419

- Arkansas Attorney General’s Office

California

State Statute: California Code of Civil Procedure § 706.050

Enhanced Garnishment Limits: California provides GREATER protection than federal law:

- 25% of disposable earnings, OR

- Amount exceeding 40 times the California state minimum wage

- Whichever is LESS

California Minimum Wage (2025): $16.00/hour Protected Weekly Amount: $640 (40 × $16.00)

This provides significantly more protection than the federal $217.50 threshold.

Bank Account Protections:

- As of September 1, 2020: $1,788 in bank accounts is automatically exempt (adjusted annually for inflation)

- This exemption is self-executing (debtor doesn’t need to file claim)

- Deposited wages remain exempt if traceable

Recent Legislative Changes: Assembly Bill 2837 (strengthened 2025):

- Enhanced notice requirements

- Stricter compliance rules for creditors

- Improved protections for low-income workers

Head of Household Protection: Not applicable in same form as other states, but California’s higher minimum wage multiplier provides similar protection.

Sources:

Colorado

State Statute: Colorado Revised Statutes § 13-54-104

Standard Garnishment Limits: Colorado generally follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times the federal minimum wage ($217.50 weekly)

- Whichever is LESS

Important Limitation: Certain types of consumer debts may face restrictions. Garnishment generally NOT allowed for certain medical bills and student loans under specific circumstances.

Protected Income: Public benefits, Social Security, and certain other income sources fully protected.

Sources:

- Colorado Revised Statutes § 13-54-104

- Colorado Department of Labor and Employment – (888) 390-7936

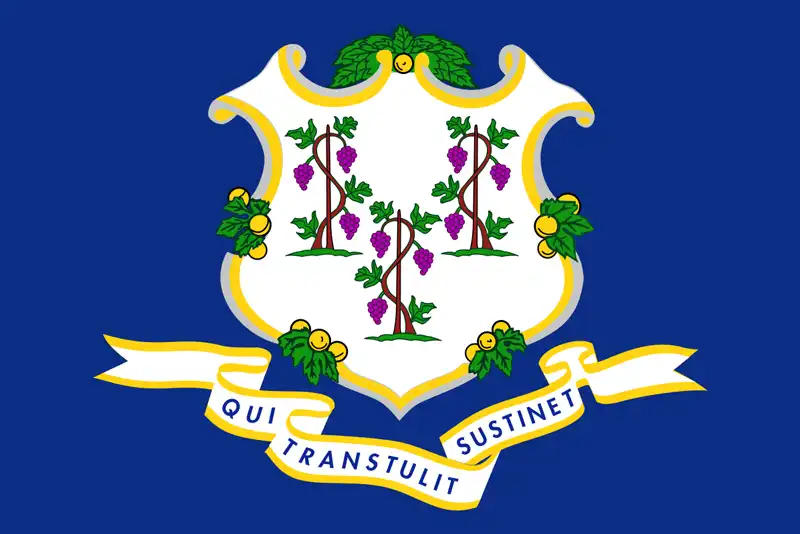

Connecticut

State Statute: Connecticut General Statutes § 52-361a

Enhanced Garnishment Limits: Connecticut provides additional protections:

- 25% of disposable earnings, OR

- Amount exceeding 40 times the federal minimum wage

- Whichever is LESS

Protected Weekly Amount: $290 (40 × $7.25)

For workers earning above the threshold, Connecticut’s 40x multiplier (vs. federal 30x) provides more protection.

Special Provisions:

- Exemptions for certain types of debts

- Medical bills and credit card debts may face garnishment restrictions

- Enhanced protections for low-income workers

Sources:

- Connecticut General Statutes § 52-361a

- Connecticut Department of Labor – (860) 263-6000

Delaware

State Statute: Delaware Code Title 10, § 4913

Strict Garnishment Limits: Delaware provides MORE protection than federal law:

Wage Garnishment: Limited to 15% of disposable earnings

Bank Account Garnishment: Delaware PROHIBITS garnishment of bank accounts altogether (for consumer debts).

This is one of the most protective states for workers facing garnishment.

Child Support Exception: Higher percentages allowed for child support obligations.

Sources:

- Delaware Code Title 10, § 4913

- Delaware Department of Labor

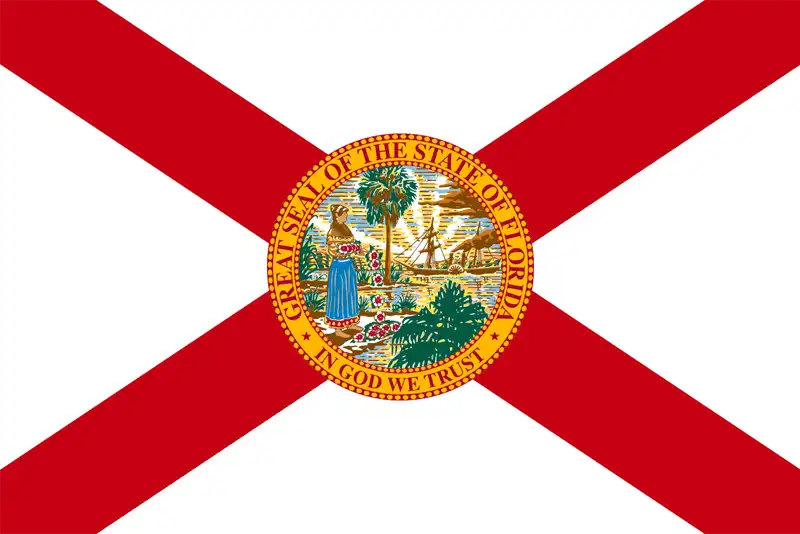

Florida

State Statute: Florida Statutes § 77.041, § 222.11

Standard Garnishment Limits: Florida follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

CRITICAL HEAD OF HOUSEHOLD EXEMPTION:

Florida provides one of the STRONGEST protections in the nation for heads of household.

Who Qualifies as Head of Household:

- Provides more than half of the support for a dependent

- Dependent can be: spouse, child, parent, or anyone with legal/moral obligation to support

- Dependent does NOT need to live with the debtor

- Dependent does NOT need to qualify as tax dependent

Protection Level:

If weekly disposable earnings are $750 or LESS:

- 100% EXEMPT from garnishment (fully protected)

If weekly disposable earnings are MORE than $750:

- First $750 is fully protected

- Only amount above $750 can be garnished (up to 25% of the excess)

Bank Account Protection:

- Head of household exempt wages deposited in bank remain exempt for 6 months

- Even if commingled with other funds (but must be traceable)

Waiver:

- Debtor CAN waive head of household exemption in writing

- Waiver must be in separate document (at least 14-point font)

- Waiver must clearly describe the exemption being waived

- Bankruptcy protection: Bankruptcy Code § 522(e) invalidates waivers made to unsecured creditors

Claiming the Exemption:

- Must file “Claim of Exemption” form with court within 20 days of garnishment notice

- Must serve copy on creditor

- Court schedules hearing (typically 4-10 weeks later)

- Garnishment continues until court orders otherwise

- Must provide proof: pay stubs, tax returns, proof of dependents

Employer vs. Independent Contractor:

- Exemption applies to EMPLOYEES only (W-2 workers)

- Generally does NOT apply to independent contractors (1099 workers)

- Courts examine degree of control, regular paycheck, employment contract

If Both Spouses Work:

- Only ONE spouse can claim head of household exemption

- Usually the higher-earning spouse with children

- If no children: more complex analysis of who provides primary support

Sources:

- Florida Statutes § 222.11

- Florida Statutes § 77.041

- Florida Bar Journal – Head of Household Exemption analysis

Georgia

State Statute: Georgia Code § 18-4-20

Standard Garnishment Limits: Georgia follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Special Provisions:

- Continuing garnishment allowed

- Standard 25% limit applies to most consumer debts

Sources:

- Georgia Code § 18-4-20

- Georgia Department of Labor – (404) 656-3011

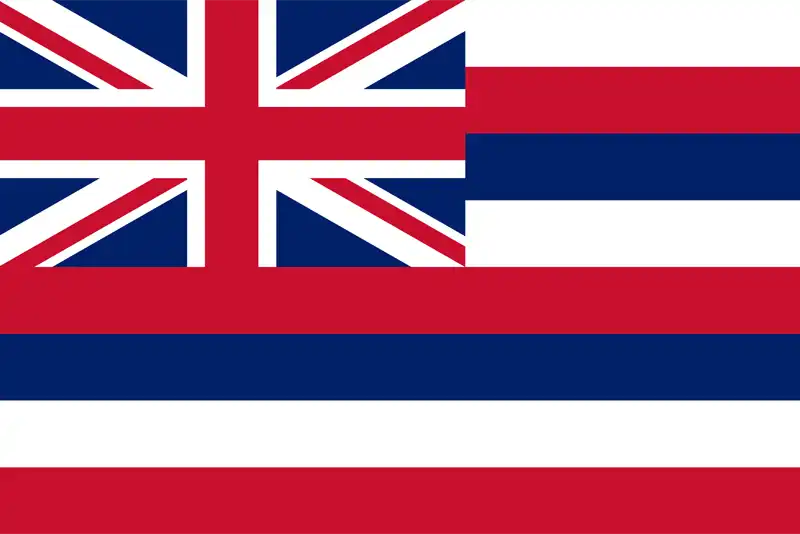

Hawaii

State Statute: Hawaii Revised Statutes § 652-1

UNIQUE Tiered Garnishment System:

Hawaii uses a completely different calculation than most states:

Tier 1: First $100 of disposable earnings per MONTH

- 5% can be garnished (95% protected)

Tier 2: Second $100 of disposable earnings per MONTH

- 10% can be garnished (90% protected)

Tier 3: Earnings ABOVE $200 per MONTH

- 20% can be garnished (80% protected)

Example Calculation: Monthly disposable earnings of $1,000:

- First $100: $5 garnished (5%)

- Second $100: $10 garnished (10%)

- Remaining $800: $160 garnished (20%)

- Total garnished: $175/month

This system provides MORE protection for lower-income workers.

Sources:

- Hawaii Revised Statutes § 652-1

- State garnishment calculation guides

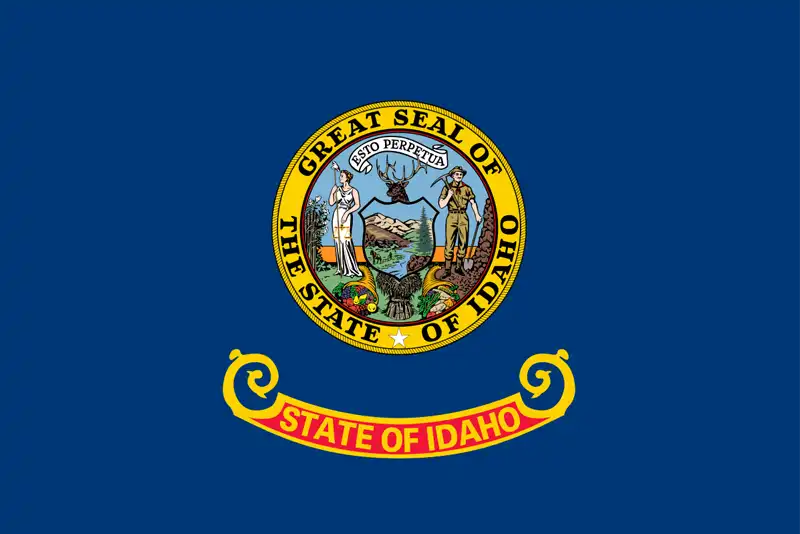

Idaho

State Statute: Idaho Code § 11-207

Standard Garnishment Limits: Idaho follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Bank Account Protection: Deposited wages that are traceable remain exempt under certain conditions.

Sources:

- Idaho Code § 11-207

- Idaho Department of Labor

Illinois

State Statute: 735 ILCS 5/12-803

Enhanced Garnishment Limits: Illinois provides GREATER protection than federal law:

- 15% of gross weekly wages, OR

- Amount exceeding 45 times the Illinois state minimum wage

- Whichever is LESS

Illinois Minimum Wage (2025): $14.00/hour Protected Weekly Amount: $630 (45 × $14.00)

Key Difference: Illinois caps at 15% of GROSS wages (before deductions), not 25% of disposable (after-tax) earnings. This typically results in less garnishment.

Additional Protections:

- Enhanced protections for low-wage workers

- Stronger notice requirements

Sources:

- 735 Illinois Compiled Statutes 5/12-803

- Illinois Department of Labor

Indiana

State Statute: Indiana Code § 24-4.5-5-105

Standard Garnishment Limits: Indiana generally follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Special Provision – First Payment Protection: Employees have the right to argue for a reduction to 10% of disposable earnings for the first garnishment payment.

Sources:

- Indiana Code § 24-4.5-5-105

- Indiana Department of Labor

Iowa

State Statute: Iowa Code § 642.21

Enhanced Garnishment Limits: Iowa provides additional protections through exemptions and is considered a state with “stricter limits than federal.”

Protected Amounts: Standard federal calculations apply, but Iowa courts have interpreted exemptions favorably for workers.

Bank Account Protection: Deposited wages remain exempt if properly traced.

Sources:

- Iowa Code § 642.21

- Iowa Division of Labor

Kansas

State Statute: Kansas Statutes § 60-2310

Standard Garnishment Limits: Kansas follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Sources:

- Kansas Statutes Annotated § 60-2310

- Kansas Department of Labor

Kentucky

State Statute: Kentucky Revised Statutes § 425.506

Standard Garnishment Limits: Kentucky follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Sources:

- Kentucky Revised Statutes § 425.506

- Kentucky Labor Cabinet

Louisiana

State Statute: Louisiana Code of Civil Procedure Article 2892

Standard Garnishment Limits: Louisiana follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Head of Household Enhancement: Louisiana provides additional exemptions for heads of household, though not as comprehensive as Florida.

Sources:

- Louisiana Code of Civil Procedure Article 2892

- Louisiana Workforce Commission

Maine

State Statute: Maine Revised Statutes Title 14, § 3127

Enhanced Garnishment Limits: Maine is categorized as a state with “stricter limits” providing more protection than federal minimums.

Exemptions: Enhanced wildcard exemptions available that can be applied to wages and bank accounts.

Sources:

- Maine Revised Statutes Title 14, § 3127

- Maine Department of Labor

Maryland

State Statute: Maryland Code, Commercial Law § 15-601

Enhanced Garnishment Limits: Maryland provides additional protections beyond federal law for certain income levels.

Protected Wages: Calculation favors employee protection, particularly for lower-income workers.

Sources:

- Maryland Code, Commercial Law § 15-601

- Maryland Department of Labor

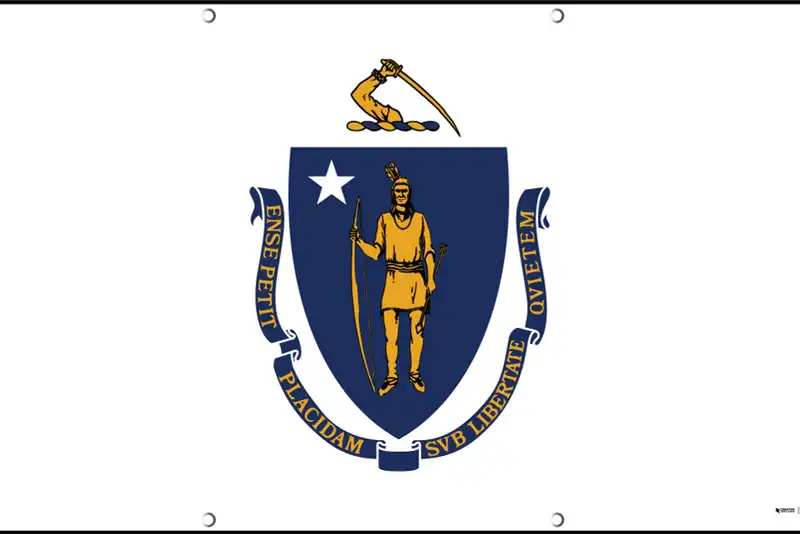

Massachusetts

State Statute: Massachusetts General Laws Chapter 246, § 28

MUCH STRONGER Protection Than Federal:

Massachusetts provides some of the best wage garnishment protections:

- 15% of gross weekly wages, OR

- Amount exceeding 50 times the state minimum wage

- Whichever is LESS

Massachusetts Minimum Wage (2025): $15.00/hour Protected Weekly Amount: $750 (50 × $15.00)

Key Advantages:

- Only 15% maximum (vs. federal 25%)

- Based on GROSS wages (before taxes), not disposable earnings

- 50x multiplier (vs. federal 30x) with state minimum wage

This combination creates extremely strong worker protections.

Fixed Amount Protection: Workers can protect a fixed weekly amount, which is particularly beneficial for low-income earners.

Sources:

- Massachusetts General Laws Chapter 246, § 28

- Massachusetts Executive Office of Labor and Workforce Development

Michigan

State Statute: Michigan Compiled Laws § 600.4012

Standard Garnishment Limits: Michigan generally follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Partial Protection for Lower-Income: Michigan courts have applied protections for lower-income workers in certain circumstances.

Sources:

- Michigan Compiled Laws § 600.4012

- Michigan Department of Labor and Economic Opportunity

Minnesota

State Statute: Minnesota Statutes § 571.922

Enhanced Garnishment Limits: Minnesota uses:

- 25% of disposable earnings, OR

- Amount exceeding 40 times the federal minimum wage per week

- Whichever is LESS

Protected Weekly Amount: $290 (40 × $7.25)

This 40x multiplier (vs. federal 30x) provides additional protection.

Bank Account Protection: Deposited wages remain exempt if properly traced.

Sources:

- Minnesota Statutes § 571.922

- Minnesota Department of Labor and Industry

Mississippi

State Statute: Mississippi Code § 85-3-4

Standard Garnishment Limits: Mississippi follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Sources:

- Mississippi Code Annotated § 85-3-4

- Mississippi Department of Employment Security

Missouri

State Statute: Missouri Revised Statutes § 525.030

Standard Garnishment Limits: Missouri follows federal limits exactly with no additional state protections:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

No Enhanced Protections: Missouri does not provide worker protections beyond federal minimums.

Sources:

- Missouri Revised Statutes § 525.030

- Missouri Department of Labor and Industrial Relations

Montana

State Statute: Montana Code Annotated § 25-13-614

Standard Garnishment Limits: Montana follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Bank Account Protection: Deposited wages remain exempt under certain tracing conditions.

Sources:

- Montana Code Annotated § 25-13-614

- Montana Department of Labor and Industry

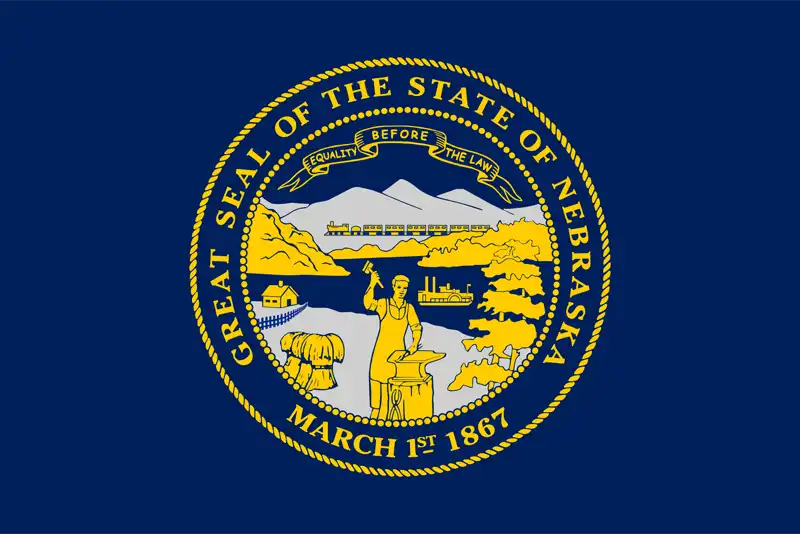

Nebraska

State Statute: Nebraska Revised Statutes § 25-1558

Standard Garnishment Limits: Nebraska follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Bank Account Protection: Deposited wages traceable for exemption protection.

Sources:

- Nebraska Revised Statutes § 25-1558

- Nebraska Department of Labor

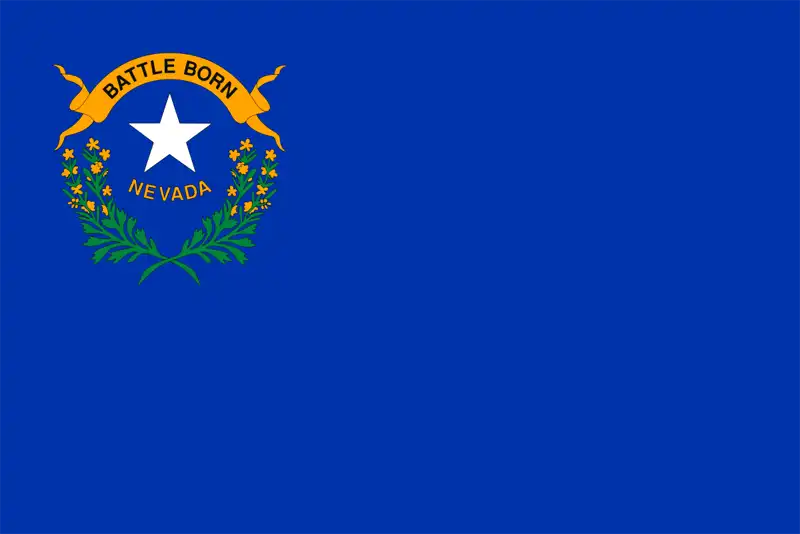

Nevada

State Statute: Nevada Revised Statutes § 31.295

Enhanced Garnishment Limits: Nevada uses:

- 25% of disposable earnings, OR

- Amount exceeding 50 times the federal minimum wage per week

- Whichever is LESS

Protected Weekly Amount: $362.50 (50 × $7.25)

The 50x multiplier (vs. federal 30x) provides significantly MORE protection for Nevada workers.

Professional Income Exemptions: Nevada provides broad exemptions for certain professional incomes (doctors, lawyers) beyond standard limits.

Sources:

- Nevada Revised Statutes § 31.295

- Nevada Department of Employment, Training and Rehabilitation

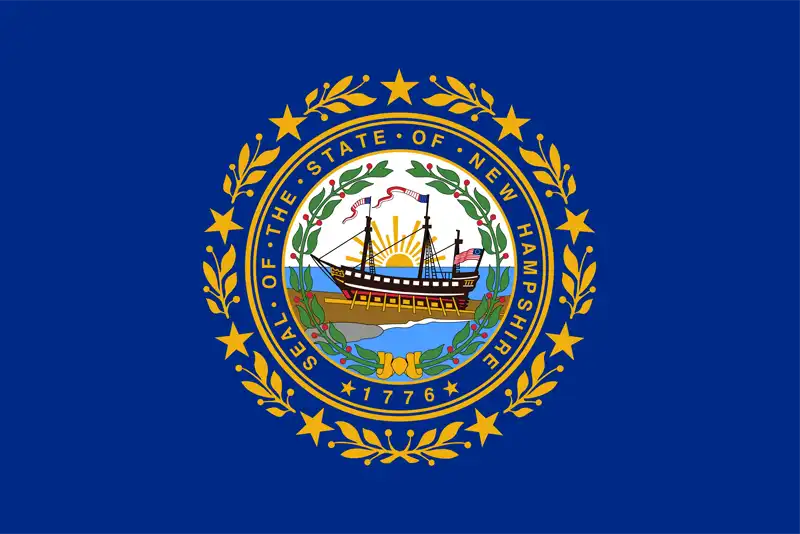

New Hampshire

State Statute: New Hampshire Revised Statutes § 512:21

Enhanced Garnishment Limits: New Hampshire uses:

- 25% of disposable earnings, OR

- Disposable earnings minus 50 times federal hourly minimum wage

- Whichever is LESS

Protected Weekly Amount: $362.50 (50 × $7.25)

CRITICAL LIMITATION – Non-Continuing: New Hampshire garnishments are NOT continuing. Each garnishment is limited to a specific time period (typically 2 weeks of wages).

Requirement for Additional Collection: If creditor wants to garnish more than 2 weeks of wages, they must return to court and obtain a new garnishment order each time.

This makes New Hampshire garnishments more burdensome for creditors and provides practical protection for workers.

Hardship Exemptions: Additional exemptions available upon showing financial hardship.

Sources:

- New Hampshire Revised Statutes § 512:21

- New Hampshire Department of Labor – (603) 271-3176

New Jersey

State Statute: New Jersey Statutes § 2A:17-56

Income-Based Tiered System:

New Jersey has a UNIQUE system based on income level:

For individuals earning 250% or LESS of federal poverty level:

- Maximum 10% of disposable earnings can be garnished

For individuals earning GREATER than 250% of federal poverty level:

- Up to 25% of disposable earnings can be garnished

Minimum Weekly Earnings Protection: Workers with gross wages of $154.50 or less per week CANNOT have wages garnished.

This income-based approach provides exceptional protection for low-wage workers.

Exceptions: Higher percentages allowed for child support, taxes, and student loans.

Sources:

- New Jersey Statutes Annotated § 2A:17-56

- New Jersey Department of Labor and Workforce Development – (609) 777-3200

New Mexico

State Statute: New Mexico Statutes § 35-12-7

Enhanced Garnishment Limits: New Mexico uses:

- 25% of disposable earnings, OR

- Amount exceeding 40 times the federal minimum wage per week

- Whichever is LESS

Protected Weekly Amount: $290 (40 × $7.25)

The 40x multiplier provides more protection than the federal 30x standard.

Sources:

- New Mexico Statutes Annotated § 35-12-7

- New Mexico Department of Workforce Solutions

New York

State Statute: New York Civil Practice Law and Rules § 5231

EXCEPTIONAL Multi-Factor Protection:

New York uses the MOST protective approach in the nation:

The amount subject to garnishment is the LEAST of three calculations:

- 10% of gross wages, OR

- 25% of disposable earnings, OR

- Disposable earnings minus 30 times the New York state minimum wage

New York Minimum Wage (2025 NYC): $16.00/hour Protected Weekly Amount: $480 (30 × $16.00)

Whichever calculation results in the SMALLEST garnishment amount is used.

Example: Worker earning $800/week gross, $650 disposable:

- 10% of gross: $80

- 25% of disposable: $162.50

- Disposable minus (30 × $16): $650 – $480 = $170 Garnishment: $80 (lowest amount)

Bank Account Protection (Self-Executing): New York provides automatic exemption of $2,664 to $3,600 in bank accounts (depending on minimum wage), which requires NO action by the debtor. Banks must automatically protect this amount.

Strengthened 2025 Employer Rules: New legislation in 2025 enhanced employer obligations and worker protections.

Continuing Garnishment: New York allows continuing wage garnishment orders. If employee changes jobs, wages at new employer automatically garnished if creditor has continuing order.

Sources:

- New York CPLR § 5231

- New York Department of Labor

- New York State minimum wage orders

North Carolina

State Statute: North Carolina General Statutes § 1-362

🚫 Statutory Prohibition on Consumer Debt Wage Garnishment

North Carolina is one of only FOUR states that PROHIBIT wage garnishment for consumer debts.

What CANNOT be garnished:

- Credit card debt

- Medical bills

- Personal loans

- Auto loan deficiencies

- Collection agency debts

- Most civil judgments

What CAN be garnished:

- Child support and alimony

- Federal income taxes (IRS levies)

- State income taxes

- Federal student loans (administrative garnishment)

- Court-ordered fines and restitution (criminal cases)

Limit for Allowed Garnishments: For the garnishments that ARE allowed, North Carolina limits wage garnishment to 10% of gross wages.

Out-of-State Garnishment Orders: Important caveat: If a creditor obtains a garnishment order from a court in another state that has jurisdiction over the employer (e.g., employer has offices in multiple states), the out-of-state garnishment MAY be enforceable even for consumer debts. However, this requires specific jurisdictional criteria to be met.

Bank Account Garnishment: While wages are protected, bank accounts CAN be garnished for consumer debts. However, deposited wages remain exempt if properly traced.

Sources:

- North Carolina General Statutes § 1-362

- North Carolina Department of Labor

- National Consumer Law Center – State Wage Garnishment Analysis

North Dakota

State Statute: North Dakota Century Code § 32-09.1-03

Standard Garnishment Limits: North Dakota follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Sources:

- North Dakota Century Code § 32-09.1-03

- North Dakota Department of Labor and Human Rights

Ohio

State Statute: Ohio Revised Code § 2329.66

Standard Garnishment Limits: Ohio follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

EBT Protection: Ohio specifically protects funds directly deposited through electronic benefit transfers (EBTs) from welfare programs, even if in the same account as garnishable wages.

Sources:

- Ohio Revised Code § 2329.66

- Ohio Department of Job and Family Services

Oklahoma

State Statute: Oklahoma Statutes Title 12, § 1171

Standard Garnishment Limits: Oklahoma follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Bank Account Protection: Deposited wages remain exempt under certain tracing conditions.

Sources:

- Oklahoma Statutes Title 12, § 1171

- Oklahoma Employment Security Commission

Oregon

State Statute: Oregon Revised Statutes § 18.385

Enhanced Garnishment Limits (2025 Updates):

Oregon provides STRONG protection:

- 25% of disposable earnings, OR

- Greater of:

- 75% of disposable income, OR

- Fixed dollar cap (adjusted periodically)

2025 Biweekly Protection: Oregon raised exempt amounts in 2025 to $509 biweekly minimum or 75% of take-home pay, whichever is GREATER.

Key Feature: Oregon’s calculation ensures workers always keep the GREATER protected amount, not the lesser.

Different Calculation Method: While the outcome is similar to federal law for many workers, Oregon’s methodology of protecting the “greater” amount can result in more protection in certain scenarios.

Bank Account Protection: Deposited wages remain exempt if properly traced.

Sources:

- Oregon Revised Statutes § 18.385

- Oregon Bureau of Labor and Industries

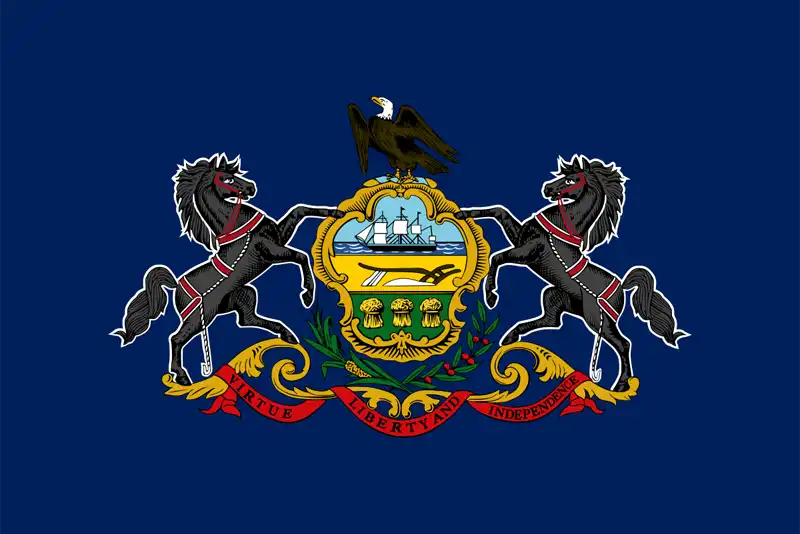

Pennsylvania

State Statute: Pennsylvania Rules of Civil Procedure 3146

🚫 Significant statutory limitations on Consumer Debt Wage Garnishment

Pennsylvania is one of only FOUR states that essentially BAN wage garnishment for consumer debts.

What CANNOT be garnished (wages fully protected):

- Credit card debt

- Medical bills

- Personal loans

- Collection agency debts

- Most civil judgments

- Auto loan deficiencies

What CAN be garnished:

- Child support and alimony

- Federal income taxes (IRS levies)

- Certain local taxes (earned income tax, per capita tax)

- Federal student loan defaults

- Criminal restitution orders

- Back rent (in limited circumstances)

- Divorce property distribution orders

Limits for Allowed Garnishments: When garnishment IS allowed, limits vary by type of debt but generally cannot exceed amounts necessary to satisfy the specific obligation.

Sources:

- Pennsylvania Rules of Civil Procedure 3146

- Pennsylvania Department of Labor and Industry

- Pennsylvania statute exemptions

Rhode Island

State Statute: Rhode Island General Laws § 9-26-4

Standard Garnishment Limits: Rhode Island follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Sources:

- Rhode Island General Laws § 9-26-4

- Rhode Island Department of Labor and Training

South Carolina

State Statute: South Carolina Code § 37-5-104

🚫 Statutory Prohibition on Consumer Debt Wage Garnishment

South Carolina is one of only FOUR states that PROHIBIT wage garnishment for consumer debts.

What CANNOT be garnished:

- Credit card debt

- Medical bills

- Personal loans

- Collection agency debts

- Auto loan deficiencies

- Most civil judgments

What CAN be garnished:

- Child support and alimony

- Federal income taxes (IRS levies)

- State income taxes

- Federal student loans (administrative garnishment)

- Court-ordered fines and restitution (criminal cases)

Different Restrictions by Debt Type: South Carolina law features different restrictions depending on the specific type of debt.

Bank Account Garnishment: While wages are fully protected, bank accounts CAN still be garnished for consumer debts.

Out-of-State Orders: Similar to North Carolina, South Carolina’s protections may be circumvented if a creditor obtains jurisdiction through an employer’s offices in another state, though this is limited.

Sources:

- South Carolina Code of Laws § 37-5-104

- South Carolina Department of Employment and Workforce

- National Consumer Law Center analysis

South Dakota

State Statute: South Dakota Codified Laws § 21-18-51

Standard Garnishment Limits: South Dakota follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Sources:

- South Dakota Codified Laws § 21-18-51

- South Dakota Department of Labor and Regulation

Tennessee

State Statute: Tennessee Code Annotated § 26-2-106

Standard Garnishment Limits: Tennessee follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Sources:

- Tennessee Code Annotated § 26-2-106

- Tennessee Department of Labor and Workforce Development

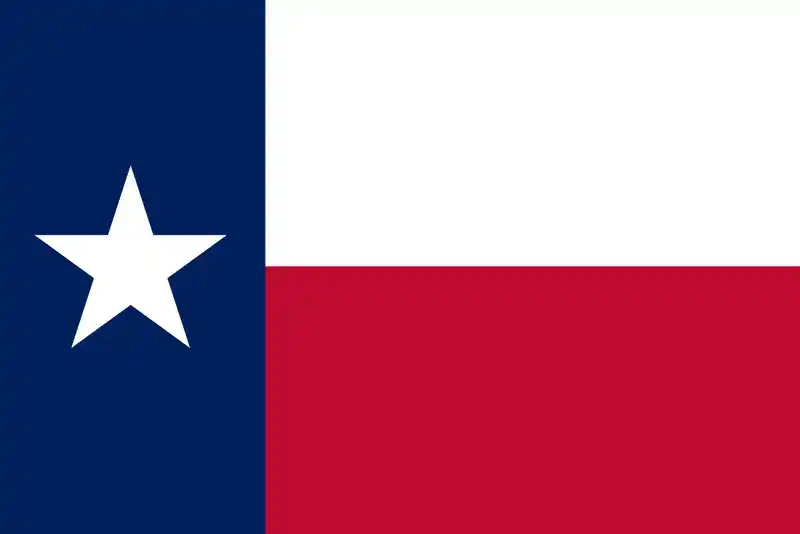

Texas

State Statute: Texas Constitution Article 16, Section 28; Texas Property Code § 42.001

Texas is one of only FOUR states that BAN wage garnishment for consumer debts, and has the MOST comprehensive protection.

What CANNOT be garnished (wages FULLY protected):

- Credit card debt

- Medical bills

- Personal loans

- Collection agency debts

- Auto loan deficiencies

- Most civil judgments

- Business debts

- Tort judgments

What CAN be garnished:

- Child support and alimony ONLY

- Federal income taxes (IRS levies) ONLY

- Federal student loans (administrative garnishment) ONLY

- State income taxes (none in Texas, but theoretical)

Key Distinction: Texas provides the MOST LIMITED list of garnishable debts. Even court-ordered fines and many items allowed in other “no garnishment” states are NOT garnishable in Texas.

Bank Account Garnishment: While wages are protected, bank accounts CAN be garnished for judgments. However, certain exempt funds remain protected even in bank accounts.

Head of Household Protection: Texas provides additional exemptions for heads of household that apply to bank account garnishments and property seizures (though not applicable to wages since wages already cannot be garnished for consumer debts).

Out-of-State Orders: Texas’s constitutional protection is strong but may not prevent enforcement of out-of-state garnishment orders if the employer has sufficient contacts with the other state to give that state’s court personal jurisdiction over the employer.

Sources:

- Texas Constitution Article 16, Section 28

- Texas Property Code § 42.001

- Texas Workforce Commission

Utah

State Statute: Utah Code § 70C-7-103

Standard Garnishment Limits: Utah follows federal limits exactly:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

No Enhanced Protections: Utah provides no additional state protections beyond federal minimums.

Sources:

- Utah Code Annotated § 70C-7-103

- Utah Labor Commission

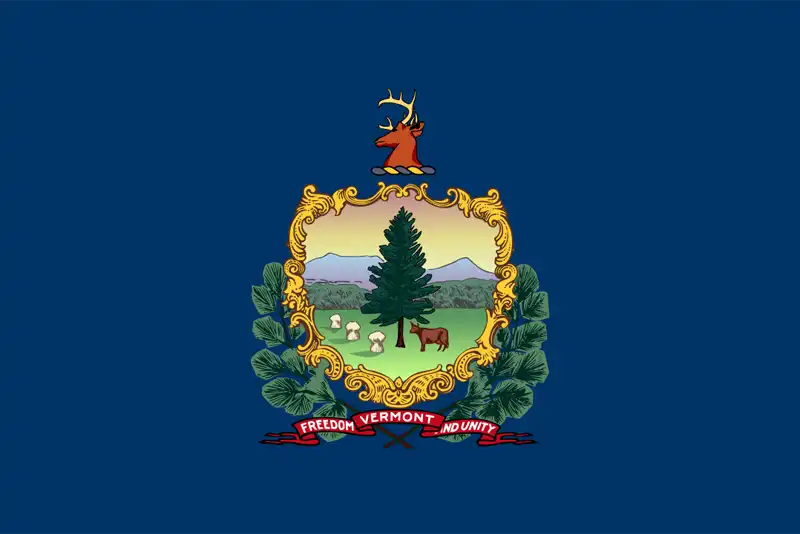

Vermont

State Statute: Vermont Statutes Title 12, § 3170

Enhanced Garnishment Limits: Vermont is categorized among states with “stricter limits” providing more protection than federal minimums.

Additional Exemptions: Vermont courts have applied exemptions favorably for workers.

Sources:

- Vermont Statutes Annotated Title 12, § 3170

- Vermont Department of Labor

Virginia

State Statute: Virginia Code § 34-29

Enhanced Garnishment Limits: Virginia uses:

- 25% of disposable earnings, OR

- Disposable earnings minus 40 times the federal minimum wage

- Whichever is LESS

Protected Weekly Amount: $290 (40 × $7.25)

The 40x multiplier (vs. federal 30x) provides additional protection for Virginia workers.

Sources:

- Virginia Code § 34-29

- Virginia Employment Commission

Washington

State Statute: Revised Code of Washington § 6.27.150

Enhanced Garnishment Limits: Washington provides GREATER protection:

- 25% of disposable earnings, OR

- Disposable earnings minus 35 times the Washington state minimum wage per week

- Whichever is LESS

Washington Minimum Wage (2025): $16.28/hour Protected Weekly Amount: $569.80 (35 × $16.28)

This is one of the HIGHEST protected amounts in the nation due to Washington’s high minimum wage and 35x multiplier.

Exception for Child Support: Higher percentages allowed for child support garnishments.

Sources:

West Virginia

State Statute: West Virginia Code § 38-5A-3

Enhanced Garnishment Limits: West Virginia uses:

- 20% of disposable earnings (LOWER than federal 25%), OR

- Disposable earnings minus 30 times federal minimum wage

- Whichever is LESS

Maximum Cap: West Virginia’s 20% maximum (vs. federal 25%) provides more protection for all workers above the minimum threshold.

Sources:

- West Virginia Code § 38-5A-3

- West Virginia Division of Labor

Wisconsin

State Statute: Wisconsin Statutes § 812.34

Enhanced Garnishment Limits: Wisconsin uses:

- 20% of disposable earnings (LOWER than federal 25%), OR

- Disposable earnings minus 30 times federal minimum wage

- Whichever is LESS

Maximum Cap: Wisconsin’s 20% maximum provides more protection than the federal 25% standard.

Sources:

- Wisconsin Statutes § 812.34

- Wisconsin Department of Workforce Development

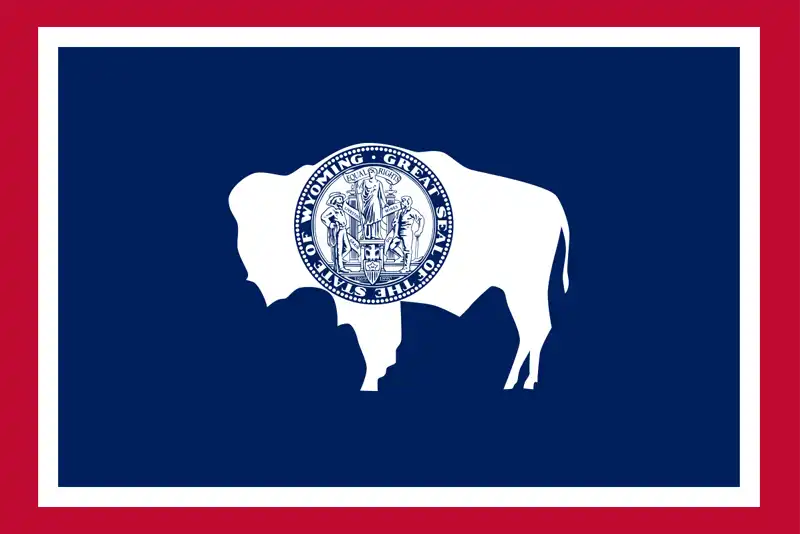

Wyoming

State Statute: Wyoming Statutes § 1-15-408

Standard Garnishment Limits: Wyoming follows federal limits:

- 25% of disposable earnings, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is LESS

Sources:

- Wyoming Statutes Annotated § 1-15-408

- Wyoming Department of Workforce Services

District of Columbia

Statute: D.C. Code § 16-572

Enhanced Garnishment Limits: The District of Columbia provides protections beyond federal minimums.

Standard Limits Apply: Federal calculations with additional exemptions available.

Sources:

- D.C. Code § 16-572

- DC Department of Employment Services

Special Garnishment Rules

Child Support and Alimony Wage Garnishment

Federal Limits (Apply in All States):

Child support wage garnishment follows different rules than consumer debt garnishments. Under the Consumer Credit Protection Act, garnishment for child support and alimony can be much higher than for consumer debts:

If supporting another spouse or child:

- Up to 50% of disposable earnings

- Up to 55% if 12+ weeks in arrears

If NOT supporting another spouse or child:

- Up to 60% of disposable earnings

- Up to 65% if 12+ weeks in arrears

Automatic Withholding: Many states (including California, New York) enforce automatic income withholding once a support order is issued. This doesn’t require additional court action.

Priority: Child support garnishments take PRIORITY over all other garnishments.

Interstate Enforcement: Child support orders are enforceable across state lines under federal law and the Uniform Interstate Family Support Act (UIFSA).

Source: 15 U.S.C. § 1673(b)(2)

Federal Tax Debt Garnishment (IRS Wage Levy)

Different Rules Apply:

IRS wage garnishment, also called a wage levy, operates differently from standard garnishments. IRS tax levies do NOT follow the standard garnishment percentage rules. Instead:

Exempt Amount Calculation: The IRS uses Publication 1494 to determine exempt amounts based on:

- Filing status (single, married, head of household)

- Number of dependents

- Standard deduction

Amount Above Exemption: The IRS can take ALL earnings above the calculated exempt amount – there is NO percentage cap like the 25% limit for consumer debts.

Example: If IRS calculation determines $400/week is exempt and worker earns $1,000/week, the IRS can levy the full $600 difference.

Notice Requirements:

- IRS must have assessed the tax

- IRS must have sent Notice and Demand for Payment

- Taxpayer must have failed to pay

- IRS must send Final Notice (30 days before levy)

Stopping an IRS Levy:

- Pay the debt in full

- Set up installment agreement

- Request Currently Not Collectible status

- File Offer in Compromise

- Request Collection Due Process hearing

State Tax Levies: States like California, New York, and Illinois have similar administrative garnishment powers for state tax debts.

Sources:

- Internal Revenue Code § 6331

- IRS Publication 1494

- IRS.gov – Levy Information

Federal Student Loan Wage Garnishment

Administrative Wage Garnishment (AWG):

Federal student loan wage garnishment is one of the most common types of administrative garnishment. Federal student loans can be collected through administrative garnishment WITHOUT a court judgment.

Amount:

- Up to 15% of disposable earnings (increased from 10% as of December 20, 2018)

Minimum Protection:

- Worker must keep amount equal to 30 times federal minimum wage ($217.50/week)

- If AWG + other garnishments would exceed 25% of disposable earnings, AWG is reduced

Notice:

- Must receive written notice at least 30 days before garnishment begins

- Notice must explain debt, garnishment amount, and right to hearing

Hearing Rights: Worker can request hearing to dispute:

- Existence or amount of debt

- Terms of repayment schedule

- Involuntary job separation within last 12 months

Employment Protection: Cannot be garnished if employee:

- Has been in current job LESS than 12 months, AND

- Was involuntarily separated from previous job

Stopping Student Loan Garnishment:

- Consolidate loans and enter Income-Driven Repayment plan

- Request rehabilitation (9 voluntary on-time payments)

- Pay in full

- Prove financial hardship

- Challenge in hearing if debt is incorrect

Sources:

- Higher Education Act amendments

- 31 U.S.C. § 3720D

- Federal Student Aid – Default

- U.S. Department of Education regulations

Employee Rights and Protections

Right to Notice

Federal Requirement: Employees must receive notice that their wages will be garnished. Notice requirements vary by garnishment type:

Court-Ordered Garnishments:

- Notification of lawsuit (summons and complaint)

- Notification of judgment

- Notification of garnishment order

- Timeframe: Varies by state, typically 20-30 days to respond

Administrative Garnishments (student loans, federal debt):

- Written notice at least 30 days before garnishment begins

- Must explain: debt amount, garnishment amount, right to hearing

Notice Must Include:

- Amount of debt

- Amount to be garnished

- How to claim exemptions

- Deadlines for response

- Contact information for creditor/agency

Right to Claim Exemptions

All employees have the right to claim legal exemptions.

Common Exemptions:

- Head of household status (in applicable states)

- Income below threshold amounts

- Certain types of income (Social Security, disability, etc.)

- Hardship circumstances

How to Claim:

- File “Claim of Exemption” form with court

- Typically must be filed within 20 days of receiving notice

- Must provide supporting documentation

- Court schedules hearing

Burden of Proof:

- Employee must prove they qualify for exemption

- Required documentation: pay stubs, tax returns, proof of dependents

- Garnishment continues until court orders otherwise

State-Specific Procedures: Each state has its own forms and procedures for claiming exemptions.

Right to Challenge the Debt

Employees can challenge garnishments on multiple grounds:

Procedural Defects:

- Improper service of lawsuit

- Lack of jurisdiction

- Failure to follow garnishment procedures

- Calculation errors

Substantive Defenses:

- Debt already paid

- Debt not owed (mistaken identity)

- Debt discharged in bankruptcy

- Statute of limitations expired

- Improper creditor practices

How to Challenge:

- Respond to lawsuit within deadline

- File motion to dismiss garnishment

- Attend court hearing

- Present evidence and documentation

Deadlines Are Critical: Missing response deadlines can result in default judgment and loss of defense rights.

Protection Against Termination

Federal Protection: Employer CANNOT fire employee for garnishment for ONE debt.

Exceptions:

- Protection does NOT apply if wages garnished for two or more separate debts

- Some states provide STRONGER protections than federal law

State-Specific Protections:

Alabama:

- Cannot fire or refuse to hire for child support withholding

- Cannot fire or refuse to hire for criminal restitution withholding

Florida:

- Protection applies even with multiple garnishments in some circumstances

Additional State Protections: Some states prohibit retaliation beyond federal requirements.

Remedies for Wrongful Termination:

- File complaint with U.S. Department of Labor

- File lawsuit for wrongful termination

- Seek reinstatement and back pay

- Criminal penalties may apply to employer

Source: 15 U.S.C. § 1674(a)

Right to Accurate Calculations

Employees have the right to accurate garnishment calculations.

Common Employer Errors:

- Incorrect calculation of disposable earnings

- Failure to deduct legally required withholdings first

- Garnishing exempt income

- Exceeding maximum percentage

- Ignoring state law protections

- Failing to stop garnishment when paid

Employee’s Remedies:

- Request wage garnishment calculation from employer

- Compare to federal/state limits

- File objection if incorrect

- Contact U.S. Department of Labor if employer violates CCPA

Employer Liability: Employers who fail to comply with garnishment orders OR who violate garnishment limits can be held liable for:

- The full amount of debt (if they ignore valid garnishment)

- Damages to employee (if they over-garnish)

- Penalties under CCPA

Exempt Income Sources

Certain types of income are FULLY EXEMPT from garnishment:

Federal Benefits (Fully Protected):

- Social Security retirement benefits

- Social Security disability benefits (SSDI)

- Supplemental Security Income (SSI)

- Veterans benefits (VA disability, pensions)

- Railroad Retirement benefits

- Federal employee retirement (Civil Service)

State and Local Benefits:

- Workers’ compensation benefits

- Unemployment benefits

- Public assistance (TANF, food stamps)

- State disability benefits

Other Protected Income:

- Child support received

- Alimony received (in most states)

- Certain pension and retirement benefits

- Life insurance proceeds

- Certain damage awards (personal injury)

Exceptions: Some of these benefits CAN be garnished for:

- Child support arrears

- Federal tax debts

- Alimony arrears

- Certain federal debts

Bank Account Protection: When these exempt funds are deposited in bank accounts, special rules apply. Many states require banks to protect these funds, but procedures vary.

Source: 42 U.S.C. § 407 (Social Security); various federal and state statutes

Employer Wage Garnishment Obligations

Editorial Notice – Employer Information

The following section summarizes general employer obligations described in federal and state statutes, court forms, and agency guidance related to wage garnishment processing. This information is provided for general informational purposes only and does not constitute legal, payroll, or compliance advice.

Responding to Garnishment Orders

Employers who receive employer wage garnishment orders are legally required to comply. Employer wage garnishment processing involves specific legal duties:

Employer’s Legal Duties:

1. Timely Response:

- Must respond within timeframe specified in order (typically 10-20 days)

- Must complete and return “Answer to Garnishment” form

- Failure to respond can result in liability for full debt amount

2. Accurate Calculations:

- Calculate disposable earnings correctly

- Apply federal and state limits properly

- Document calculations

- Maintain records

3. Begin Withholding:

- Start withholding on schedule specified in order

- Typically begins with first paycheck after deadline

- Continue until debt paid or order terminated

4. Remit Funds:

- Send withheld amounts to creditor or court

- Follow instructions in garnishment order exactly

- Remit on schedule (monthly, bi-weekly, etc.)

- Include required documentation

5. Notify Employee:

- Provide copy of garnishment order to employee

- Explain withholding amount and schedule

- Inform employee of exemption rights

6. Prioritize Multiple Garnishments:

- Follow federal and state priority rules

- Ensure total does not exceed limits

- Process in correct order (child support first, then taxes, then others)

Calculation Requirements

Step-by-Step Employer Calculation:

While RemoteLaws.com does not provide a wage garnishment calculator tool, employers can follow this manual calculation process:

Step 1: Determine Gross Pay Total compensation for pay period before any deductions.

Step 2: Subtract Legally Required Deductions

- Federal income tax withholding

- State and local income tax withholding

- Social Security tax (FICA employee share)

- Medicare tax (employee share)

- State unemployment insurance (if employee-paid)

- Mandatory state retirement (if required by law)

Result = Disposable Earnings

Step 3: Apply Garnishment Formula

For Weekly Pay Period (example):

- Calculate the wage garnishment percentage: 25% of disposable earnings

- Calculate disposable earnings minus $217.50 (30 × federal minimum wage)

- Use LESSER amount

For Other Pay Periods: Use corresponding multiplier from federal table.

Step 4: Check State Law If state law results in LESS garnishment, use state calculation instead.

Step 5: Verify Maximum Wage Garnishment Limits Ensure total of all garnishments does not exceed the maximum wage garnishment limits allowed by federal and state law, considering priority rules.

Example Calculation:

Employee paid weekly:

- Gross pay: $800

- Federal tax: $80

- State tax: $30

- Social Security: $49.60

- Medicare: $11.60

- Disposable earnings: $628.80

Federal calculation:

- 25% of $628.80 = $157.20

- $628.80 – $217.50 = $411.30

- Garnishment: $157.20 (lesser amount)

If employee in Massachusetts:

- 15% of gross ($800) = $120

- Disposable minus (50 × $15 MA minimum) = $628.80 – $750 = cannot use this calculation

- Garnishment: $120 (Massachusetts law more protective)

Record Keeping Requirements

Employers must maintain detailed records:

Records to Keep:

- Copy of garnishment order

- Garnishment calculation worksheets

- Dates and amounts withheld

- Dates and amounts remitted

- Employee notifications

- Correspondence with courts/creditors

Retention Period: Federal law: minimum 3 years State requirements may be longer.

Source: Fair Labor Standards Act record-keeping requirements; state statutes

Employer Liability

Employers face liability for:

1. Failure to Honor Valid Garnishment:

- Can be liable for FULL AMOUNT of judgment debt

- Court may hold employer in contempt

- Additional penalties and attorney fees

2. Over-Garnishing (Taking Too Much):

- Liable to employee for amounts improperly withheld

- Potential CCPA violations

- Employee can sue for damages

3. Wrongful Termination:

- Firing employee for garnishment for one debt

- Federal penalties: up to $1,000 fine and 1 year imprisonment

- Employee lawsuit for wrongful termination

- Back pay and reinstatement

4. Calculation Errors:

- Must correct errors promptly

- May owe refunds to employee

- Potential liability if errors harm employee

5. Failure to Remit:

- Taking money from employee but not sending to creditor

- Can be liable for full amounts withheld

- Criminal charges in some cases

Employer Requirements:

- Designated payroll personnel for garnishment processing

- Garnishment calculation systems

- Detailed documentation and record-keeping

- Timely response to orders

- Access to legal resources for complex situations

- HR staff training on garnishment compliance

Fees Employers Can Charge

Some states allow employers to charge administrative fees for processing garnishments.

Typical Allowable Fees:

- California: Up to certain dollar amount per garnishment

- Other states: Vary widely, from $0 to $25+ per pay period

Limitations:

- Must be specified in state law

- Cannot exceed statutory maximum

- Cannot be deducted from protected earnings

- Some states prohibit fees entirely

Source: State garnishment statutes

Summary of State Protections

States That PROHIBIT Consumer Debt Wage Garnishment

Four states prohibit or severely restrict wage garnishment for consumer debts:

- Texas – Strongest prohibition; only child support, taxes, student loans

- North Carolina – Ban on consumer debt garnishment; allows support, taxes, student loans, fines

- South Carolina – Ban on consumer debt garnishment; allows support, taxes, student loans, fines

- Pennsylvania – Severe restrictions; allows support, taxes, certain local taxes, student loans, rent, restitution

If you live in these states, your wages CANNOT be garnished for credit cards, medical bills, or personal loans.

States Following Only Federal Law

These states provide NO additional protection beyond federal limits:

- Alabama (with head of household exceptions)

- Georgia

- Idaho

- Indiana (with first payment exception)

- Kentucky

- Louisiana

- Mississippi

- Missouri

- Montana

- Nebraska

- North Dakota

- Ohio

- Oklahoma

- Rhode Island

- South Dakota

- Tennessee

- Utah

- Wyoming

These states use: 25% of disposable earnings OR amount exceeding 30x federal minimum wage, whichever is less.

States With STRONGER Protections Than Federal

These states limit garnishment to LESS than federal law allows:

By Percentage:

- Illinois: 15% of gross (vs. 25% of disposable)

- Delaware: 15% max

- Massachusetts: 15% of gross OR 50x state minimum wage

- New Jersey: 10% for low-income, 25% for higher income

- New York: 10% of gross OR 25% of disposable OR 30x state minimum wage (LEAST of three)

- West Virginia: 20% max (vs. 25%)

- Wisconsin: 20% max (vs. 25%)

By Higher Multiplier:

- Alaska: $402.50 weekly exempt

- Arizona: 60x state minimum wage

- California: 40x state minimum wage

- Connecticut: 40x federal minimum wage

- Minnesota: 40x federal minimum wage

- Nevada: 50x federal minimum wage

- New Hampshire: 50x federal minimum wage

- New Mexico: 40x federal minimum wage

- Oregon: 75% protected or $509 biweekly, whichever is greater

- Virginia: 40x federal minimum wage

- Washington: 35x state minimum wage

Special Protections:

- Florida: Head of household wages under $750/week fully exempt

- Hawaii: Tiered 5%/10%/20% system

- Iowa, Kansas, Maine, Maryland, Vermont: Enhanced exemptions

Frequently Asked Questions

Can my employer fire me for having a wage garnishment?

Many employees ask: can employer fire for wage garnishment? Federal law prohibits employers from firing employees for wage garnishment for ONE debt.

However, if you have garnishments for TWO or more separate debts, federal law does NOT protect you from termination. Some states (like Alabama for child support orders) provide additional protections.

Source: 15 U.S.C. § 1674

How much of my paycheck can be garnished?

For most consumer debts, the maximum is the LESSER of:

- 25% of your disposable earnings, OR

- The amount by which your disposable earnings exceed 30 times the federal minimum wage ($217.50/week)

However, many states provide GREATER protection (less garnishment allowed).

Child support can be up to 50-65% of disposable earnings.

Student loans and federal debts: up to 15% of disposable earnings.

What if I live in one state but work in another?

The law of the state where you WORK (and where your employer is located) generally applies.

However, if the garnishment order comes from a court in your state of residence, and that court has jurisdiction over your employer, the rules can be complex. Legal representation is available for interstate garnishment matters.

Can Social Security benefits be garnished?

Social Security retirement and disability benefits are generally EXEMPT from garnishment for consumer debts.

Exceptions – Social Security CAN be garnished for:

- Federal tax debts

- Child support and alimony arrears

- Federal student loans (limited to 15% of benefits)

- Other federal debts

Source: 42 U.S.C. § 407

Can my bank account be garnished?

Yes, bank accounts can be garnished even if wages cannot be garnished in your state.

However:

- Exempt funds (Social Security, SSI, VA benefits, etc.) remain protected

- Some states (like Delaware) prohibit bank account garnishment for consumer debts

- Deposited wages may remain exempt in some states if properly traced

- Many states provide automatic protections for minimum account balances

What is “disposable earnings”?

Disposable earnings are the amount left AFTER legally required deductions:

Deductions that ARE subtracted:

- Federal, state, local income taxes

- Social Security and Medicare taxes

- State unemployment insurance (if required)

- Mandatory retirement contributions required by law

Deductions that are NOT subtracted:

- Health insurance

- Life insurance

- 401(k) contributions (unless required by law)

- Union dues

- Charitable giving

- Voluntary wage assignments

Source: 15 U.S.C. § 1673(b)

Can I have multiple wage garnishments at once?

Yes, you can have multiple garnishments, but:

The TOTAL amount garnished cannot exceed federal/state limits.

Priority rules apply:

- Child support (highest priority)

- Federal tax levies

- State tax levies

- Federal student loans

- Other judgments

If child support is already taking 50% of your disposable earnings, no additional garnishment for consumer debts can occur.

What happens when I change jobs?

If you have a continuing garnishment order:

Consumer debts: The garnishment order typically terminates when employment ends. The creditor must obtain a new garnishment order against your new employer.

Child support: Automatic withholding typically continues. The support agency will locate your new employer and send a new withholding order. In some states, the original order may transfer automatically.

Student loans and federal debts: Administrative garnishments may continue more easily than consumer debt garnishments.

Always notify the court and creditor of employment changes as required by law.

Can wages in my bank account be garnished?

In most states: YES, once wages are deposited in a bank account, they can be garnished.

However, several states protect deposited wages:

- California: $1,788 automatically exempt (self-executing)

- Florida: Head of household wages remain exempt for 6 months if traceable

- New York: $2,664-$3,600 automatically exempt

- Delaware: Bank accounts cannot be garnished for consumer debts

- Other states: If you can trace the deposits to exempt wages, they may remain protected

Protection depends on:

- State law

- Whether funds are commingled with non-exempt money

- Whether you can prove source of funds

- Type of debt

What if the garnishment is wrong or unfair?

If you believe the garnishment is incorrect:

File a claim of exemption or motion to dismiss within the deadline (typically 20 days).

Common errors:

- Debt not owed

- Amount miscalculated

- Wrong person

- Debt already paid

- Statute of limitations expired

- Bankruptcy discharge

- Employer calculation errors

Response deadlines are strict and typically range from 10-30 days.

Legal representation and legal aid organizations provide assistance with garnishment challenges.

Can tax refunds be garnished?

Yes, tax refunds CAN be garnished.

Federal tax refunds can be offset for:

- Past-due child support

- Federal student loans in default

- State income tax debts

- Federal agency debts

- Unemployment compensation debts

State tax refunds can be offset for:

- State debts and obligations

- Child support

- Student loans (in some states)

Tax refunds are NOT considered “wages” and are NOT protected by wage garnishment exemptions, even head of household exemptions.

Source: Treasury Offset Program (TOP); state offset programs

This article provides an overview of wage garnishment laws. You can find more information on garnishment in general at the U.S. Department of Labor website.