Student Loan Wage Garnishment Laws by State 2026

We gather information exclusively from government sources (.gov websites) and provide state-by-state guidance on employee rights and employer obligations when wages are garnished to repay defaulted student loans.

2026 Federal Student Loan Policy Changes

Resumption of Wage Garnishment (January 2026)

The U.S. Department of Education announced it will resume administrative wage garnishment for defaulted federal student loans beginning January 7, 2026. This Trump administration student loan policy marks the end of a pause that began in March 2020 during the COVID-19 pandemic.

Key Timeline:

- Week of January 7, 2026: First garnishment notices sent to approximately 1,000 defaulted borrowers

- Monthly escalation: Number of garnishment notices will increase each month throughout 2026

- 30-day notice requirement: Borrowers must receive written notice at least 30 days before wage withholding begins

Source: U.S. Department of Education announcement, December 2025

One Big Beautiful Bill Act (OBBB) – July 2025

President Trump signed the One Big Beautiful Bill Act into law on July 4, 2025, fundamentally restructuring federal student loan programs. Key provisions affecting borrowers:

Repayment Plan Eliminations:

- SAVE Plan: Terminated through settlement agreement (December 2025)

- PAYE (Pay As You Earn): Phased out by July 1, 2028

- ICR (Income-Contingent Repayment): Phased out by July 1, 2028

- IBR (Income-Based Repayment): Remains available for loans disbursed before July 1, 2026

New Repayment Assistance Plan (RAP):

- Effective July 1, 2026 for all new loans

- Requires 30 years of payments for forgiveness (increased from 20-25 years)

- Higher monthly payments compared to eliminated IDR plans

- Only repayment option for new borrowers (besides standard repayment)

Parent PLUS Loan Changes:

- Loans disbursed after July 1, 2026 NOT eligible for RAP or any income-driven plan

- Parent borrowers lose access to loan forgiveness through income-driven repayment

- Consolidation completed before July 1, 2026 maintains IBR eligibility

Source: One Big Beautiful Bill Act (P.L. 119-21), U.S. Department of Education Dear Colleague Letter, July 18, 2025

Public Service Loan Forgiveness (PSLF) Restrictions

Executive Order 14235 (March 2025) directed changes to PSLF eligibility criteria.

New Rule Effective July 1, 2026:

- Excludes organizations with “substantial illegal purpose” from qualifying employers

- Department of Education Secretary determines which organizations qualify

- Borrowers receive credit for payments made BEFORE employer disqualification

- Targets organizations involved in activities administration considers unlawful

Affected Categories:

- Organizations supporting undocumented immigration

- Entities providing certain medical services

- Groups engaging in activities the administration deems illegal under federal or state law

Source: U.S. Department of Education Final Rule, October 30, 2025; Executive Order 14235

Borrowers Currently in Default (2025 Data)

- 5.3 million borrowers in default as of June 2025

- Nearly $117 billion in defaulted federal student loans

- 3.7 million borrowers more than 270 days delinquent (approaching default)

- 2.7 million borrowers in early-stage delinquency

- Estimated 25% of all federal student loan borrowers at risk of default

Source: Federal Student Aid data, American Enterprise Institute analysis, 2025

Federal Student Loan Wage Garnishment Law

Legal Authority

The U.S. Department of Education has statutory authority to garnish wages for defaulted federal student loans without obtaining a court judgment. This is called administrative wage garnishment or federal student loan wage garnishment.

Governing Laws:

- Higher Education Act of 1965 (20 U.S.C. § 1095a)

- Debt Collection Improvement Act of 1996

- Consumer Credit Protection Act (15 U.S.C. § 1673)

Source: U.S. Department of Labor, Wage and Hour Division

What Is Default?

Federal student loans enter default status when no payment has been made for 270 days (approximately 9 months) for loans in monthly repayment. Student loan default triggers serious consequences including wage garnishment, tax refund offset, and damage to credit reports.

Source: Federal Student Aid, studentaid.gov

Maximum Garnishment Amount

For federal student loans, the Department of Education can garnish the lesser of:

- 15% of disposable income, OR

- The amount by which disposable income exceeds 30 times the federal minimum wage per week

Current Federal Minimum Wage: $7.25/hour

Protected Weekly Income: $217.50 (30 × $7.25)

This wage garnishment exemption means:

- If weekly disposable income is $217.50 or less: No garnishment allowed

- If weekly disposable income is between $217.50 and $290: Amount above $217.50 can be garnished

- If weekly disposable income is $290 or more: Maximum 15% can be garnished

Source: U.S. Department of Labor Fact Sheet #30, December 2024

Disposable Income Definition

Disposable income means compensation remaining after deduction of amounts required by law to be withheld:

INCLUDED deductions (subtracted before calculating garnishment):

- Federal income tax withholding

- State income tax withholding

- Local income tax withholding

- Social Security (FICA) taxes

- Medicare taxes

- State unemployment insurance tax

- Mandatory retirement contributions required by law

EXCLUDED deductions (NOT subtracted, still subject to garnishment):

- Voluntary retirement plan contributions (401k, 403b, etc.)

- Health insurance premiums

- Life insurance premiums

- Union dues

- Charitable contributions

- Garnishments for other debts

- Child support withholding (counted separately)

Source: U.S. Department of Labor, Wage and Hour Division; 15 U.S.C. § 1673

Multiple Garnishments

If a borrower faces wage garnishment for multiple defaulted federal student loans, federal law limits total garnishments to 25% of disposable earnings.

However, each individual administrative garnishment for student loans is still capped at 15% of disposable income.

Source: Consumer Credit Protection Act; Department of Labor Fact Sheet #30

No Statute of Limitations

There is no time limit on the federal government’s ability to collect defaulted student loan debt. Borrowers can face wage garnishment for loans that are decades old.

Source: Student Loan Borrower Assistance, National Consumer Law Center

How Federal Student Loan Wage Garnishment Works

Step-by-Step Process

1. Default Occurs (Day 1)

- Borrower misses payments for 270+ days

- Loan officially enters default status

- Default reported to credit bureaus

2. Department Initiates Collection (Months 1-6)

- Department of Education or guaranty agency begins collection process

- Attempts to contact borrower

- Verifies borrower’s current employment

3. Garnishment Notice Sent (30+ Days Before Withholding)

Borrower receives written notice including:

- Intent to garnish wages

- Amount to be garnished

- Right to request a hearing

- Deadline to respond (typically 30 days)

- Instructions for challenging garnishment

Important: This is a legal notice, not a payment reminder.

Source: Federal Student Aid; 34 C.F.R. § 682.410

4. 30-Day Response Period

Borrower has 30 days from notice date to:

- Request a hearing to dispute garnishment

- Claim financial hardship

- Enter into voluntary repayment agreement

- Consolidate or rehabilitate the loan

During this period: No money is taken from paychecks.

5. Employer Withholding Order Issued

If borrower does not respond or resolve the debt:

- Department of Education sends wage withholding order to employer

- Order legally requires employer to withhold specified amount

- Employer must comply with the order

6. Garnishment Begins

- Employer withholds up to 15% of disposable pay each pay period

- Withheld funds sent to Department of Education or guaranty agency

- Garnishment continues until:

- Defaulted loan is paid in full, OR

- Borrower exits default through rehabilitation/consolidation, OR

- Borrower successfully challenges garnishment

Source: Student Loan Borrower Assistance; Department of Education Default Resolution Group

Employer Cannot Fire Employee

Federal law prohibits employers from terminating employment solely because wages are being garnished for student loan debt.

Source: Consumer Credit Protection Act, 15 U.S.C. § 1674(a)

Verifying Employment (Why Delays Occur)

Before garnishment begins, the Department of Education must:

- Identify borrower’s current employer

- Verify employment status

- Coordinate with employer’s payroll system

This multi-step verification process can cause delays and explains why garnishment restart in 2026 is phased over many months.

Source: U.S. Department of Education statement to media, December 2025

State-by-State Student Loan Wage Garnishment Laws

Understanding State vs. Federal Law

Federal student loans: Governed by federal law (15% maximum garnishment)

- Federal law preempts state law for federal student loans

- State wage garnishment limits generally do not apply to federal student loan administrative garnishment

- Exception: Some state consumer protection laws may provide additional procedures

Private student loans: Must follow state wage garnishment laws

- Creditor must obtain court judgment first

- State limits apply (typically 25% maximum, but varies by state)

- Some states offer greater protections

Source: U.S. Department of Labor; Consumer Financial Protection Bureau

State Wage Garnishment Laws Table

While federal student loans are subject to federal limits (15%), private student loans and general garnishment rules vary by state. Below is a compilation of state-specific wage garnishment laws that apply to private student loans after a judgment is obtained.

Alabama

State Wage Garnishment Limits (Private Student Loans)

Alabama follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage ($217.50/week)

- Whichever is less

Head of Household Exemption

Alabama provides additional protections for heads of household under certain circumstances.

Court Judgment Requirement

Private student loan creditors must obtain court judgment before garnishing wages.

State-Specific Provisions

- Code of Alabama § 6-10-7 governs garnishment procedures

- Exemptions available for certain types of income

State Resources

- Alabama Department of Labor: labor.alabama.gov

- Alabama Courts: judicial.alabama.gov

Source: Code of Alabama § 6-10-7; Alabama Department of Labor

Alaska

State Wage Garnishment Limits (Private Student Loans)

Alaska follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

Exemptions

Alaska Stat. § 09.38.030 provides wage exemptions:

- Weekly earnings up to certain thresholds protected

- Head of household protections

Court Judgment Requirement

Judgment required before wage garnishment for private student loans.

State Resources

- Alaska Department of Labor: labor.alaska.gov

- Alaska Court System: courts.alaska.gov

Source: Alaska Stat. § 09.38.030; Alaska Department of Labor

Arizona

State Wage Garnishment Limits (Private Student Loans)

Arizona follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

Special Provisions

- Arizona Revised Statutes § 12-1598 through § 12-1598.16 govern garnishment

- Exemptions available under Arizona law

Court Judgment Requirement

Court judgment required for private student loan wage garnishment.

State Resources

- Arizona Department of Economic Security: des.az.gov

- Arizona Courts: azcourts.gov

Source: Arizona Revised Statutes § 12-1598 et seq.

Arkansas

State Wage Garnishment Limits (Private Student Loans)

Arkansas follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Arkansas Code governs garnishment procedures and exemptions.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Arkansas Department of Labor: labor.arkansas.gov

- Arkansas Judiciary: arcourts.gov

Source: Arkansas Code; Arkansas Department of Labor

California

State Wage Garnishment Limits (Private Student Loans)

California provides MORE protection than federal law for private student loans:

California’s Lower Limits (Effective September 1, 2023):

- Maximum: 20% of disposable income, OR

- Amount exceeding 40 times California minimum wage

- Whichever is less

California Minimum Wage (2025): $16.50/hour Protected Weekly Income: $660 (40 × $16.50)

This means California residents keep MORE of their wages compared to federal limits.

Federal Student Loans

- Still subject to 15% federal maximum

- California limits do not override federal administrative garnishment

Court Judgment Requirement

Private student loan creditors must sue and obtain judgment.

Community Property Considerations

California is a community property state:

- Spouse’s wages may be subject to garnishment for debt incurred by either spouse

- Applies even if debt was incurred before marriage

State Resources

- California Department of Industrial Relations: dir.ca.gov

- California Courts: courts.ca.gov

Source: California Code of Civil Procedure; California Department of Industrial Relations

Colorado

State Wage Garnishment Limits (Private Student Loans)

Colorado follows federal limits for most garnishments but has specific protections:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

Colorado-Specific Provisions

Colorado law provides exemptions for certain earnings.

Court Judgment Requirement

Judgment required for private student loan garnishment.

State Resources

- Colorado Department of Labor: cdle.colorado.gov

- Colorado Judicial Branch: courts.state.co.us

Source: Colorado Revised Statutes; Colorado Department of Labor

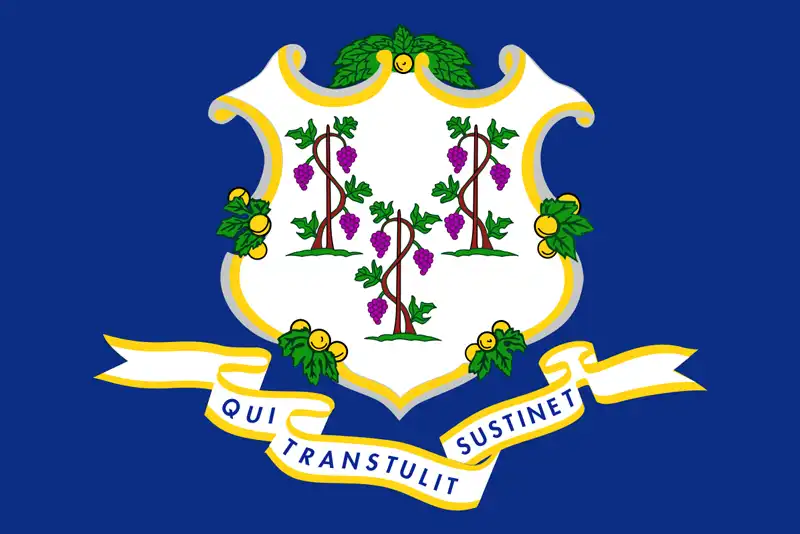

Connecticut

State Wage Garnishment Limits (Private Student Loans)

Connecticut follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Connecticut General Statutes govern garnishment procedures.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Connecticut Department of Labor: ct.gov/dol

- Connecticut Judicial Branch: jud.ct.gov

Source: Connecticut General Statutes; Connecticut Department of Labor

Delaware

State Wage Garnishment Limits (Private Student Loans)

Delaware follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Delaware Code governs garnishment procedures.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Delaware Department of Labor: labor.delaware.gov

- Delaware Courts: courts.delaware.gov

Source: Delaware Code; Delaware Department of Labor

Florida

State Wage Garnishment Limits (Private Student Loans)

Florida provides head of household exemption:

Head of Household (Providing >50% support for child/dependent):

- Wages are exempt from garnishment for private debts

Non-Head of Household:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

Federal Student Loans

Head of household exemption does not apply to federal student loan administrative garnishment (15% still applies).

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Florida Department of Economic Opportunity: floridajobs.org

- Florida Courts: flcourts.gov

Source: Florida Statutes § 222.11; Florida Department of Economic Opportunity

Georgia

State Wage Garnishment Limits (Private Student Loans)

Georgia follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Georgia Code governs garnishment procedures.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Georgia Department of Labor: dol.georgia.gov

- Georgia Courts: georgiacourts.gov

Source: Georgia Code; Georgia Department of Labor

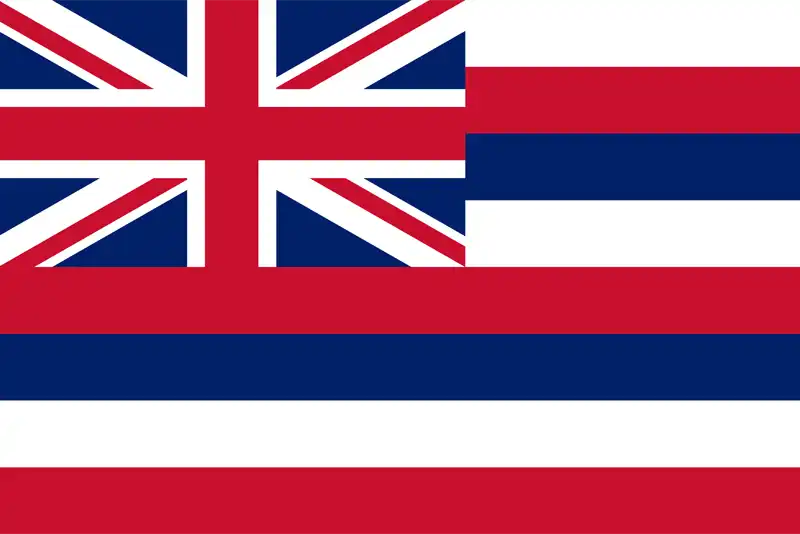

Hawaii

State Wage Garnishment Limits (Private Student Loans)

Hawaii follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Hawaii Revised Statutes govern garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Hawaii Department of Labor: labor.hawaii.gov

- Hawaii State Judiciary: courts.state.hi.us

Source: Hawaii Revised Statutes; Hawaii Department of Labor

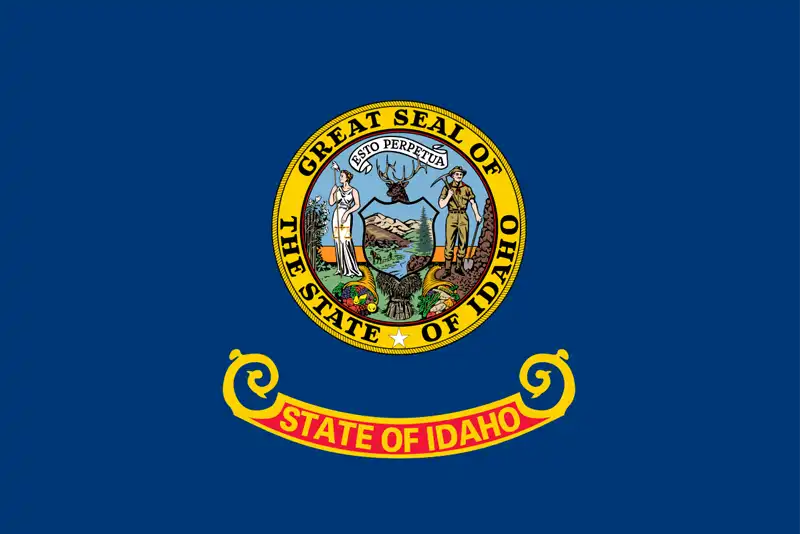

Idaho

State Wage Garnishment Limits (Private Student Loans)

Idaho follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Idaho Code governs garnishment procedures.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Idaho Department of Labor: labor.idaho.gov

- Idaho Courts: isc.idaho.gov

Source: Idaho Code; Idaho Department of Labor

Illinois

State Wage Garnishment Limits (Private Student Loans)

Illinois provides stronger protections than federal law:

Illinois Limits:

- Maximum: 15% of gross wages, OR

- Amount exceeding 45 times Illinois minimum wage per week

- Whichever is less

Illinois Minimum Wage (2025): $15.00/hour Protected Weekly Income: $675 (45 × $15.00)

This provides significantly more protection than federal limits.

Federal Student Loans

Still subject to 15% federal administrative garnishment (but calculated differently).

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Illinois Department of Labor: labor.illinois.gov

- Illinois Courts: illinoiscourts.gov

Source: 735 ILCS 5/12-803; Illinois Department of Labor

Indiana

State Wage Garnishment Limits (Private Student Loans)

Indiana follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Indiana Code governs garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Indiana Department of Labor: in.gov/dol

- Indiana Courts: in.gov/courts

Source: Indiana Code; Indiana Department of Labor

Iowa

State Wage Garnishment Limits (Private Student Loans)

Iowa follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Iowa Code governs garnishment procedures.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Iowa Workforce Development: iowaworkforcedevelopment.gov

- Iowa Judicial Branch: iowacourts.gov

Source: Iowa Code; Iowa Workforce Development

Kansas

State Wage Garnishment Limits (Private Student Loans)

Kansas follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Kansas Statutes govern garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Kansas Department of Labor: dol.ks.gov

- Kansas Courts: kscourts.org

Source: Kansas Statutes Annotated; Kansas Department of Labor

Kentucky

State Wage Garnishment Limits (Private Student Loans)

Kentucky follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Kentucky Revised Statutes govern garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Kentucky Labor Cabinet: labor.ky.gov

- Kentucky Court of Justice: kycourts.gov

Source: Kentucky Revised Statutes; Kentucky Labor Cabinet

Louisiana

State Wage Garnishment Limits (Private Student Loans)

Louisiana follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Louisiana Code of Civil Procedure governs garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Louisiana Workforce Commission: laworks.net

- Louisiana Courts: louisianacourts.org

Source: Louisiana Code of Civil Procedure; Louisiana Workforce Commission

Maine

State Wage Garnishment Limits (Private Student Loans)

Maine follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Maine Revised Statutes govern garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Maine Department of Labor: maine.gov/labor

- Maine Judicial Branch: courts.maine.gov

Source: Maine Revised Statutes; Maine Department of Labor

Maryland

State Wage Garnishment Limits (Private Student Loans)

Maryland provides stronger protections than federal law:

Maryland Limits:

- Maximum: 25% of disposable income (for earnings above certain threshold)

- Special protections for lower-income earners

Maryland law requires creditors to leave more disposable income for borrowers.

Federal Student Loans

Still subject to 15% federal administrative garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Maryland Department of Labor: labor.maryland.gov

- Maryland Courts: mdcourts.gov

Source: Maryland Commercial Law; Maryland Department of Labor

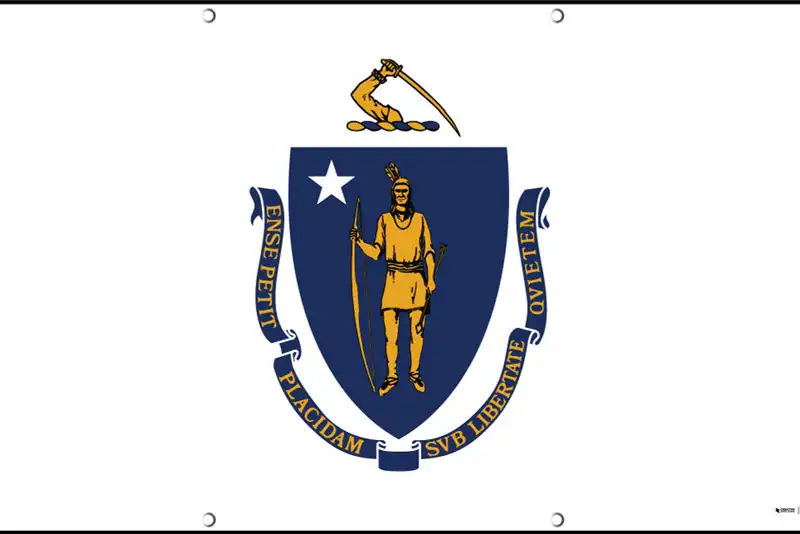

Massachusetts

State Wage Garnishment Limits (Private Student Loans)

Massachusetts provides significantly stronger protections:

Massachusetts Limits:

- Maximum: 15% of gross wages (compared to federal 25%)

This is the same percentage as federal student loan garnishment but applies to all garnishments.

Federal Student Loans

Still subject to 15% federal administrative garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Massachusetts Department of Labor: mass.gov/dls

- Massachusetts Courts: mass.gov/courts

Source: Mass. Gen. Laws ch. 246 § 28; Massachusetts Department of Labor Standards

Michigan

State Wage Garnishment Limits (Private Student Loans)

Michigan follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Michigan Compiled Laws govern garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Michigan Department of Labor: michigan.gov/leo

- Michigan Courts: courts.michigan.gov

Source: Michigan Compiled Laws; Michigan Department of Labor and Economic Opportunity

Minnesota

State Wage Garnishment Limits (Private Student Loans)

Minnesota provides stronger protections:

Minnesota Limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 40 times federal minimum wage per week (not 30)

- Whichever is less

Protected Weekly Income: $290 (40 × $7.25) – higher than federal $217.50

Federal Student Loans

Still subject to 15% federal administrative garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Minnesota Department of Labor: dli.mn.gov

- Minnesota Courts: mncourts.gov

Source: Minnesota Statutes § 571.922; Minnesota Department of Labor and Industry

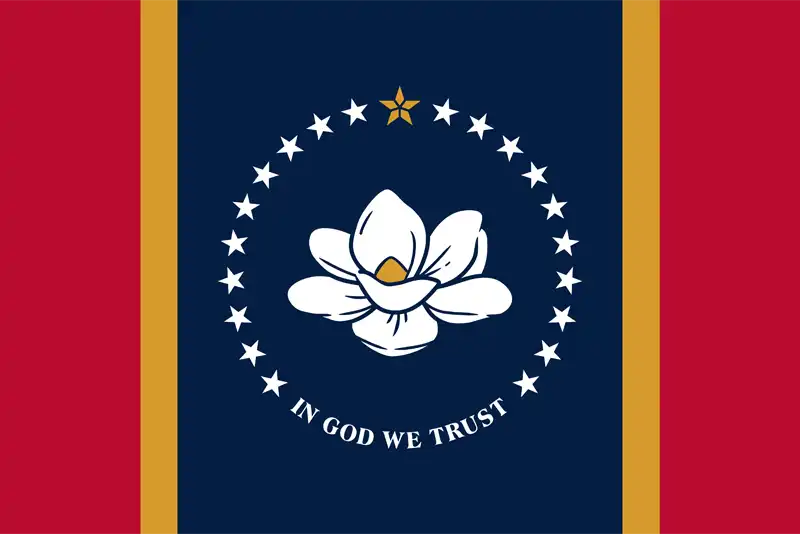

Mississippi

State Wage Garnishment Limits (Private Student Loans)

Mississippi follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Mississippi Code governs garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Mississippi Department of Employment Security: mdes.ms.gov

- Mississippi Courts: courts.ms.gov

Source: Mississippi Code; Mississippi Department of Employment Security

Missouri

State Wage Garnishment Limits (Private Student Loans)

Missouri follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Missouri Revised Statutes govern garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Missouri Department of Labor: labor.mo.gov

- Missouri Courts: courts.mo.gov

Source: Missouri Revised Statutes; Missouri Department of Labor and Industrial Relations

Montana

State Wage Garnishment Limits (Private Student Loans)

Montana follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Montana Code Annotated governs garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Montana Department of Labor: dli.mt.gov

- Montana Courts: courts.mt.gov

Source: Montana Code Annotated; Montana Department of Labor and Industry

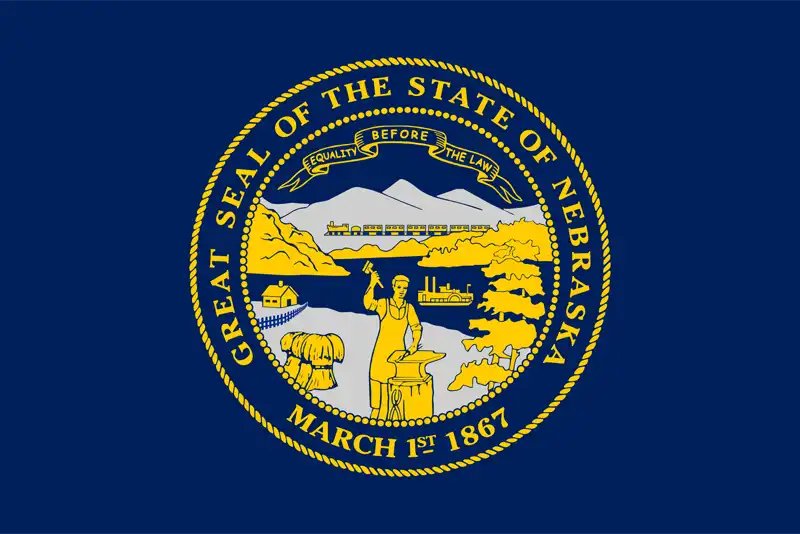

Nebraska

State Wage Garnishment Limits (Private Student Loans)

Nebraska follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Nebraska Revised Statutes govern garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Nebraska Department of Labor: dol.nebraska.gov

- Nebraska Courts: supremecourt.nebraska.gov

Source: Nebraska Revised Statutes; Nebraska Department of Labor

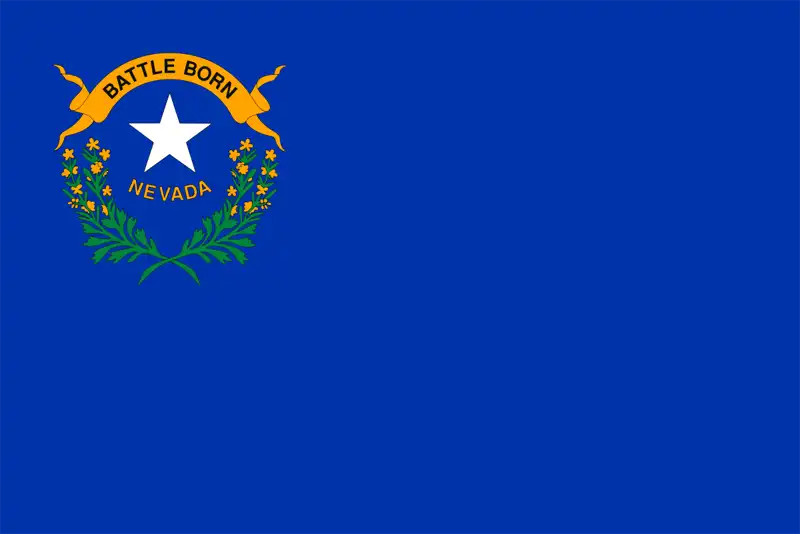

Nevada

State Wage Garnishment Limits (Private Student Loans)

Nevada provides stronger protections:

Nevada Limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 50 times federal minimum wage per week (not 30)

- Whichever is less

Protected Weekly Income: $362.50 (50 × $7.25) – significantly higher than federal $217.50

Federal Student Loans

Still subject to 15% federal administrative garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Nevada Department of Employment: detr.nv.gov

- Nevada Courts: nvcourts.gov

Source: Nevada Revised Statutes § 31.295; Nevada Department of Employment, Training and Rehabilitation

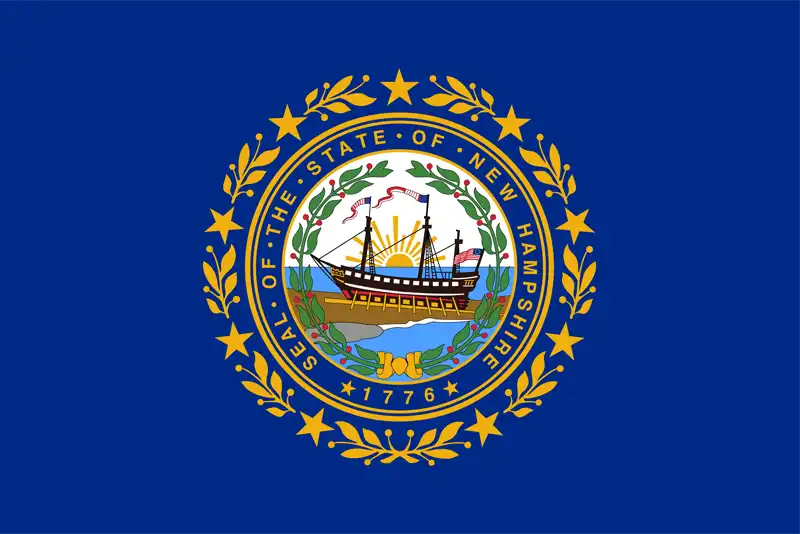

New Hampshire

State Wage Garnishment Limits (Private Student Loans)

New Hampshire provides stronger protections:

New Hampshire Limits:

- Maximum: 25% of disposable income (after additional protections)

- Minimum weekly earnings protections

New Hampshire law provides additional exemptions beyond federal limits.

Federal Student Loans

Still subject to 15% federal administrative garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- New Hampshire Department of Labor: nh.gov/labor

- New Hampshire Courts: courts.nh.gov

Source: New Hampshire Revised Statutes; New Hampshire Department of Labor

New Jersey

State Wage Garnishment Limits (Private Student Loans)

New Jersey provides stronger protections:

New Jersey Limits:

- Maximum: 10% of gross income, OR

- 25% of disposable income

- Whichever is less

This 10% of gross income option often results in lower garnishment than federal limits.

Federal Student Loans

Still subject to 15% federal administrative garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- New Jersey Department of Labor: nj.gov/labor

- New Jersey Courts: njcourts.gov

Source: New Jersey Court Rules; New Jersey Department of Labor and Workforce Development

New Mexico

State Wage Garnishment Limits (Private Student Loans)

New Mexico follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

New Mexico Statutes govern garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- New Mexico Department of Workforce Solutions: dws.state.nm.us

- New Mexico Courts: nmcourts.gov

Source: New Mexico Statutes Annotated; New Mexico Department of Workforce Solutions

New York

State Wage Garnishment Limits (Private Student Loans)

New York provides stronger protections:

New York Limits:

- Maximum: 10% of gross wages, OR

- 25% of disposable income

- Whichever is less

Like New Jersey, the 10% of gross income option often provides greater protection than federal limits.

Federal Student Loans

Still subject to 15% federal administrative garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- New York Department of Labor: labor.ny.gov

- New York Courts: nycourts.gov

Source: New York CPLR § 5205; New York Department of Labor

North Carolina

State Wage Garnishment Limits (Private Student Loans)

North Carolina provides the strongest wage garnishment protections in the United States:

North Carolina Limits:

- Wage garnishment for private debt is PROHIBITED (with very limited exceptions)

- Only child support, taxes, and student loans can garnish wages

Federal Student Loans

- Subject to 15% federal administrative garnishment (federal law preempts state law)

Private Student Loans

- Must be federal student loans to garnish in North Carolina

- Private student loan creditors cannot garnish wages even with court judgment

State Resources

- North Carolina Department of Labor: labor.nc.gov

- North Carolina Courts: nccourts.gov

Source: North Carolina General Statutes § 1-362; North Carolina Department of Labor

North Dakota

State Wage Garnishment Limits (Private Student Loans)

North Dakota follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

North Dakota Century Code governs garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- North Dakota Department of Labor: nd.gov/labor

- North Dakota Courts: ndcourts.gov

Source: North Dakota Century Code; North Dakota Department of Labor and Human Rights

Ohio

State Wage Garnishment Limits (Private Student Loans)

Ohio follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Ohio Revised Code governs garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Ohio Department of Job and Family Services: jfs.ohio.gov

- Ohio Courts: supremecourt.ohio.gov

Source: Ohio Revised Code; Ohio Department of Job and Family Services

Oklahoma

State Wage Garnishment Limits (Private Student Loans)

Oklahoma follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Oklahoma Statutes govern garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Oklahoma Employment Security Commission: ok.gov/oesc

- Oklahoma Courts: oscn.net

Source: Oklahoma Statutes; Oklahoma Employment Security Commission

Oregon

State Wage Garnishment Limits (Private Student Loans)

Oregon follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Oregon Revised Statutes govern garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Oregon Bureau of Labor: oregon.gov/boli

- Oregon Courts: courts.oregon.gov

Source: Oregon Revised Statutes; Oregon Bureau of Labor and Industries

Pennsylvania

State Wage Garnishment Limits (Private Student Loans)

Pennsylvania provides the strongest protections alongside North Carolina and South Carolina:

Pennsylvania Limits:

- Wage garnishment for private debt is severely restricted

- Only child support, taxes, and certain government-backed loans can garnish

Federal Student Loans

- Subject to 15% federal administrative garnishment (federal law preempts state law)

Private Student Loans

- Extremely difficult to garnish wages in Pennsylvania

- Must meet strict statutory requirements

State Resources

- Pennsylvania Department of Labor: dli.pa.gov

- Pennsylvania Courts: pacourts.us

Source: Pennsylvania Consolidated Statutes; Pennsylvania Department of Labor and Industry

Rhode Island

State Wage Garnishment Limits (Private Student Loans)

Rhode Island follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Rhode Island General Laws govern garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Rhode Island Department of Labor: dlt.ri.gov

- Rhode Island Courts: courts.ri.gov

Source: Rhode Island General Laws; Rhode Island Department of Labor and Training

South Carolina

State Wage Garnishment Limits (Private Student Loans)

South Carolina provides extremely strong protections:

South Carolina Limits:

- Wage garnishment for private debt is PROHIBITED (with limited exceptions)

- Only child support, taxes, and student loans can garnish wages

Federal Student Loans

- Subject to 15% federal administrative garnishment (federal law preempts state law)

Private Student Loans

- Cannot garnish wages even with court judgment

State Resources

- South Carolina Department of Employment and Workforce: dew.sc.gov

- South Carolina Courts: sccourts.org

Source: South Carolina Code of Laws; South Carolina Department of Employment and Workforce

South Dakota

State Wage Garnishment Limits (Private Student Loans)

South Dakota follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

South Dakota Codified Laws govern garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- South Dakota Department of Labor: dlr.sd.gov

- South Dakota Courts: ujs.sd.gov

Source: South Dakota Codified Laws; South Dakota Department of Labor and Regulation

Tennessee

State Wage Garnishment Limits (Private Student Loans)

Tennessee follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Tennessee Code governs garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Tennessee Department of Labor: tn.gov/workforce

- Tennessee Courts: tncourts.gov

Source: Tennessee Code Annotated; Tennessee Department of Labor and Workforce Development

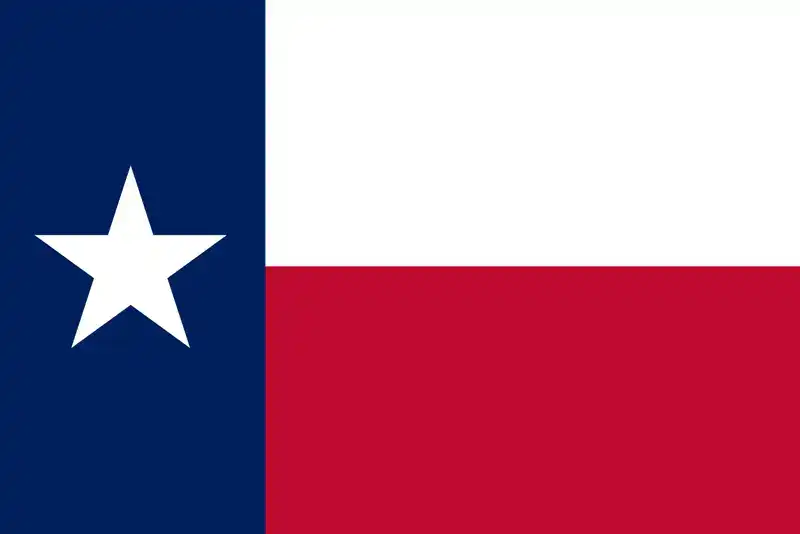

Texas

State Wage Garnishment Limits (Private Student Loans)

Texas provides very strong protections:

Texas Limits:

- Wage garnishment for private debt is severely restricted

- Generally prohibited except for child support, taxes, student loans, and court-ordered restitution

Federal Student Loans

- Subject to 15% federal administrative garnishment

Private Student Loans

- Extremely difficult to garnish wages in Texas

- Must meet statutory requirements

State-Specific Provisions

- 15% maximum for federal student loan garnishment (same as federal law)

- Texas state agencies follow federal student loan garnishment procedures

State Resources

- Texas Workforce Commission: twc.texas.gov

- Texas Comptroller: comptroller.texas.gov

Source: Texas Government Code; Texas Workforce Commission; Texas Comptroller

Utah

State Wage Garnishment Limits (Private Student Loans)

Utah follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Utah Code governs garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Utah Department of Workforce Services: jobs.utah.gov

- Utah Courts: utcourts.gov

Source: Utah Code; Utah Department of Workforce Services

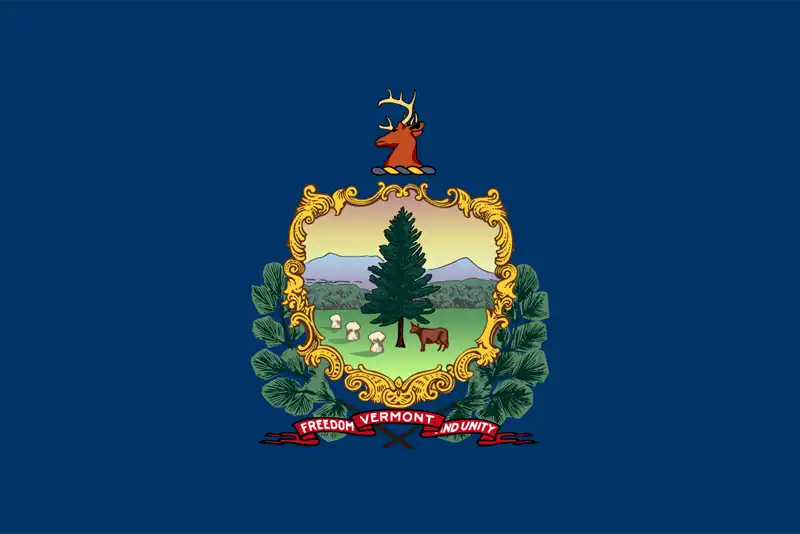

Vermont

State Wage Garnishment Limits (Private Student Loans)

Vermont follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Vermont Statutes govern garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Vermont Department of Labor: labor.vermont.gov

- Vermont Courts: vermontjudiciary.org

Source: Vermont Statutes Annotated; Vermont Department of Labor

Virginia

State Wage Garnishment Limits (Private Student Loans)

Virginia follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Virginia Code governs garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Virginia Employment Commission: vec.virginia.gov

- Virginia Courts: vacourts.gov

Source: Virginia Code; Virginia Employment Commission

Washington

State Wage Garnishment Limits (Private Student Loans)

Washington follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Washington Revised Code governs garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Washington Employment Security Department: esd.wa.gov

- Washington Courts: courts.wa.gov

Source: Washington Revised Code; Washington Employment Security Department

West Virginia

State Wage Garnishment Limits (Private Student Loans)

West Virginia follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

West Virginia Code governs garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- West Virginia Division of Labor: labor.wv.gov

- West Virginia Courts: courtswv.gov

Source: West Virginia Code; West Virginia Division of Labor

Wisconsin

State Wage Garnishment Limits (Private Student Loans)

Wisconsin follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Wisconsin Statutes govern garnishment.

Court Judgment Requirement

Judgment required for private student loans.

State Resources

- Wisconsin Department of Workforce Development: dwd.wisconsin.gov

- Wisconsin Courts: wicourts.gov

Source: Wisconsin Statutes; Wisconsin Department of Workforce Development

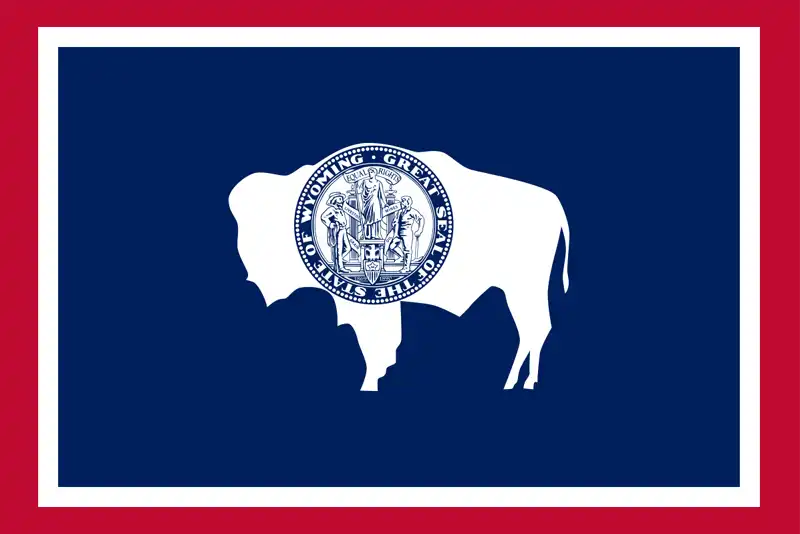

Wyoming

State Wage Garnishment Limits (Private Student Loans)

Wyoming follows federal garnishment limits:

- Maximum: 25% of disposable income, OR

- Amount exceeding 30 times federal minimum wage

- Whichever is less

State Provisions

Wyoming Statutes govern garnishment.

Court Judgment Requirement

Judgment required before garnishment.

State Resources

- Wyoming Department of Workforce Services: wyomingworkforce.org

- Wyoming Courts: courts.state.wy.us

Source: Wyoming Statutes; Wyoming Department of Workforce Services

Employee Rights and Protections

Right to Notice

Federal student loans:

- Borrowers must receive written notice at least 30 days before wage garnishment begins

- Notice must include:

- Amount to be garnished

- Right to inspect and copy loan records

- Right to request hearing

- Deadline to respond

- Information about voluntary repayment options

Source: 34 C.F.R. § 682.410(b)(5)

Right to Hearing

Borrowers have the right to request a hearing to challenge wage garnishment on the following grounds:

Valid defenses:

- Mistaken identity: You are not the person who owes the debt

- Loan already paid: The loan has been paid in full or is not in default

- Bankruptcy discharge: The loan was discharged in bankruptcy

- School closure: You qualify for closed school discharge

- False certification: School falsely certified your eligibility

- Identity theft: The loan was taken out fraudulently

- Undue financial hardship: Garnishment would cause severe financial hardship

How to request:

- Must request hearing within 30 days of receiving garnishment notice

- Contact Department of Education Default Resolution Group: 1-800-621-3115

- Online at myeddebt.ed.gov

Source: Department of Education; Federal Student Aid

Financial Hardship Exemption

Borrowers may request suspension or reduction of wage garnishment due to financial hardship.

Requirements:

- Garnishment prevents payment of basic living expenses

- Examples: eviction, foreclosure, utility shut-off

- Temporary relief only (typically 6-12 months)

Hardship relief does not eliminate the debt; garnishment may resume after hardship period.

Source: Student Loan Borrower Assistance; National Consumer Law Center

Protection from Termination

Federal law prohibits employers from firing employees because their wages are being garnished for student loan debt.

Coverage:

- Applies to federal and private student loan garnishment

- Protects employees whose wages are garnished for any single debt

- Does NOT protect if wages are garnished for multiple separate debts

Source: Consumer Credit Protection Act, 15 U.S.C. § 1674(a)

Social Security and Federal Benefits

Federal student loans: The government can garnish (offset) up to 15% of Social Security benefits to repay defaulted federal student loans, BUT:

Minimum protected amount: First $750/month is protected from garnishment

Protected benefits (generally):

- Supplemental Security Income (SSI) – fully protected

- Veterans benefits (VA) – fully protected for private loans

- Railroad Retirement benefits

Private student loans: Social Security benefits are generally protected from garnishment by private creditors.

Source: Treasury Offset Program; Social Security Administration

Tax Refund Offset

The federal government can seize (offset) federal and state tax refunds to repay defaulted student loans through the Treasury Offset Program.

Notice requirements:

- Borrowers receive “Notice of Intent to Offset” at least 65 days before tax refund seizure

- Opportunity to contest or enter repayment arrangement

Source: Treasury Offset Program; 26 U.S.C. § 6402(d)

Employer Obligations

Processing Wage Garnishment Orders

When employer receives garnishment order:

- Verify order authenticity

- Confirm order is from legitimate government agency or court

- Contact issuing agency if questions arise

- Begin withholding

- Start withholding from employee’s next pay period

- Calculate correct garnishment amount based on disposable income

- Continue withholding

- Withhold specified amount each pay period

- Do NOT stop until receiving official termination notice

- Remit withheld amounts

- Send withheld funds to agency specified in order

- Follow payment instructions carefully

- Maintain records of all withheld amounts

Source: U.S. Department of Education; Department of Labor

Calculating Disposable Income

Employers must correctly calculate “disposable income” for garnishment purposes:

Step 1: Start with gross wages for pay period

Step 2: Subtract ONLY legally required deductions:

- Federal income tax withholding

- State income tax withholding

- Local income tax withholding

- FICA (Social Security and Medicare)

- State unemployment insurance tax

- Mandatory retirement (required by law)

Step 3: Result = Disposable income

Step 4: Apply garnishment limits:

- Federal student loans: 15% of disposable income (or amount exceeding 30× minimum wage)

- Private student loans (with judgment): 25% of disposable income (or amount exceeding 30× minimum wage) – subject to state law

Do NOT subtract:

- Voluntary 401(k)/403(b) contributions

- Health insurance premiums

- Life insurance premiums

- Union dues

- Charitable contributions

- Other voluntary deductions

Source: U.S. Department of Labor Fact Sheet #30

Record-Keeping Requirements

Employers must maintain records of:

- Garnishment orders received

- Amounts withheld each pay period

- Payments remitted to agencies

- Dates of all transactions

Retention: Maintain records according to state and federal requirements (typically 3-7 years)

Source: Department of Labor; IRS regulations

Multiple Garnishment Orders

When employee has multiple garnishment orders:

Priority order (federal law):

- Child support and alimony (up to 50-65%)

- Federal tax levies

- Federal student loans (up to 15%)

- State tax levies

- Other garnishments (25% limit)

Total limit: Generally cannot exceed 25% of disposable income for all non-support garnishments combined

Exception: Child support can take up to 50-65%, leaving less available for other garnishments

Source: Consumer Credit Protection Act; Department of Labor

Employer Liability

Employers may be liable if:

- Fail to comply with lawful garnishment order

- Withhold incorrect amount

- Fail to remit withheld amounts to creditor

- Terminate employee because of garnishment

Penalties:

- May be ordered to pay amount that should have been garnished

- Possible civil penalties

- Attorney fees and court costs

Source: Various state and federal statutes

Administrative Fees

Some states allow employers to charge administrative fees for processing garnishment orders:

- Typically $5-$25 per pay period

- Must be authorized by state law

- Cannot exceed statutory limits

Check your state labor department for specific fee rules.

Source: State wage garnishment statutes (varies by state)

How to Stop or Prevent Wage Garnishment

Before Garnishment Begins

1. Avoid Default

If behind on payments but not yet in default (<270 days):

Options:

- Deferment: Temporarily postpone payments (specific eligibility requirements)

- Forbearance: Temporarily suspend or reduce payments

- Income-Driven Repayment Plan: Reduce monthly payment based on income

- Note: Many plans eliminated under OBBB for loans after July 1, 2026

- IBR still available for existing borrowers

- Loan Rehabilitation: Make 9 on-time payments to remove default status

Contact: Federal Student Aid at 1-800-4-FED-AID (1-800-433-3243) or studentaid.gov

Source: Federal Student Aid

2. Income-Driven Repayment (IDR) Plans

For borrowers NOT yet in default:

Available plans (as of 2025-2026):

Income-Based Repayment (IBR):

- Available for loans before July 1, 2026

- Payment: 10% of discretionary income (new borrowers) or 15% (older loans)

- Forgiveness after 20-25 years

- Parent PLUS borrowers: Consolidation before July 1, 2026 required to access IBR

Repayment Assistance Plan (RAP):

- Available for loans after July 1, 2026

- Payment: Higher than previous IDR plans

- Forgiveness after 30 years

- Not available for Parent PLUS loans

Available plans are being phased out under the One Big Beautiful Bill Act. Borrowers seeking income-driven repayment protection for existing loans may apply through Federal Student Aid.

Source: U.S. Department of Education; One Big Beautiful Bill Act

3. Loan Consolidation

Direct Consolidation Loan can prevent wage garnishment if done BEFORE garnishment begins:

How it works:

- Combines multiple federal loans into one new loan

- Takes loan out of default status

- New loan is not in default

- Stops garnishment process

Parent PLUS Consolidation Deadline:

- Consolidation completed before July 1, 2026 maintains IBR access

- After this date, Parent PLUS consolidation loans cannot use income-driven plans

Limitation:

- Cannot consolidate once wage garnishment is active

- Must complete consolidation BEFORE withholding order sent to employer

Apply: studentaid.gov or 1-800-4-FED-AID

Source: Federal Student Aid; Department of Education Dear Colleague Letter

4. Loan Rehabilitation

For loans already in default:

How it works:

- Make 9 consecutive on-time monthly payments

- Payment amount based on discretionary income (typically 15%)

- After 9th payment, loan exits default status

- Default removed from credit report

Benefit: Can prevent garnishment if completed before withholding begins

Apply: Contact loan servicer or Default Resolution Group: 1-800-621-3115

Source: Federal Student Aid

Employer Wage Garnishment Obligations

Editorial Notice – Employer Information

The following section summarizes general employer obligations described in federal and state statutes, court forms, and agency guidance related to wage garnishment processing. This information is provided for general informational purposes only and does not constitute legal, payroll, or compliance advice.

Responding to Garnishment Orders

Employers who receive employer wage garnishment orders are legally required to comply. Employer wage garnishment processing involves specific legal duties:

Employer’s Legal Duties:

1. Timely Response:

- Must respond within timeframe specified in order (typically 10-20 days)

- Must complete and return “Answer to Garnishment” form

- Failure to respond can result in liability for full debt amount

2. Accurate Calculations:

- Calculate disposable earnings correctly

- Apply federal and state limits properly

- Document calculations

- Maintain records

3. Begin Withholding:

- Start withholding on schedule specified in order

- Typically begins with first paycheck after deadline

- Continue until debt paid or order terminated

4. Remit Funds:

- Send withheld amounts to creditor or court

- Follow instructions in garnishment order exactly

- Remit on schedule (monthly, bi-weekly, etc.)

- Include required documentation

5. Notify Employee:

- Provide copy of garnishment order to employee

- Explain withholding amount and schedule

- Inform employee of exemption rights

6. Prioritize Multiple Garnishments:

- Follow federal and state priority rules

- Ensure total does not exceed limits

- Process in correct order (child support first, then taxes, then others)

Calculation Requirements

Step-by-Step Employer Calculation:

While RemoteLaws.com does not provide a wage garnishment calculator tool, employers can follow this manual calculation process:

Step 1: Determine Gross Pay Total compensation for pay period before any deductions.

Step 2: Subtract Legally Required Deductions

- Federal income tax withholding

- State and local income tax withholding

- Social Security tax (FICA employee share)

- Medicare tax (employee share)

- State unemployment insurance (if employee-paid)

- Mandatory state retirement (if required by law)

Result = Disposable Earnings

Step 3: Apply Garnishment Formula

For Weekly Pay Period (example):

- Calculate the wage garnishment percentage: 25% of disposable earnings

- Calculate disposable earnings minus $217.50 (30 × federal minimum wage)

- Use LESSER amount

For Other Pay Periods: Use corresponding multiplier from federal table.

Step 4: Check State Law If state law results in LESS garnishment, use state calculation instead.

Step 5: Verify Maximum Wage Garnishment Limits Ensure total of all garnishments does not exceed the maximum wage garnishment limits allowed by federal and state law, considering priority rules.

Example Calculation:

Employee paid weekly:

- Gross pay: $800

- Federal tax: $80

- State tax: $30

- Social Security: $49.60

- Medicare: $11.60

- Disposable earnings: $628.80

Federal calculation:

- 25% of $628.80 = $157.20

- $628.80 – $217.50 = $411.30

- Garnishment: $157.20 (lesser amount)

If employee in Massachusetts:

- 15% of gross ($800) = $120

- Disposable minus (50 × $15 MA minimum) = $628.80 – $750 = cannot use this calculation

- Garnishment: $120 (Massachusetts law more protective)

Record Keeping Requirements

Employers must maintain detailed records:

Records to Keep:

- Copy of garnishment order

- Garnishment calculation worksheets

- Dates and amounts withheld

- Dates and amounts remitted

- Employee notifications

- Correspondence with courts/creditors

Retention Period: Federal law: minimum 3 years State requirements may be longer.

Source: Fair Labor Standards Act record-keeping requirements; state statutes

Employer Liability

Employers face liability for:

1. Failure to Honor Valid Garnishment:

- Can be liable for FULL AMOUNT of judgment debt

- Court may hold employer in contempt

- Additional penalties and attorney fees

2. Over-Garnishing (Taking Too Much):

- Liable to employee for amounts improperly withheld

- Potential CCPA violations

- Employee can sue for damages

3. Wrongful Termination:

- Firing employee for garnishment for one debt

- Federal penalties: up to $1,000 fine and 1 year imprisonment

- Employee lawsuit for wrongful termination

- Back pay and reinstatement

4. Calculation Errors:

- Must correct errors promptly

- May owe refunds to employee

- Potential liability if errors harm employee

5. Failure to Remit:

- Taking money from employee but not sending to creditor

- Can be liable for full amounts withheld

- Criminal charges in some cases

Employer Requirements:

- Designated payroll personnel for garnishment processing

- Garnishment calculation systems

- Detailed documentation and record-keeping

- Timely response to orders

- Access to legal resources for complex situations

- HR staff training on garnishment compliance

Fees Employers Can Charge

Some states allow employers to charge administrative fees for processing garnishments.

Typical Allowable Fees:

- California: Up to certain dollar amount per garnishment

- Other states: Vary widely, from $0 to $25+ per pay period

Limitations:

- Must be specified in state law

- Cannot exceed statutory maximum

- Cannot be deducted from protected earnings

- Some states prohibit fees entirely

Source: State garnishment statutes

After Garnishment Notice Received (Within 30 Days)

1. Request Hearing

You have 30 days from notice date to request hearing

Valid reasons to request hearing:

- Loan is not yours (mistaken identity)

- Loan already paid or not in default

- Bankruptcy discharge

- School closure discharge eligibility

- False certification

- Identity theft

- Financial hardship

How to request:

- Call Default Resolution Group: 1-800-621-3115

- Submit request online: myeddebt.ed.gov

- Mail written request to address on garnishment notice

Source: 34 C.F.R. § 682.410(b)(6); Department of Education

2. Enter Voluntary Repayment Agreement

Within 30-day notice period:

- Contact Department of Education

- Negotiate affordable monthly payment

- Agreement must be in writing

- Stops garnishment if agreement completed before withholding begins

Source: Department of Education Default Resolution Group

3. Financial Hardship Request

Criteria:

- Garnishment prevents payment of basic living expenses

- Demonstrate urgent financial crisis:

- Eviction or foreclosure notice

- Utility shut-off notice

- Medical emergency

- Other documented crisis

Process:

- Submit Financial Disclosure Statement

- Provide documentation of hardship

- Request submitted within 30 days

Result if approved:

- Temporary suspension (typically 6-12 months)

- Garnishment may resume after hardship period

- Debt remains

Source: Student Loan Borrower Assistance

After Garnishment Begins (Withholding Already Active)

1. Loan Rehabilitation (Most Common)

Requirements:

- Make 5 consecutive monthly payments under rehabilitation agreement

- Payment amount based on discretionary income

- Payments must be on time

Process:

- Contact Default Resolution Group: 1-800-621-3115

- Complete income verification

- Agree to monthly payment amount (typically 15% of discretionary income)

- Make 5 consecutive payments

- After 5th payment posts: Government must remove wage garnishment

Timeline:

- Typically 5-6 months to complete

- Garnishment CONTINUES during rehabilitation

- Garnishment STOPS after 5th payment

Benefit:

- Removes loan from default

- Restores eligibility for deferment, forbearance, and repayment plans

- Default removed from credit report after rehabilitation

Limitation:

- Can only rehabilitate each loan once

- If default again, rehabilitation not available

Source: Federal Student Aid; 34 C.F.R. § 682.405

2. Loan Consolidation

Note on Active Garnishment: Consolidation is not available once garnishment is active

Exception: Can consolidate if:

- Garnishment has been lifted through another process first (rehabilitation, repayment agreement, hearing decision)

- Then consolidation becomes available

After June 30, 2026:

- Consolidation loans subject to new RAP rules

- Limited access to income-driven plans

- Parent PLUS borrowers lose access to all IDR plans

Source: Federal Student Aid; OBBB Act

3. Pay in Full

Paying entire defaulted balance stops garnishment immediately upon payment.

Context:

- Full payment often unrealistic for borrowers facing garnishment

- Loan rehabilitation provides alternative requiring lower monthly payments over time

Bankruptcy and Student Loans

General Rule: Student loans are generally NOT dischargeable in bankruptcy

Exception: Undue Hardship Discharge

Requirements (Brunner Test – most courts):

- Cannot maintain minimal standard of living if forced to repay

- Hardship will persist for significant portion of repayment period

- Made good faith effort to repay

Result:

- Difficult to prove

- Requires adversary proceeding in bankruptcy court

- Success rate historically low (but improving in recent years)

Bankruptcy and Garnishment:

- Filing bankruptcy triggers automatic stay

- Garnishment must stop immediately

- May provide temporary relief while case pending

Source: 11 U.S.C. § 523(a)(8); U.S. Courts Bankruptcy Information

Private Student Loan Wage Garnishment

Key Differences from Federal Student Loans

Private student loan creditors:

- Must obtain court judgment FIRST

- Cannot garnish wages without suing borrower

- Must win lawsuit

- Judge must issue garnishment order

- Higher garnishment limit

- Up to 25% of disposable income (not 15%)

- Still subject to 30× minimum wage protection

- Subject to state law

- State garnishment limits apply

- Some states prohibit or severely restrict garnishment (NC, SC, PA, TX)

- Statute of limitations applies

- Creditor must sue within state statute of limitations period

- Typically 3-10 years depending on state

- After expiration, creditor cannot sue (but debt still exists)

Source: Consumer Financial Protection Bureau

State Protections for Private Student Loans

States with strongest protections (garnishment prohibited or severely restricted):

- North Carolina – Wage garnishment prohibited except taxes, child support, student loans

- South Carolina – Wage garnishment prohibited except taxes, child support, student loans

- Pennsylvania – Wage garnishment severely restricted

- Texas – Wage garnishment severely restricted

Note: “Student loans” in these states typically refers to government-backed loans. Private student loan garnishment may still be prohibited.

States with lower limits than federal:

- California – 20% maximum (vs. 25% federal)

- Illinois – 15% of gross wages

- Massachusetts – 15% maximum

- New Jersey – 10% of gross income OR 25% disposable (lesser)

- New York – 10% of gross income OR 25% disposable (lesser)

Source: State labor department websites; state statutes

How to Stop Private Student Loan Garnishment

Before Lawsuit Filed

- Negotiate settlement

- Private lenders may accept reduced lump sum

- Or extended payment plan

- Verify statute of limitations

- Check if debt is beyond statute of limitations for your state

- If so, creditor cannot sue

- Dispute debt if not valid

- Request debt validation

- Challenge inaccurate debts

After Judgment Obtained

- File bankruptcy

- Private student loans MAY be dischargeable in bankruptcy

- Undue hardship standard applies

- Consult bankruptcy attorney

- Negotiate payment plan

- Even after judgment, may negotiate

- Request lower monthly payment

- Claim exemptions

- State law may provide additional exemptions

- Head of household exemptions (some states)

Source: National Consumer Law Center

Frequently Asked Questions

Can student loan wage garnishment be stopped?

Yes. Federal student loan wage garnishment can be stopped through:

- Loan rehabilitation (5 payments)

- Loan consolidation (before garnishment starts)

- Full payment of defaulted balance

- Successful hearing challenging garnishment

- Bankruptcy filing (temporary automatic stay)

Source: Federal Student Aid

How much can be garnished from my paycheck for student loans?

Federal student loans: Up to 15% of disposable income (or amount exceeding $217.50/week, whichever is less)

Private student loans: Up to 25% of disposable income (subject to state law)

Source: Department of Labor

Can my employer fire me for having my wages garnished?

No. Federal law prohibits employers from firing employees because wages are garnished for any single debt, including student loans.

Source: 15 U.S.C. § 1674(a)

Does wage garnishment affect my credit score?

Wage garnishment itself is not reported to credit bureaus. However, the default that led to garnishment IS reported and severely damages credit (typically 7 years).

Source: Credit bureaus; Fair Credit Reporting Act

Can Social Security benefits be garnished for student loans?

Federal student loans: Yes, up to 15%, but first $750/month is protected

Private student loans: Generally no

SSI (Supplemental Security Income): Fully protected

Source: Social Security Administration; Treasury Offset Program

What happens if I ignore the wage garnishment notice?

If you do not respond within 30 days:

- Garnishment proceeds automatically

- Employer receives withholding order

- Up to 15% of pay withheld each period

- Continues until debt paid or you exit default through rehabilitation

Source: Department of Education

Can I be garnished for student loans that are in forbearance or deferment?

No. Loans in approved forbearance or deferment are not in default. Only defaulted loans (270+ days without payment) can be garnished.

Source: Federal Student Aid

What is the difference between wage garnishment and tax refund offset?

Wage garnishment: Money withheld from paycheck each pay period

Tax refund offset: Entire tax refund seized to pay student loan debt

Both can happen simultaneously for defaulted federal student loans.

Source: Treasury Offset Program

Can Parent PLUS loans be garnished?

Yes. Parent PLUS loans in default are subject to same 15% wage garnishment as other federal student loans.

Note on Policy Changes: Under the One Big Beautiful Bill Act, parents who consolidate Parent PLUS loans before July 1, 2026 maintain access to income-driven repayment. Consolidation after this date eliminates access to income-driven repayment plans.

Source: Department of Education; OBBB Act

How long does wage garnishment last?

Wage garnishment continues until:

- Defaulted loan is paid in full, OR

- Loan is rehabilitated (5 payments), OR

- Loan is consolidated (before garnishment starts), OR

- Successful hearing stops garnishment

There is no time limit. Garnishment can continue for years if borrower takes no action.

Source: Federal Student Aid

What is the One Big Beautiful Bill Act and how does it affect me?

The OBBB Act (July 2025) eliminated most income-driven repayment plans:

- SAVE, PAYE, ICR phased out

- New RAP plan requires 30 years for forgiveness

- Parent PLUS loans lose access to income-driven plans after July 1, 2026

Borrowers seeking income-driven repayment for existing loans may enroll or consolidate before July 1, 2026 to maintain access to IBR.

Source: P.L. 119-21; Department of Education

Can student loan wage garnishment take my entire paycheck?

No. Federal law limits paycheck garnishment for student loans to maximum 15% of disposable income AND protects income equal to 30× minimum wage ($217.50/week).

If your disposable income is below $217.50/week, no garnishment is allowed.

Source: Department of Labor

Will wage garnishment resume in 2026 for all borrowers?

No. Only borrowers already in default (no payment for 270+ days) face wage garnishment.

Borrowers making payments or in approved deferment/forbearance are NOT subject to garnishment.

Source: Department of Education announcement, December 2025